BEYOND THE NUMBERS

Final CTC Changes Don’t Alter Tax Bill Basics: 10 Million Working Family Children Get Little or Nothing

Update, December 18, 2017: The earlier version of this post misstated the income level of a family of four receiving a CTC increase of $800; it is $24,000, not $30,000.

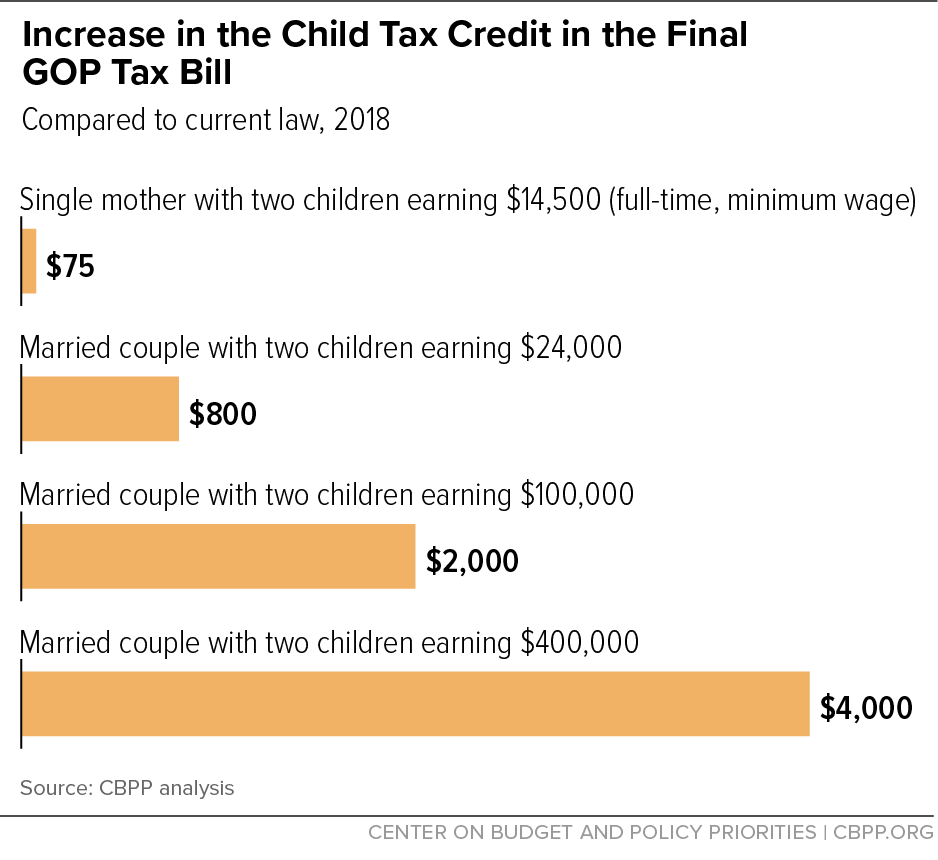

Last-minute changes to the Child Tax Credit (CTC) that Republican leaders put in their final tax bill do not change the fundamental fact: low-income working families still would largely miss out on the full CTC increase from the current $1,000 per child to $2,000.

For starters, 10 million children under 17 in the lowest-income working families — who already receive only a partial CTC or no credit at all — will either receive no improvement in the credit or a token increase of $1 to $75. Despite the last-minute changes, these families would receive nothing more than they would have received under the Senate-passed bill.

Another 14 million children in low- and modest-income working families would get a CTC increase of more than $75 but less than the full $1,000-per-child increase that families at higher income levels would receive, though they would fare better than under the Senate bill.

Under current law, the CTC provides a maximum tax credit of $1,000 per eligible child under age 17. The credit is “partially refundable,” meaning that it’s partly, but not entirely, available to families with incomes below certain levels. The refundable portion of the CTC is limited to 15 percent of a family’s earnings over $3,000.

The Senate bill would have increased the maximum CTC from $1,000 to $2,000 per child and made the credit newly available to children aged 17. But it only slightly increased the refundability of the existing credit, which would be limited to 15 percent of earnings over $2,500 (as opposed to $3,000 under current law).

In fashioning a final tax bill, Republican leaders made last-minute changes to their CTC provisions in an effort to secure the support of Senator Marco Rubio. He and Senator Mike Lee had proposed to give low- and moderate-income working families a somewhat more adequate CTC increase, and Senator Rubio had threatened to oppose the final bill unless it did so.

But the last-minute changes that Republican leaders made were modest and did almost nothing to change the bill’s fundamental nature. It still provides large tax cuts heavily tilted toward wealthy households and profitable corporations and adds at least $1.5 trillion to deficits over ten years while doing little if anything for millions of low- and modest-income households.

As for the CTC changes:

- The final bill does nothing, compared to the Senate bill, to improve the CTC for 10 million children in low-income working families — meaning that those children will get only a token increase of up to $75 per family or no increase at all. Many working families with children under 17 with incomes that are too low to owe much or any income tax can get part of the CTC as a tax refund. As noted, that refundable amount is limited under current law to 15 percent of their earnings over $3,000. The Senate bill lowered the threshold so that earnings over $2,500 would count towards earning a CTC — translating to a CTC increase of just $75 for those families. The last-minute changes to the CTC do nothing more for these 10 million children.

Senators Rubio and Lee had proposed to let those 10 million children under age 17 get a more meaningful CTC increase. They proposed that those families qualify for a CTC of 15.3 cents per dollar on all of their earnings (not just on their earnings above $2,500). That would be enough to offset all of the payroll taxes that workers face on their wages (including both the employee and employer shares of the 15.3 percent payroll taxes).

Under Rubio-Lee, a single mother with two children who works full time at the federal minimum wage and earns $14,500 a year would have received a $494 CTC increase — an increase of $247 per child. That’s far less than the Senate bill’s full $1,000-per-child CTC increase but far more than the $75 total ($37.50 per child) that she’d get under the Senate bill. The final bill leaves that full-time worker’s CTC increase at $75.

The interactive below shows the number of children in low-income working families in each state who would see a $75 or smaller increase in their CTC under both the Senate and the final bills.

- The final bill modestly increases the CTC for moderate-income families — but 14 million children still won’t get the full $1,000-per-child increase that higher-income families would receive. The Senate bill prevented 16 million children in moderate-income families from receiving the full CTC increase. That’s because it capped the refundable amount of the credit at $1,000 per child, adjusted for inflation going forward. The final bill modestly increases that level to $1,400, adjusted for inflation.

The $1,400 limit means that millions of moderate-income children will get a CTC increase of no more than $400 per child. Some 14 million children in moderate-income families would get less than the full $1,000 CTC increase, we estimate. That’s a modest improvement over the Senate bill, under which 16 million children would have been denied the full credit, and the increase that a number of these families received would have been smaller.

For example, a married couple with two children making $24,000 would get an $800 increase in their CTC ($400 per child) under the final bill compared to $200 ($100 per child) under the Senate bill. The original Rubio-Lee proposal would have delivered a $1,672 increase to this family, because it wouldn’t have created this new, artificial limit on the CTC for moderate-income families.

- The final bill pays for these modest CTC improvements (relative to the Senate bill) with other changes that limit the CTC, even as it retains costly tax cuts for the wealthy and corporations. The Senate bill would have extended the credit to 17-year-olds. But, to offset the cost of the other modest, last-minute CTC improvements, the final bill returns to current law, leaving 17-year-olds out. Also to offset the cost of these provisions, the bill sets the income level at which the CTC begins to phase out at $400,000 for married couples, instead of $500,000 under the Senate bill. But that is still a huge increase in the credit for affluent families compared to current law. Today, the credit begins to phase down for married families at $110,000 in income, and phases out for families with two children at $150,000 a year. As a result, while millions of low-income working families would receive no CTC increase or an increase of $1 to $75, families making $400,000 that have two children would become newly eligible for the CTC and receive a $4,000 credit.

Improvements Fall Far Short of Rubio-Lee

Rubio-Lee would have allowed 10 million low-income children to receive more than a $75 credit increase and would have provided a more significant improvement to the CTC for 16 million more children in moderate-income families. This would have cost of $87 billion over ten years.

That’s about the cost difference between setting the corporate rate at 21 percent instead of 20 percent, as the Senate bill did. Senators Rubio and Lee had proposed paying for their proposal by setting the top corporate rate at 20.9 percent instead of 20 percent (and as compared to 35 percent in current law). The final bill sets the rate at 21 percent — but it devotes all of the savings to giving corporations that lower rate a year earlier. In fact, the final bill’s corporate rate cuts increased in cost by about $20 billion, compared to the Senate bill.

The bill would also harm about 1 million children in low-income working families by denying them the CTC they now receive because they lack a Social Security Number. These children are overwhelmingly “Dreamers” — undocumented children who were brought to the United States by their immigrant parents.

Of course, even the original Rubio-Lee proposal wouldn’t have fixed either the final bill’s extreme tilt to the top or its fiscal profligacy, nor would it have changed the fact that key congressional Republicans are already saying they will seek to pay for their tax cuts next year by cutting an array of programs that serve low- and middle-income families, such as food assistance and possibly health care.

But Rubio-Lee would have allowed millions of working families to fare somewhat better. Instead, the final bill will do far less than that, and will all but exclude 10 million children in low-income working families from its CTC expansion.