BEYOND THE NUMBERS

Celebrating the EITC

Groups nationwide today are recognizing the important contribution that the Earned Income Tax Credit (EITC) makes to the lives of low- and moderate-income working people. The credit encourages and rewards work as well as offsets federal payroll and income taxes. Twenty-six states, plus the District of Columbia, have established their own EITCs to supplement the federal credit.

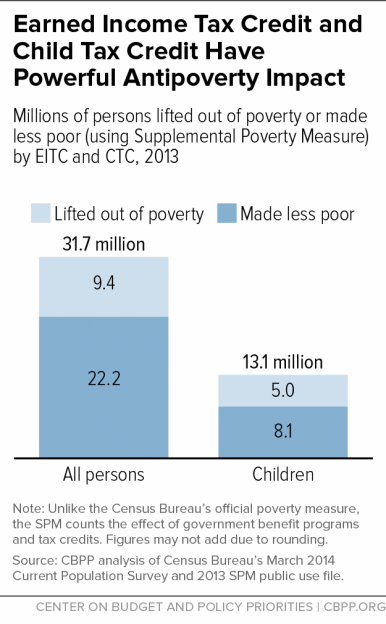

In 2013, the EITC lifted about 6.2 million people out of poverty, including about 3.2 million children. The number of poor children would have been one-quarter higher without the EITC. The credit reduced the severity of poverty for another 21.6 million people, including 7.8 million children. In combination with the Child Tax Credit (CTC), the EITC lifts even more families with children out of poverty (see figure).

Growing evidence indicates that not only do the EITC and CTC encourage and reward work, but the income that low-income working families receive from these credits is also linked to improvements in maternal and infant health, better school performance among children, higher college enrollment, and increased work effort and earnings when the children reach adulthood.

But the EITC can do even more. It largely excludes workers who aren’t raising children and completely excludes them if they’re under age 25; in part for this reason childless adults are the one group that the federal tax code taxes into poverty. President Obama and House Speaker Paul Ryan have nearly identical proposals to expand the EITC for this group to make the credit a more effective work incentive. Policymakers found common ground last year to make permanent critical improvements to the EITC and low-income part of the CTC that were scheduled to expire in 2017. This year, they should take up President Obama and Speaker Ryan’s proposals and fix the glaring hole in the EITC for childless workers.

For more on the EITC, see:

- Policy Basics: The Earned Income Tax Credit

- Policy Basics: The Child Tax Credit

- State Fact Sheets: The Earned Income and Child Tax Credits

- Chart Book: The Earned Income Tax Credit and Child Tax Credit

- EITC and Child Tax Credit Promote Work, Reduce Poverty, and Support Children’s Development, Research Finds

- Tax Deal Makes Permanent Key Improvements to Working-Family Tax Credits

- Obama Wisely Calls for Boosting the EITC for Childless Adults

- Policy Basics: State Earned Income Tax Credits

- States Can Adopt or Expand Income Tax Credits to Build a Stronger Future Economy

- How Much Would a State Earned Income Tax Credit Cost in Fiscal Year 2017?

- State Earned Income Tax Credits and Minimum Wages Work Best Together

- Get It Back: Tax Credits for People Who Work