BEYOND THE NUMBERS

Kansas closed its latest budget shortfall in part by raising sales taxes — for the second time in three years — to help pay for its massive income tax cuts. This shift from income to sales taxes is not in Kansas’ (or any state’s) interest, for three main reasons.

-

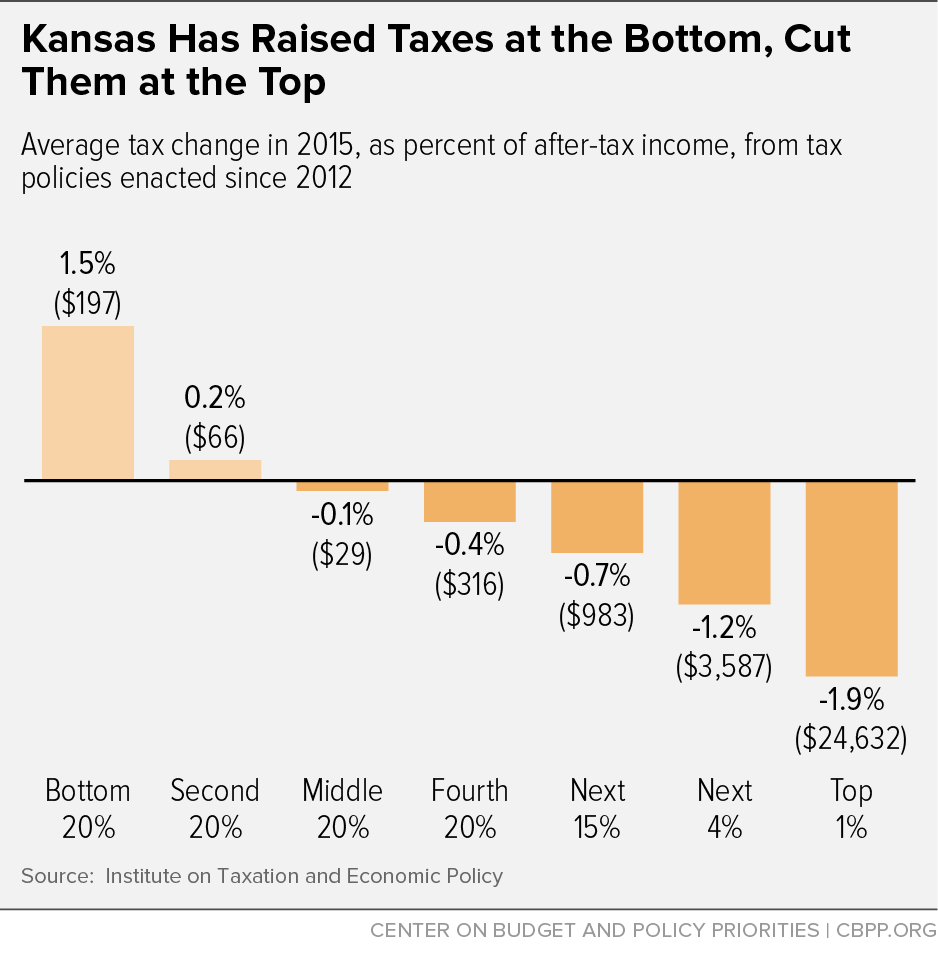

It shifts taxes from the wealthy to low- and middle-income residents. The income tax cuts enacted in 2012 and 2013 delivered their largest benefits (both in dollars and as a share of income) to high-income people. Sales tax hikes, in contrast, hit lower-income people the hardest, since they spend a larger share of their incomes on taxable items than more affluent people do.

Taken together, the tax changes enacted since 2012 result in a $197 tax increase this year for Kansans with incomes below about $20,000 and a $24,632 tax cut for households with incomes over about $400,000, according to the Institute on Taxation and Economic Policy (ITEP). (See chart.) It’s no wonder ITEP ranks Kansas’ state and local tax system as the ninth most unfair in the nation.

-

It won’t boost the economy. The 2012 tax cuts failed to provide the “adrenaline shot” to the economy that Governor Sam Brownback promised. That shouldn’t have been surprising, given the lack of evidence that income tax cuts spur growth.

Further, there’s no consensus among economists that relying less on income taxes will improve economic growth, as we’ve noted, and shifting from income to sales taxes would likely do more harm than good — contrary to Governor Brownback’s claims.

-

It makes further cuts in public services more likely down the road. Sales tax revenues don't keep pace with economic growth as well as income tax revenues do. One reason is that sales taxes generally don't apply to many of the fastest growing sectors of the economy, like health care and many Internet-related services. Also, a growing share of the benefits of economic growth is going to wealthy people, who spend a smaller share of their income on in-state products and services than less-affluent people do.

Kansas’ income tax cuts have already forced cuts in education and other public services. (Many of those cuts hit low- and moderate-income households, who also are paying higher taxes due largely to the sales tax increase.) With even more income tax cuts scheduled in 2018 and beyond under current law, Kansas likely will continue to weaken its support for public goods that businesses need to create good jobs — an educated workforce, well-maintained roads, and effective police and fire protection.