BEYOND THE NUMBERS

The grim outlook for state economies over the next year will be even grimmer if states don’t fully use an important tool: their rainy day funds. Doing so can help lessen COVID-19’s health and economic harm and help states focus their responses on the hardest-hit people and communities — including those facing persistent racial, gender, and economic inequities — and achieve an equitable recovery that extends to all people.

The pandemic and economic downturn have left almost 1 in 4 workers with no or much less income, devastating states’ income and sales tax revenue and straining their unemployment systems. While additional, substantial federal aid would be the best way to help states cover their estimated $615 billion shortfalls over three years, states should tap their rainy day funds (which totaled about $75 billion in fiscal 2019) now to help them respond adequately to the crisis.

Here are three reasons why.

- It will help them avoid cutting economic security programs on which people rely during the crisis. Health care, food assistance, and cash assistance help people keep their homes, stay healthy, and put food on the table, especially with job opportunities down and up to 43 million people in danger of losing their employer-sponsored health coverage. Using rainy day funds can ensure that these supports are available to all eligible families when they need them the most. Otherwise, states may cut these services, likely worsening the crisis as people get evicted from their homes or can’t afford healthy food.

- It will buy them time to enact policies that put families and communities first. Tapping rainy day funds can let states take a more measured budget-balancing approach that preserves spending needed during a recession and lays the groundwork for a more equitable recovery. Unlike the federal government, states must balance their budgets each year. But the fastest measures that states can often take — especially drastic budget cuts — can deepen and prolong recessions while further raising barriers to prosperity for low-income people and people of color. Following the Great Recession of about a decade ago, states relied too heavily on cuts that helped create unemployment systems that are ill-equipped for today’s economy and that led to permanent teacher shortages. States also imposed higher fines and fees, which ask the most from people with the least ability to pay, particularly low-income communities of color.

- It will keep money flowing through state economies. Taking money out of state savings and putting it to work during an economic downturn makes good sense. It keeps money circulating through the state’s economy and minimizes layoffs and furloughs for first responders, teachers, health care workers, and others who are especially needed during the pandemic. Rainy day fund spending also helps fuel state economies when people can’t buy as much because so many are out of work.

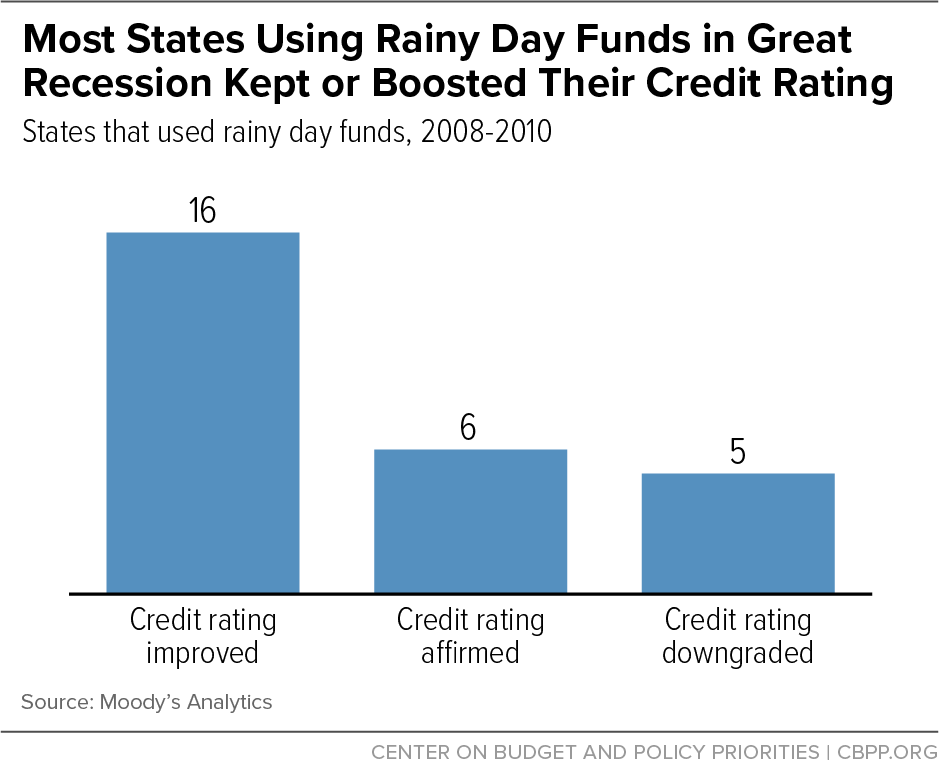

State rainy day funds are at record highs, and tapping them won’t likely harm states’ bond ratings or ability to borrow. Credit rating agencies generally expect states to draw on the funds during a recession or natural disaster. And they likely won’t downgrade states’ credit, assuming that states rebuild those reserves after the recession ends, as most have done since the Great Recession. Forty states tapped their funds from 2008 to 2010 in response to the recession, but only five suffered a credit downgrade from Moody’s Analytics during that time.

Never using a rainy day fund is equivalent to not having one. States risk very little by tapping those funds, which were designed for an emergency like the COVID-19 pandemic. Not doing so risks repeating the mistakes of the Great Recession. States should chart a different path this time.