BEYOND THE NUMBERS

We’ve updated two important pieces about Disability Insurance (DI), an integral part of Social Security that protects workers who can’t support themselves anymore because of a severe medical impairment, to reflect the latest statistics and research.

The first of those pieces, our popular chart book, presents nearly two dozen graphs that illustrate key DI facts: why it’s important, why the DI rolls have grown, who receives benefits, and what financing issues the program faces.

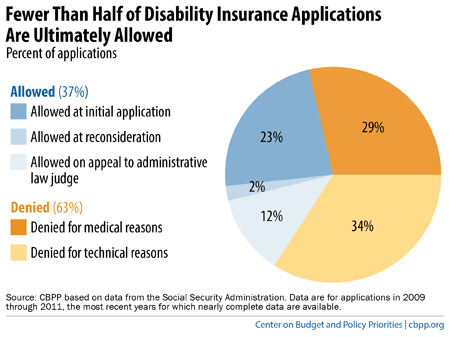

The chart below, for example, shows that most DI applications are rejected. People who seek DI benefits must meet strict criteria: they must have a solid work history (essentially, they must have worked for at least one-fourth of their adult life and five of the last ten years); they must suffer from a severe physical or mental impairment that has lasted five months and that’s expected to last 12 months or result in death, as evidenced by clinical findings from acceptable medical sources; and they must be unable to perform “substantial gainful activity” (any job that pays $1,090 per month) anywhere in the national economy. In recent years, fewer than 40 percent of applicants to the program have qualified under those stringent criteria, even after all appeals (see graph).

The second piece, our primer (or “Policy Basic”), is a short backgrounder on the Disability Insurance program and why it’s important.

In the next few weeks, we’ll explain more about what other graphs from the chart book show and why they matter. In the meantime, check out our collection of the many analyses we’ve done on this vital program here and related blog posts here.