- Home

- Federal Tax

- 2017 Tax Law Shrinks Revenue When More R...

2017 Tax Law Shrinks Revenue When More Revenue Is Needed

The major tax legislation enacted in December 2017 not only invites rampant tax sheltering and is heavily tilted in favor of wealthy people and corporations, but also suffers from a third fundamental flaw: it weakens revenues at a time when the nation will need more revenue as the baby boom moves deeper into retirement, health costs grow, and other factors will increase federal spending.[1]

The 2017 tax law costs $1.9 trillion over ten years (2018-2027), according to the Congressional Budget Office (CBO).[2] Nearly all of the law’s changes to the individual income tax expire after 2025; extending them would cost about $250 billion in 2027 alone and $2.8 trillion from 2026 to 2035. Extending other provisions — such as the tax break for business investment known as “expensing”— would add even more to the law’s cost.

Yet the nation is facing long-term fiscal challenges that will require more revenue, not less. The law therefore weakens the tax system’s ability to deliver on its core responsibility: raising sufficient revenue to adequately finance critical national needs and avoid spiraling debt and interest burdens.

Major Cost Drivers Include Demographics, Health, and Interest Costs

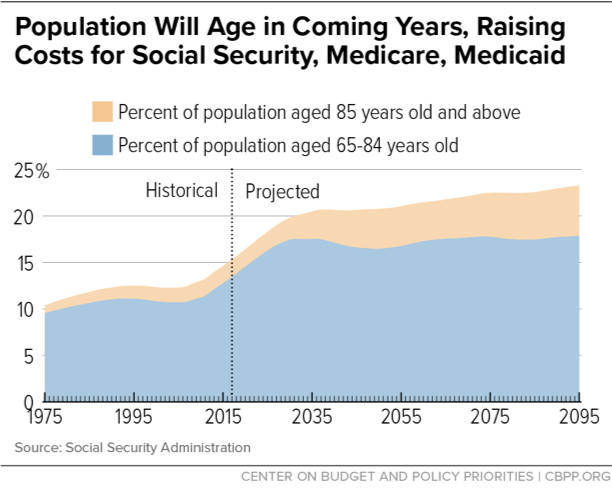

Federal spending will necessarily increase as a share of GDP over the next few decades due to several factors. The most important is the aging of the population. For the next two decades, people 65 or older will grow from 15 percent to 21 percent of the population. And the “old-old” population — those aged 85 years old and above, who have much higher health care costs than other elderly individuals — will grow even more rapidly (see graph). This will increase spending on Social Security, Medicare, and Medicaid.

Compounding the higher costs associated with these demographic realities, health care expenditures — in both the public and private sectors — have long grown faster than the economy and will likely continue to do so, in part due to new procedures, drugs, and treatments that improve health and save lives but also add to costs. In recent years, the pace of health care cost growth has slowed, but the extent to which the slowdown will persist is unknown.

Interest payments on the debt will also rise. Interest rates are expected to increase from their historically low levels to more normal levels; the Federal Reserve has begun gradually increasing interest rates, and most economic forecasters anticipate rates to continue rising in future years. The projected increase in the debt will raise interest payments further.

There also are strong pressures for higher spending outside Social Security and major health programs. Defense and non-defense discretionary programs have borne the bulk of deficit reduction efforts since 2010, and spending in both areas is well below their historical averages as shares of GDP. These reductions aren’t sustainable, as the recent bipartisan agreement to boost funding for these programs in 2018 and 2019 indicates. In addition, resources will surely be required — or demanded — to offset the cost of new federal initiatives to grapple with evolving challenges in the 21st century, such as the need to address a decaying infrastructure.

Policymakers should pursue appropriate avenues for achieving budgetary savings, such as eliminating duplicative, outdated, or ineffective programs and reducing errors and overpayments in federal programs. But those savings won’t come close to offsetting the factors that will raise federal expenditures overall. Absent a radical shift in longstanding public values and preferences about the role of the federal government, more revenue will be needed.

Revenue Needs Will Grow Accordingly

Since 1976, federal spending has averaged 20.5 percent of GDP, although its composition has changed substantially, while federal revenue has averaged 17.4 percent of GDP. We estimate that the factors noted above will boost federal spending to roughly 23 percent of GDP in 2035 — an increase of 3 percentage points over the historical average.[3] This projection is conservative; in CBO’s long-term baseline, spending rises to 25.3 percent of GDP in 2035.

Complicating this spending pressure, the debt stands today at 78 percent of GDP, high by historical standards, and is on a track to rise to over 100 percent of GDP over the next two decades. While there are no absolute thresholds for when a debt-to-GDP ratio becomes problematic, a perpetually rising debt ratio isn’t sustainable over the long run, as it leaves less and less saving available for private investment. Stabilizing or reducing the debt-to-GDP ratio doesn’t require balancing the budget or running surpluses as long as the debt isn’t growing more rapidly than the economy.

The foreseeable upward pressure on spending, combined with an already elevated debt-to-GDP ratio, means that policymakers will need to raise significant additional revenue over the next two decades. Revenues were 17.3 percent of GDP in 2017, or roughly at their 40-year average, before enactment of the new tax law. To keep pace with the estimated growth in spending, revenues would need to rise by at least 3 percentage points of GDP by 2035, and possibly more.

The law, however, does the opposite. Under it, revenues will fall below their historical average as a percent of GDP for the next several years, before beginning to edge up slowly. Indeed, as former Council of Economic Advisers Chair Jason Furman has pointed out, the only times in the past 50 years that revenue has been so low as a percent of the economy as it is today was in the aftermath of the past two recessions.

The revenue picture later in the decade is less certain, because many of the law’s provisions — particularly its changes to individual income taxes — are set to expire after 2025. (The bill’s drafters did this so that the bill would comply with Senate rules and could pass the Senate with a simple majority, rather than the 60 votes that would otherwise be required.) This means Congress will have a chance later in the decade to revisit these policies. But Congress should not wait that long; lawmakers should act as soon as possible to reverse the law’s fiscally irresponsible revenue losses and the upward pressure it’s placing on deficits and debt.

End Notes

[1] For more information, see Chuck Marr, Brendan Duke, and Chye-Ching Huang, “New Tax Law Is Fundamentally Flawed and Will Require Basic Restructuring,” Center on Budget and Policy Priorities, updated August 14, 2018, https://www.cbpp.org/research/federal-tax/new-tax-law-is-fundamentally-flawed-and-will-require-basic-restructuring.

[2] CBO estimates that the law could generate additional economic growth to offset a small share of this revenue loss, but — if interest costs from the new debt the law will incur are also added — it still costs $1.9 trillion. Congressional Budget Office, “The Budget and Economic Outlook: 2018 to 2028,” April 9, 2018, https://www.cbo.gov/publication/53651.

[3] Paul N. Van de Water, “Federal Spending and Revenues Will Need to Grow in Coming Years, Not Shrink,” Center on Budget and Policy Priorities, September 6, 2017, https://www.cbpp.org/research/federal-budget/federal-spending-and-revenues-will-need-to-grow-in-coming-years-not-shrink.