off the charts

POLICY INSIGHT

BEYOND THE NUMBERS

BEYOND THE NUMBERS

During open enrollment, which runs from November 1 to December 15, consumers should take a close look at the benefits of signing up for health insurance on HealthCare.gov or their state-based marketplace. Here are five good reasons why:

- Financial help is available to reduce the cost of coverage and care. Once again this year, the vast majority of people signing up for 2020 health insurance on the marketplace will get financial help through federal premium tax credits, which lower their monthly insurance costs. Nearly nine of ten marketplace enrollees received these tax credits to help them pay for their 2019 coverage. In addition, more than half of marketplace enrollees qualified for substantial cost-sharing assistance, which lowered their out-of-pocket costs for health care services. One in three people may qualify for 2020 plans with typical annual deductibles under $150. (Information on the affordability of marketplace plans in each HealthCare.gov state is available here.)

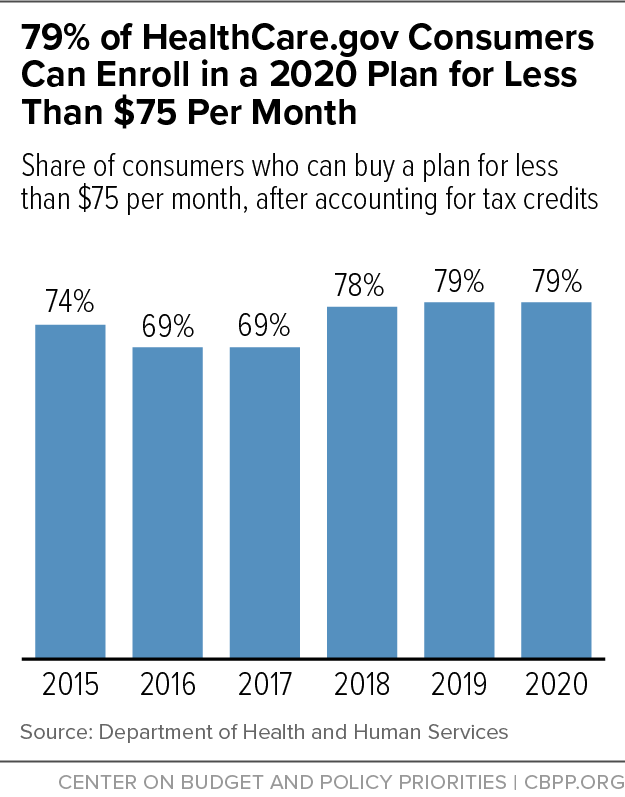

- Plans are more affordable than people think. Thanks to financial help, 79 percent of 2019 HealthCare.gov consumers can find a 2020 plan that costs less than $75 per month after tax credits, according to the Department of Health and Human Services (see figure). More insurers are offering plans on HealthCare.gov this year, enabling consumers to choose from an average of 38 plans for 2020, up from 26 plans in 2019. And it’s worth shopping around, even for the small share of marketplace consumers who don’t qualify for tax credits. Average premiums are down again this year, with the average premium for benchmark (second-lowest cost) silver plans falling by 4 percent.

- Consumers can save money by comparison shopping on HealthCare.gov. While the marketplace is set up to automatically renew a consumer’s coverage from one year to the next, consumers who are renewing their coverage should update their application and compare their plan options during open enrollment because plans and prices change from year to year. In 2019, renewals comprised about 75 percent of total enrollments on the federal marketplace, according to enrollment data. Of consumers renewing their coverage, 28 percent opted for automatic renewal, while the other 72 percent compared their options before choosing a plan. Consumers who went on HealthCare.gov, compared plans, and selected the plan that best fit their health and financial needs paid 38 percent less per month on average than the consumers whose plans were automatically renewed.

- Plans purchased on HealthCare.gov are comprehensive and guaranteed to cover the essentials. Consumers enrolling in a plan on HealthCare.gov are guaranteed comprehensive coverage, with no exclusions of, or mark-ups in prices for, pre-existing conditions. In addition to covering essential health benefits (including prescription drugs, mental health treatment, and maternity care, among other health care services), consumers enrolled in a marketplace plan also receive free preventive care services, such as annual check-ups and immunizations. Many 2020 plans also include coverage of essential benefits, including primary care visits and generic drugs, before enrollees meet their deductible.

- Beware of insurance plans sold outside of HealthCare.gov. Consumers should avoid insurance plans offered outside of HealthCare.gov that seem too good to be true. Unfortunately, a bevy of substandard plans will be available because the Trump Administration has loosened regulations that govern them. These products aren’t required to comply with Affordable Care Act (ACA) regulations, which means they can deny coverage to consumers with pre-existing conditions, charge consumers more based on their gender, reject claims altogether for health care services related to a pre-existing condition, and impose annual coverage limits. These plans are heavily marketed online and by brokers, but they put consumers at serious financial risk. HealthCare.gov and state marketplaces are the only places where consumers are guaranteed to get comprehensive, ACA-compliant coverage.

The health insurance landscape can be confusing, but free, local in-person help is available in many states, and you can find options through the Get Covered Connector. Consumers should log on to HealthCare.gov by December 15 to get the comprehensive health coverage they and their family need.

Topics:

Policy Basics

Health

Report

Health Care Executive Order Would Destabilize Insurance Markets, Weaken Coverage

November 29, 2017

Stay up to date

Receive the latest news and reports from the Center