- Home

- Large Job Growth Unlikely To Follow Tax ...

Large Job Growth Unlikely to Follow Tax Cuts for the Rich and Corporations

The tax framework that the Trump Administration and congressional Republican leaders announced on September 27 includes massive tax cuts that overwhelmingly benefit high-income and high-wealth individuals. Proponents claim they will create jobs and boost economic growth; for example, Treasury Secretary Steven Mnuchin claims that that the framework would help the economy “get back to sustained 3 percent GDP or higher, which adds literally millions and millions of jobs.” In reality, tax cuts for high-income people and corporations won’t likely lead to substantial job growth and could even cost jobs.[1]

Tax Cuts for Wealthy Haven’t Led to Jobs Boom

History shows tax cuts for the rich aren’t a surefire way to create jobs — and that tax increases don’t preclude robust job and economic growth.

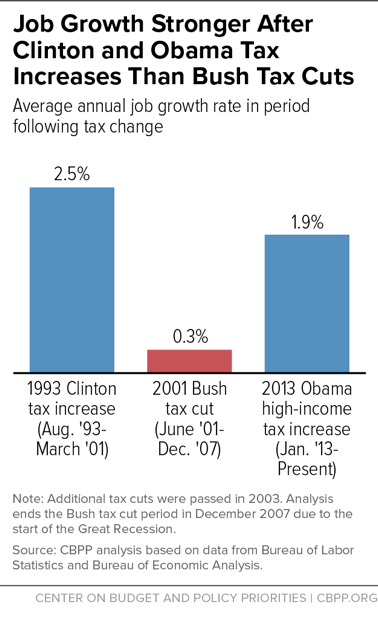

- Job growth was much weaker following the George W. Bush tax cuts, which gave the biggest boosts to high-income households, than after the tax increases on high-income households under Presidents Clinton and Obama. (See chart.)

- When Kansas enacted large tax cuts overwhelmingly for the wealthy, Gov. Sam Brownback claimed the tax cuts would act “like a shot of adrenaline into the heart of the Kansas economy.” But Kansas’ job growth, growth in small business formation, and economic growth have lagged behind the country as a whole.

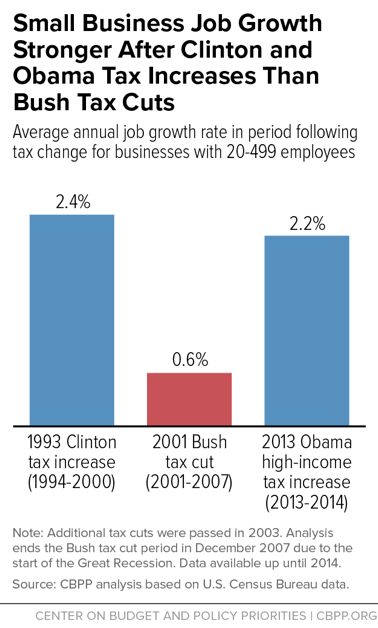

These facts don’t prove that tax cuts are bad for jobs or that tax increases lead to job growth; many other factors affect the economy and job creation. But they dispel claims that large tax cuts are a silver bullet for job creation and will create “millions and millions of jobs.”

Research Doesn’t Find Relationship Between High-Income Tax Cuts and Job Growth

Careful empirical research finds that, contrary to overstated “supply side” predictions, tax cuts on high-income people’s earnings or income from wealth (such as capital gains and dividends) don’t lead to substantial job growth.

- Tax cuts on capital gains and dividends flow overwhelmingly to the wealthiest filers but do little to boost saving and investment. For example, a recent study found “empirical evidence that the 2003 tax cuts [which lowered the rates on capital gains on dividends] had little impact on investment or employment.”

- A study of the effects of federal and state tax changes found that tax cuts for the top 10 percent of households don’t have statistically significant effects on state employment growth. It also found that state employment levels, economic activity, and net earnings are “unresponsive to tax changes for the top 10 percent.”

- High earners are unlikely to increase their work hours due to cuts in their tax rates, research shows. “Overall, evidence suggests [high-income Americans’] labor supply is insensitive to tax rates,” Tax Policy Center (TPC) co-founder Leonard Burman notes.

Tax Cuts for Corporations Are Poor Path to Job Creation — and Could Hurt It

- Most corporate rate cuts go to high-income investors and don’t “trickle down” to workers. Contrary to claims that workers will benefit as companies invest more and thereby boost jobs or wages, mainstream estimates are that only a very small share of corporate rate cuts eventually flows to workers. And, even taking this effect into account, TPC finds that about 70 percent of the benefit of a corporate rate cut ultimately flows to the top fifth of households, and more than a third flows to the top 1 percent.

- Some types of corporate tax cuts risk hurting jobs. Under the GOP framework, for example, foreign profits of U.S.-based multinational corporations would face a tax rate of zero (due to adoption of a “territorial” tax system) while U.S. profits would face a rate of 20 percent. This massive, permanent tax advantage for foreign over domestic profits would encourage corporations to shift investments overseas, threatening U.S. jobs and wages.

Top-Tilted Tax Cuts Don’t Boost Small Businesses or Entrepreneurship

Proponents of high-income tax cuts often argue that small businesses create most new jobs and face unfairly high tax rates if organized as “pass-through” businesses such as partnerships, S corporations, and sole proprietorships. However, these claims are misleading:

- Pass-through businesses are taxed through the individual income tax, and so have the advantage of being exempt from the corporate tax on profits and taxes on dividends. Further, most already face very low rates and would not benefit: 86 percent of filers with pass-through income are taxed at a statutory marginal income tax rate of 25 percent or lower.

- The GOP proposal to cut the top rate for pass-through income to 25 percent would overwhelmingly benefit the wealthy. About 80 percent of the tax cut would flow to millionaires, including hedge funds managers, lawyers, and lobbyists — not “mom and pop” businesses.

- But tax cuts for the wealthy won’t likely lead to meaningful job growth. Indeed, small business job growth was far stronger after the Clinton and Obama top rate increases than the Bush tax cuts. (See chart.)

- Tax cuts for the wealthy don’t effectively encourage entrepreneurship. In fact, “higher tax rates are more likely to encourage, rather than discourage, self-employment,” the Congressional Research Service concludes. One reason why: taxes may reduce earnings volatility. The government bears some of the risk of a new venture by allowing tax deductions for losses, but taxes the profits of successful businesses.

- Research shows that young, startup companies (rather than small businesses generally) disproportionately create new jobs. Tax increases on high-income people don’t seem to discourage entrepreneurs from starting businesses; indeed, startup firms typically pay little or no tax early on.

Tax Cuts for Wealthy and Corporations Could Hurt Workers

Huge tax cuts for the wealthy and corporations could actually hurt growth and the majority of Americans. If they aren’t paid for, the increased deficits would reduce national saving, meaning less capital would be available for investment in the economy and interest rates could rise — and wages could fall.

Further, deficit-financed tax cuts would eventually have to be paid for through increases in other taxes or cuts to government services. Social Security, Medicare, and low-income programs would be especially vulnerable, and the fiscal squeeze would mean fewer resources for additional needed investments in areas like infrastructure and education that could help the economy, jobs, and wages over time. Given these eventual financing costs, unpaid-for tax cuts for the wealthy and corporations would likely leave most Americans worse off in the long run.

Recent Studies Find Raising Taxes on High-Income Households Would Not Harm the Economy

Tax Cuts for the Rich Aren’t an Economic Panacea — and Could Hurt Growth

Policy Basics

Federal Tax

End Notes

[1] For further information, see: Chye-Ching Huang and Nate Frentz, “What Really Is the Evidence on Taxes and Growth? A Reply to the Tax Foundation,” CBPP, February 18, 2014, http://bit.ly/2psynnm; Chye-Ching Huang, “Recent Studies Find Raising Taxes on High-Income Households Would Not Harm the Economy,” CBPP, April 24, 2012, http://bit.ly/1OcYHTA; Center on Budget and Policy Priorities, “Tax Cuts for the Rich Aren’t an Economic Panacea – and Could Hurt Growth,” April 13, 2017, http://bit.ly/2pPRxkl; Owen M. Zidar, “Tax Cuts for Whom? Heterogeneous Effects of Income Tax Changes on Growth and Employment,” National Bureau of Economic Research, February 22, 2017, http://bit.ly/1D6JGNL; Danny Yagan, “Capital Tax Reform and the Real Economy: The Effects of the 2003 Dividend Tax Cut,” National Bureau of Economic Research, December 2015, http://bit.ly/2quy4XG.