Policy Brief: Increases in TANF Cash Benefit Levels Are Critical to Help Families Meet Rising Costs

End Notes

[1] Da’Shon Carr was an intern with CBPP from June 2022 through December 2022.

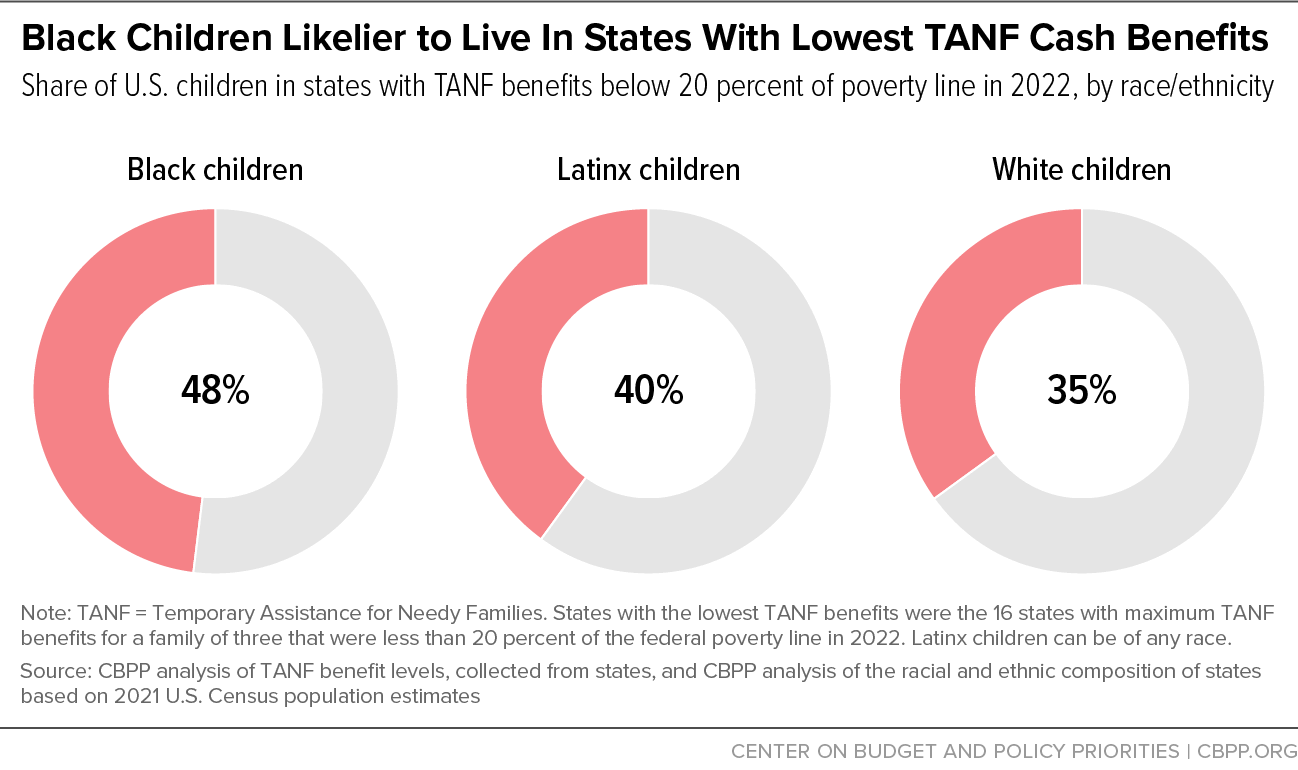

[2] For more detail, see Ife Floyd and LaDonna Pavetti, “Improvements in TANF Cash Benefits Needed to Undo the Legacy of Historical Racism,” CBPP, January 26, 2022, https://www.cbpp.org/research/income-security/improvements-in-tanf-cash-benefits-needed-to-undo-the-legacy-of-historical.

[3] Alabama, Arizona, Arkansas, Delaware, Florida, Georgia, Idaho, Indiana, Kentucky, Mississippi, Missouri, North Carolina, Oklahoma, South Carolina, and Texas.

[4] For more on the racist history of AFDC and TANF benefit levels, see Ife Floyd et al., “TANF Policies Reflect Racist Legacy of Cash Assistance,” CBPP, August 4, 2021, https://www.cbpp.org/research/family-income-support/tanf-policies-reflect-racist-legacy-of-cash-assistance.

[5]CBPP analysis of 2021 U.S. Census population estimates collected from Kids Count Data Center, “Child Population by race in the United States,” Annie E. Casey Foundation, October 2022, https://datacenter.kidscount.org/data/tables/103-child-population-by-race-and-ethnicity?loc=1&loct=2#detailed/2/2-52/false/2048/68,69,67,12,70,66,71,72/423.

[6]Heather Hahn et al., “Why Does Cash Welfare Depend on Where You Live?” Urban Institute, June 5, 2017, https://www.urban.org/research/publication/why-does-cash-welfare-depend-where-you-live.

[7] Floyd et al., op. cit.

[8]Hahn et al., op. cit.; Joe Soss et al., “Setting the Terms of Relief: Explaining State Policy Choices in the Devolution Revolution,” American Journal of Political Science, Vol. 45, No. 2, Apr. 2001, http://urban.hunter.cuny.edu/~schram/ssvosettingthetermsofrelief.pdf.

[9]Ali Zane, “Remaining States Should Lift Racist TANF Drug Felony Bans; Congress Should Lift It Nationwide,” CBPP, June 30, 2021, https://www.cbpp.org/blog/remaining-states-should-lift-racist-tanf-drug-felony-bans-congress-should-lift-it-nationwide.

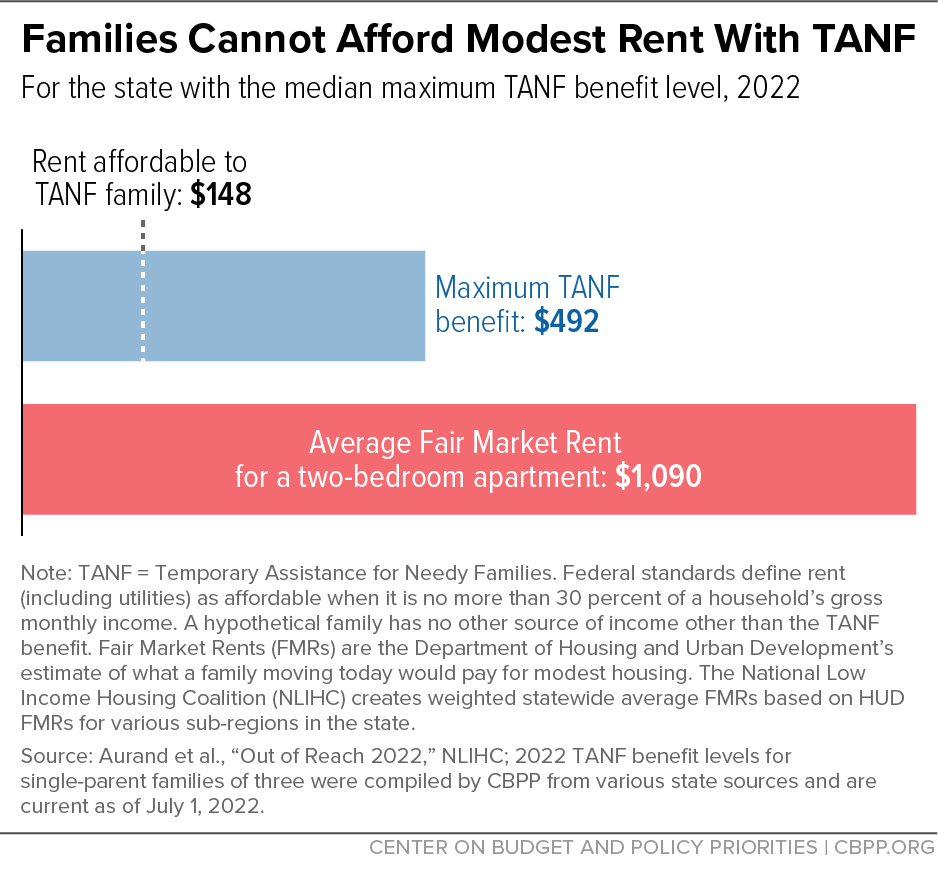

[10] HUD’s FMRs are gross rent estimates that include the shelter rent plus the cost of all utilities except phone and internet. For more on FMRs, see Andrew Aurand et al., “Out of Reach 2022,” National Low Income Housing Coalition (NLIHC), 2022, https://nlihc.org/oor.

[11] Arloc Sherman, “Widespread Economic Insecurity Pre-Pandemic Shows Need for Strong Recovery Package,” CBPP, July 14, 2021, https://www.cbpp.org/research/poverty-and-inequality/widespread-economic-insecurity-pre-pandemic-shows-need-for-strong; CBPP, “Tracking the COVID-19 Economy’s Effects on Food, Housing, and Employment Hardships,” updated November 10, 2021, https://www.cbpp.org/research/poverty-and-inequality/tracking-the-covid-19-economys-effects-on-food-housing-and; Emily Lemmerman et al., “Preliminary Analysis: Who is being filed against during the pandemic?” The Eviction Lab, December 21, 2020, https://evictionlab.org/pandemic-filing-demographics/.

[12] For more on TANF housing supplements see Ali Zane, Cindy Reyes, and LaDonna Pavetti, ”TANF Can Be a Critical Tool to Address Family Housing Instability and Homelessness,” CBPP, July 19, 2022, https://www.cbpp.org/research/family-income-support/tanf-can-be-a-critical-tool-to-address-family-housing-instability.

[13]National Academies of Science, Engineering, and Medicine, “The Consequences of Child Poverty,” A Roadmap to Reducing Child Poverty, 2019, https://www.ncbi.nlm.nih.gov/books/NBK547371/.

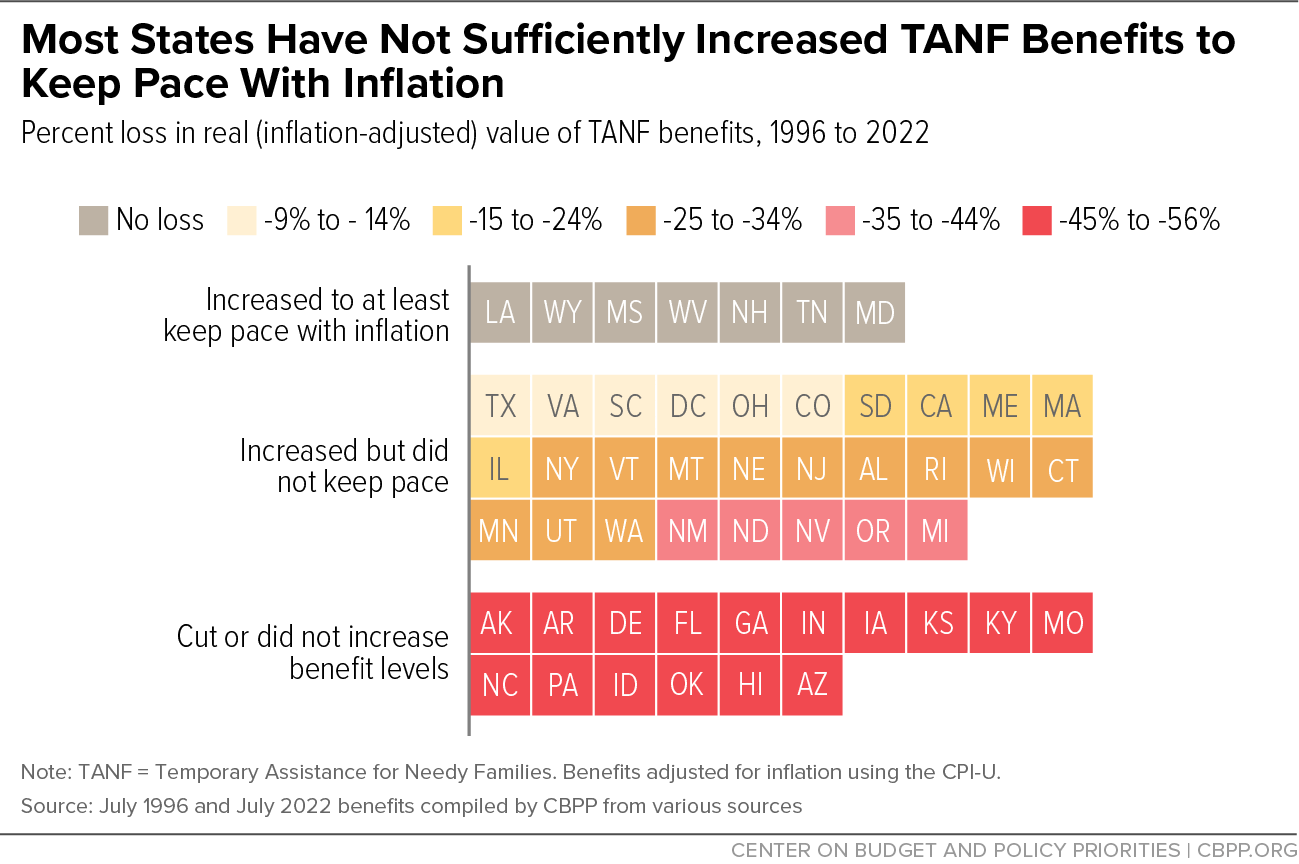

[14] A statutory COLA is the best way to ensure that benefits keep pace with inflation. For example, Wyoming’s COLA is based on the Wyoming Cost of Living Index for the previous year. New Hampshire’s benefit level is tied to 60 percent of the federal poverty line, which is indexed for inflation. Therefore, the state’s benefit also rises each year with inflation. These policies have made New Hampshire and Wyoming two of only six states whose benefits have risen since 1996 in inflation-adjusted terms.