House Republicans’ fiscal year 2024 agriculture appropriations bill[1] would make harmful policy changes and deep funding cuts to two critical food assistance programs — the Special Supplemental Nutrition Program for Women, Infants, and Children (WIC) and the Supplemental Nutrition Assistance Program (SNAP) — that would result in benefit cuts or loss of eligibility for millions of people. To adhere to the austere funding caps on annual appropriations proposed under House Republicans’ own debt-ceiling-and-cuts bill, the proposal would slash science-based WIC benefits that families use to buy fruits and vegetables for 5 million pregnant and postpartum participants and young children under 5. The bill also puts SNAP benefits at risk for 1 million older adults by including the same policy from their debt ceiling bill that takes food assistance away from people aged 50 to 55 who can’t meet a work-reporting requirement. (See Appendix Tables 1 and 2 for state-by-state estimates of the impacts of these proposals.)

The appropriations bill shortchanges WIC by $800 million relative to the amount needed to provide current benefits to all eligible applicants, a reduction of more than 12 percent. To cut funding without putting eligible applicants on waiting lists, the bill guts the increase to benefits for fruit and vegetables that has been in place since 2021 and was implemented based on a recommendation by the National Academies of Sciences, Engineering, and Medicine. This would cut benefits for nearly 1.5 million pregnant, postpartum, or breastfeeding participants and roughly 3.5 million children aged 1 through 4.

These cuts defy science and are shortsighted given the long-term health benefits of sound nutrition during these life stages. And the notion that such cuts are necessary from a fiscal standpoint doesn’t hold water: the U.S. has the means to ensure that pregnant and postpartum people and very young children can afford fruits and vegetables. Even with the cut in fruits and vegetables, the proposed funding level still may result in waitlists given current participation and food cost trends.

The bill also proposes some of the same harmful SNAP policies that are in the House Republicans’ debt-ceiling-and-cuts bill, including an expansion of SNAP’s existing harsh work-reporting requirement to include older adults aged 50 to 55. These changes would put approximately 1 million older adults at risk of losing their SNAP benefits — despite extensive research showing that this work-reporting requirement does not increase employment or earnings and just cuts people off benefits.

The bill includes several other provisions that override science-based policies related to school meal standards and WIC foods. One of the strengths of the child nutrition and WIC programs is that the foods they offer are selected through a transparent, deliberate, and science-based process with opportunities for the public and members of Congress to weigh in. By overriding this process and substituting their own judgement, members of Congress threaten to undermine the effectiveness of these critical food assistance programs.

These cuts and policy changes that threaten critical nutrition assistance for people with low incomes would come on top of the recent end of SNAP’s emergency allotments (EAs), which resulted in a $90 per-person, per-month cut on average across households that include some 42 million low-income people.[2]

The House agriculture appropriations bill would deeply cut WIC. WIC provides critical nutrition benefits, breastfeeding support, and other vital services to low-income pregnant and postpartum people, infants, and young children under age 5. Extensive research over more than four decades has shown that WIC participation is associated with an array of positive outcomes, including reduced risk of low birth weight, infant deaths, and food insecurity, and improved diet quality, child immunization rates, and access to health care.[3]

Despite a bipartisan commitment for more than 25 years to provide the program with sufficient funding to serve all eligible applicants, the bill funds WIC at a level $800 million below the level requested in the President’s fiscal year 2024 budget. That level is needed to provide full benefits to all eligible applicants, if participation and food costs remain at the levels projected in the budget, [4] which appears increasingly unlikely, as explained below. While the $6 billion in budget authority provided in the House agriculture appropriations bill is the same level provided in recent prior years, it is paired with a larger rescission of WIC funds than last year, reducing available funding by $185 million compared to fiscal year 2023, just as WIC’s funding needs have increased due to growing participation, rising food costs, and a science-driven benefit update explained below.

To prevent the funding cut from putting hundreds of thousands of eligible applicants on waiting lists, the bill slashes the fruit and vegetable benefit participants receive. For most foods, WIC provides a specific type and quantity (such as a 1-pound loaf of whole-grain bread), but participants receive a cash value benefit for fruit and vegetables. The bill reduces the monthly fruit and vegetable benefit from $25 to $11 for 1- to 4-year-olds (a 56 percent reduction), from $44 to $13 for pregnant and postpartum participants (a 70 percent reduction), and from $49 to $15 for breastfeeding participants (a 69 percent reduction). See Appendix Table 1 for state-level estimates of the number of participants who would be affected by this cut and the total benefit reduction for each state.

Because WIC’s total food benefits are modest — providing a monthly average of less than $68 per participant in fiscal year 2022, with a lower average for children and adults because they do not receive infant formula — these reductions also represent a substantial portion of WIC’s total food benefits. To maintain the current level of fruit and vegetable benefits (adjusted for inflation), the President’s budget includes $4.1 billion for food benefits, with the remaining funding covering nutrition counseling, breastfeeding support, referrals, and other services WIC provides. This means the $800 million cut amounts to a 19 percent reduction in food benefits across all participants. Because infants’ food benefits would not be affected, the percentage cut to pregnant, postpartum, and children’s benefits is even larger.

The WIC cut would directly undermine the science-based increase in the fruit and vegetable benefit that the National Academies of Science, Engineering, and Medicine recommended to provide approximately half of the recommended daily amounts of fruits and vegetables for adults and children.[5] The increase, originally enacted in the American Rescue Plan, was extended through the annual appropriations process on a bipartisan basis for the last two years and the Department of Agriculture has proposed making it a permanent feature of the program.[6] The larger benefit increased daily fruit and vegetable consumption[7] and could contribute to eligible families participating longer, which improves nutritional outcomes[8] and makes periods of food insecurity among young children less likely.

The cut would very likely lead to increased food hardship and worse pregnancy-related and child health outcomes. Reducing nutrition assistance for low-income families with pregnant people and young children is especially notable in the wake of the Supreme Court decision overturning the legal right to abortion. Access to abortion and adequate supports, including WIC, for people with low incomes who carry their pregnancies to term are both critical. Without adequate nutrition assistance, low-income families who choose to have children and those who no longer have the option to end pregnancies will have a harder time supporting the health of their growing babies and young children.

Even with the severely reduced fruit and vegetable benefit, waiting lists may be unavoidable at the bill’s overall funding level. Both food costs and participation have already exceeded the projections in the President’s budget for fiscal year 2023, indicating that the funding level requested in the President’s budget could be insufficient to serve all eligible applicants.

Average monthly participation in the first five months of fiscal year 2023 was 3.7 percent higher than in the first five months of fiscal year 2022, and has already exceeded the level the Department of Agriculture (USDA) projected for the entire fiscal year. Because participation typically rises in the spring and summer months, it will likely increase further over the remainder of the current fiscal year. USDA forecasts participation will further increase in fiscal year 2024. If participation continues to rise more than expected — or if the economy falters and need increases — states could have to institute waiting lists.

The increase in participation is important. Policymakers have recently taken much-needed steps to reduce barriers to participation and increase take-up among eligible families. Despite WIC’s strong long-term impacts, take-up has been relatively low in recent years. In 2020, the most recent year for which data are available, only 50.2 percent of those eligible for the program participated (statistically unchanged from the 2019 rate); the share was even lower for pregnant people (45.6 percent) and children aged 1 through 4 (40.6 percent).[9] The American Rescue Plan included $390 million to carry out outreach, innovation, and program modernization projects to increase participation and retention in WIC.[10] USDA is only beginning to make this funding available to states and other partners, so any increases in WIC participation resulting from these projects will likely be seen over the coming years. Simultaneously, states have used various measures to reduce participation barriers.[11]

Food price inflation will also likely continue to affect WIC’s funding needs in the short term. Food-at-home prices increased by 11.4 percent overall in 2022 and grew faster than the historical average in all food categories.[12] Food price inflation impacts not only the program’s food costs but may also encourage higher rates of participation among eligible families who need additional assistance stretching their grocery budgets.

Additionally, House Republicans’ debt-ceiling-and-cuts bill would almost certainly result in even deeper cuts to WIC in future years when the ten-year spending caps in the bill become tighter and tighter and require deeper and deeper cuts. If WIC receives a funding level that is inadequate to serve all eligible applicants, low-income families seeking support would be put on waiting lists instead of being connected to WIC’s nutrition benefits and services.

The bill would also expand SNAP’s existing harsh work-reporting requirement, which limits many adults aged 18-49 without children in their homes to only three months of SNAP benefits in a three-year period unless they can demonstrate they are working or participating in a work training program for 20 hours per week or document that they qualify for an exemption. The bill would expand this requirement to include adults 50 to 55 years old, putting roughly an additional 1 million older adults nationwide at risk of losing SNAP benefits.[13] See Appendix Table 2 for estimates of the number of older adults aged 50-55 in each state who would be at risk of losing benefits.

Additionally, the bill would limit states’ use of exemptions to keep vulnerable people subject to this requirement temporarily connected to benefits, eliminating carryover of unused exemptions. This would further hamstring a state’s ability to respond to individuals’ specific needs, or to unique labor market challenges such as a manufacturing plant closure.

While not everyone subject to the expanded work reporting requirement would lose benefits, the Congressional Budget Office has estimated that an average of 275,000 people would be cut from SNAP each month.[14] Many others would be required to submit paperwork regularly to document their work hours or that they should be exempt based on their health status or another reason.

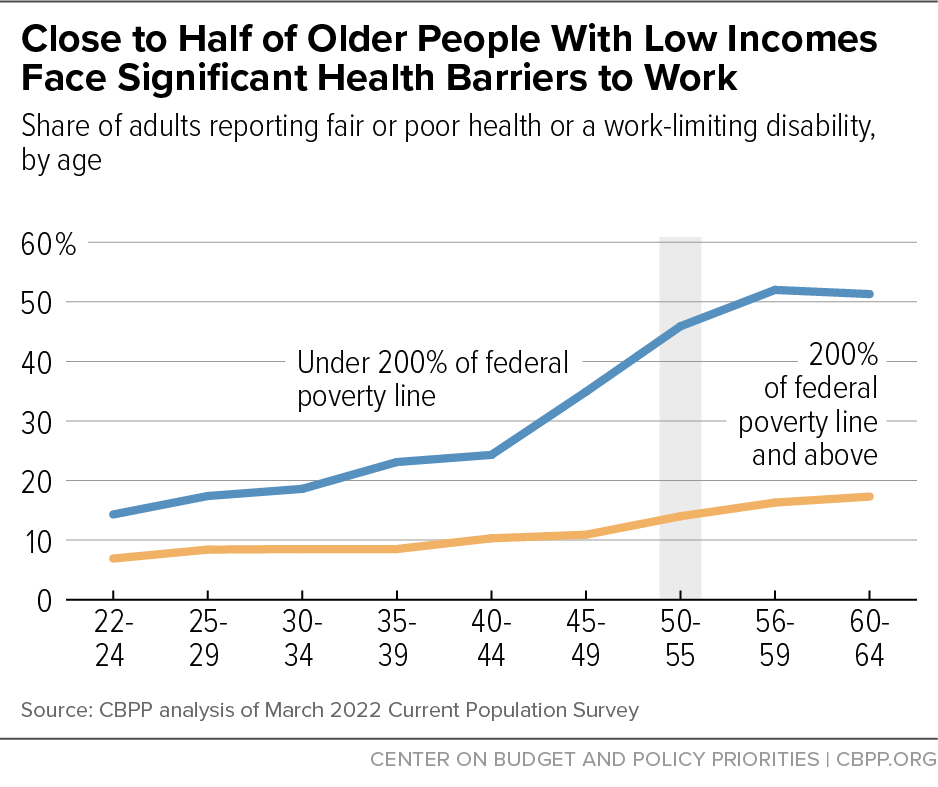

These older adults may be particularly vulnerable to losing benefits under a work-reporting requirement because they are more likely to face age-related discrimination in the labor market, may no longer be able to work in the same types of jobs that they performed when they were younger, and more frequently experience work-limiting health conditions but be unable to secure an exemption. Nearly half of low-income adults aged 50 to 55 report fair or poor health or a work-limiting disability, almost as high a share as for adults aged 56 to 64. (See Figure 1.)

Despite House Republicans’ claims that they would shield veterans from harmful cuts, many of the adults who would be at risk of losing SNAP benefits under this proposal are veterans.

Studies have repeatedly shown that this work-reporting requirement does not increase employment or earnings, it just cuts people off benefits, leaving them without the assistance they need to afford groceries.[15]

Health and nutrition are inextricably linked. Food insecurity harms people’s health; extensive research reveals a strong and consistent correlation between food insecurity and increased risk of adverse health outcomes, greater difficulty managing chronic illnesses, and higher health care costs.[16] Adequate food and health coverage are both necessary to safeguard people’s health.

Most SNAP participants who are able to work for pay, do so. But instead of being based on evidence, these requirements are based on the faulty premise that SNAP participants are choosing not to work and must be compelled to do so, an assumption that is often rooted in prejudices about people based on race, gender, disability status, and class.[17]

Taken together, these harmful policy changes and funding cuts would significantly reduce or eliminate vital food assistance benefits for millions of people across various stages of life, from toddlers and pregnant WIC participants to older SNAP participants on the verge of retirement.

| TABLE 1 |

|---|

|

| State | Number of Pregnant and Postpartum WIC Participants Who Would Be Affected by Cut* | Number of Child WIC Participants Who Would Be Affected by Cut** | Total Reduction in Fruit and Vegetable Benefits Available to WIC Participants in FY24*** |

|---|

| Alabama | 24,000 | 57,000 | $18,883,000 |

| Alaska | 3,000 | 8,000 | $2,408,000 |

| Arizona | 28,000 | 78,000 | $23,911,000 |

| Arkansas | 14,000 | 28,000 | $10,196,000 |

| California | 200,000 | 574,000 | $173,963,000 |

| Colorado | 19,000 | 45,000 | $14,787,000 |

| Connecticut | 10,000 | 26,000 | $8,142,000 |

| Delaware | 4,000 | 11,000 | $3,301,000 |

| District of Columbia | 3,000 | 5,000 | $1,875,000 |

| Florida | 96,000 | 221,000 | $74,403,000 |

| Georgia | 43,000 | 92,000 | $32,032,000 |

| Hawai’i | 6,000 | 15,000 | $4,772,000 |

| Idaho | 7,000 | 17,000 | $5,467,000 |

| Illinois | 36,000 | 82,000 | $27,845,000 |

| Indiana | 32,000 | 78,000 | $25,338,000 |

| Iowa | 12,000 | 32,000 | $10,115,000 |

| Kansas | 10,000 | 25,000 | $8,169,000 |

| Kentucky | 23,000 | 66,000 | $20,009,000 |

| Louisiana | 24,000 | 36,000 | $15,302,000 |

| Maine | 3,000 | 10,000 | $3,028,000 |

| Maryland | 28,000 | 65,000 | $21,957,000 |

| Massachusetts | 24,000 | 74,000 | $21,797,000 |

| Michigan | 41,000 | 120,000 | $35,715,000 |

| Minnesota | 22,000 | 60,000 | $18,686,000 |

| Mississippi | 13,000 | 33,000 | $10,642,000 |

| Missouri | 22,000 | 42,000 | $15,465,000 |

| Montana | 3,000 | 8,000 | $2,476,000 |

| Nebraska | 7,000 | 20,000 | $6,261,000 |

| Nevada | 11,000 | 28,000 | $9,148,000 |

| New Hampshire | 2,000 | 9,000 | $2,382,000 |

| New Jersey | 35,000 | 89,000 | $28,654,000 |

| New Mexico | 9,000 | 17,000 | $6,314,000 |

| New York | 88,000 | 233,000 | $73,239,000 |

| North Carolina | 58,000 | 148,000 | $47,194,000 |

| North Dakota | 2,000 | 6,000 | $1,757,000 |

| Ohio | 40,000 | 87,000 | $30,007,000 |

| Oklahoma | 16,000 | 34,000 | $11,895,000 |

| Oregon | 16,000 | 46,000 | $13,784,000 |

| Pennsylvania | 37,000 | 88,000 | $28,727,000 |

| Rhode Island | 4,000 | 9,000 | $2,952,000 |

| South Carolina | 20,000 | 47,000 | $15,573,000 |

| South Dakota | 3,000 | 8,000 | $2,392,000 |

| Tennessee | 31,000 | 59,000 | $21,710,000 |

| Texas | 201,000 | 357,000 | $138,682,000 |

| Utah | 9,000 | 21,000 | $7,151,000 |

| Vermont | 2,000 | 7,000 | $1,919,000 |

| Virginia | 25,000 | 70,000 | $21,111,000 |

| Washington | 27,000 | 73,000 | $22,656,000 |

| West Virginia | 7,000 | 21,000 | $6,342,000 |

| Wisconsin | 17,000 | 51,000 | $15,314,000 |

| Wyoming | 2,000 | 4,000 | $1,287,000 |

| 50 States & D.C. | 1,420,000 | 3,442,000 | $1,127,135,000 |

| TABLE 2 |

|---|

|

|

| State | Total number of SNAP participants aged

50-55 at risk of losing SNAP |

|---|

| Alabama | 17,000 |

| Alaska | 2,000 |

| Arizona | 17,000 |

| Arkansas | 6,000 |

| California | 136,000 |

| Colorado | 11,000 |

| Connecticut | 11,000 |

| Delaware | 4,000 |

| District of Columbia | 5,000 |

| Florida | 58,000 |

| Georgia | 23,000 |

| Guam | 1,000 |

| Hawai’i | 4,000 |

| Idaho | 2,000 |

| Illinois | 54,000 |

| Indiana | 10,000 |

| Iowa | 9,000 |

| Kansas | 3,000 |

| Kentucky | 18,000 |

| Louisiana | 17,000 |

| Maine | 3,000 |

| Maryland | 18,000 |

| Massachusetts | 15,000 |

| Michigan | 34,000 |

| Minnesota | 6,000 |

| Mississippi | 8,000 |

| Missouri | 12,000 |

| Montana | 2,000 |

| Nebraska | 3,000 |

| Nevada | 11,000 |

| New Hampshire | 1,000 |

| New Jersey | 11,000 |

| New Mexico | 15,000 |

| New York | 54,000 |

| North Carolina | 24,000 |

| North Dakota | 1,000 |

| Ohio | 39,000 |

| Oklahoma | 13,000 |

| Oregon | 21,000 |

| Pennsylvania | 40,000 |

| Rhode Island | 3,000 |

| South Carolina | 11,000 |

| South Dakota | 2,000 |

| Tennessee | 24,000 |

| Texas | 53,000 |

| Utah | 3,000 |

| Vermont | 1,000 |

| Virgin Islands | 1,000 |

| Virginia | 22,000 |

| Washington | 19,000 |

| West Virginia | 9,000 |

| Wisconsin | 14,000 |

| Wyoming | 1,000 |

| U.S. Total | 900,000 |