BEYOND THE NUMBERS

As state lawmakers continue to focus on recovery from the COVID-19 pandemic and recession, they should also commit to ensuring a more racially just future by making changes to their tax codes to address racial discrimination and income disparities. Most states worsen income inequality across racial groups by taxing Native American, Black, and Latinx families at higher rates than white families on average, according to a new report on taxes and racial equity from the Institute on Taxation and Economic Policy (ITEP).

Many local, state, and federal policy choices also contribute to racial and economic disparities; and tax and revenue systems often underlie and worsen those choices. For example, many states and localities make existing income disparities even worse for communities of color by relying too much on regressive forms of revenue like consumption taxes or various kinds of fees and too little on income and wealth taxes, which ask more of those at the top, a group that’s disproportionately white.

States do not raise revenue or collect taxes based on people’s race, but historical racism and ongoing forms of discrimination and bias shape people’s incomes and the property they own. In short, tax policy cannot be race neutral because of the country’s legacy of racism. ITEP’s analysis demonstrates how regressive tax policies — regardless of intent — result in worse outcomes for people of color.

State revenue policies also affect policymakers’ ability to pay for health care, education, and other public investments that strengthen communities and reduce racial inequities. Low overall tax rates reduce the revenue needed to pay for basic services as well as opportunity-broadening investments like education and job training, which are especially critical to people with low incomes and communities of color. Similarly, using local property taxes to finance education can worsen education inequities if lawmakers do not redistribute or offset the higher levels of funding available from property taxes for students in wealthier and often whiter communities with higher property values.

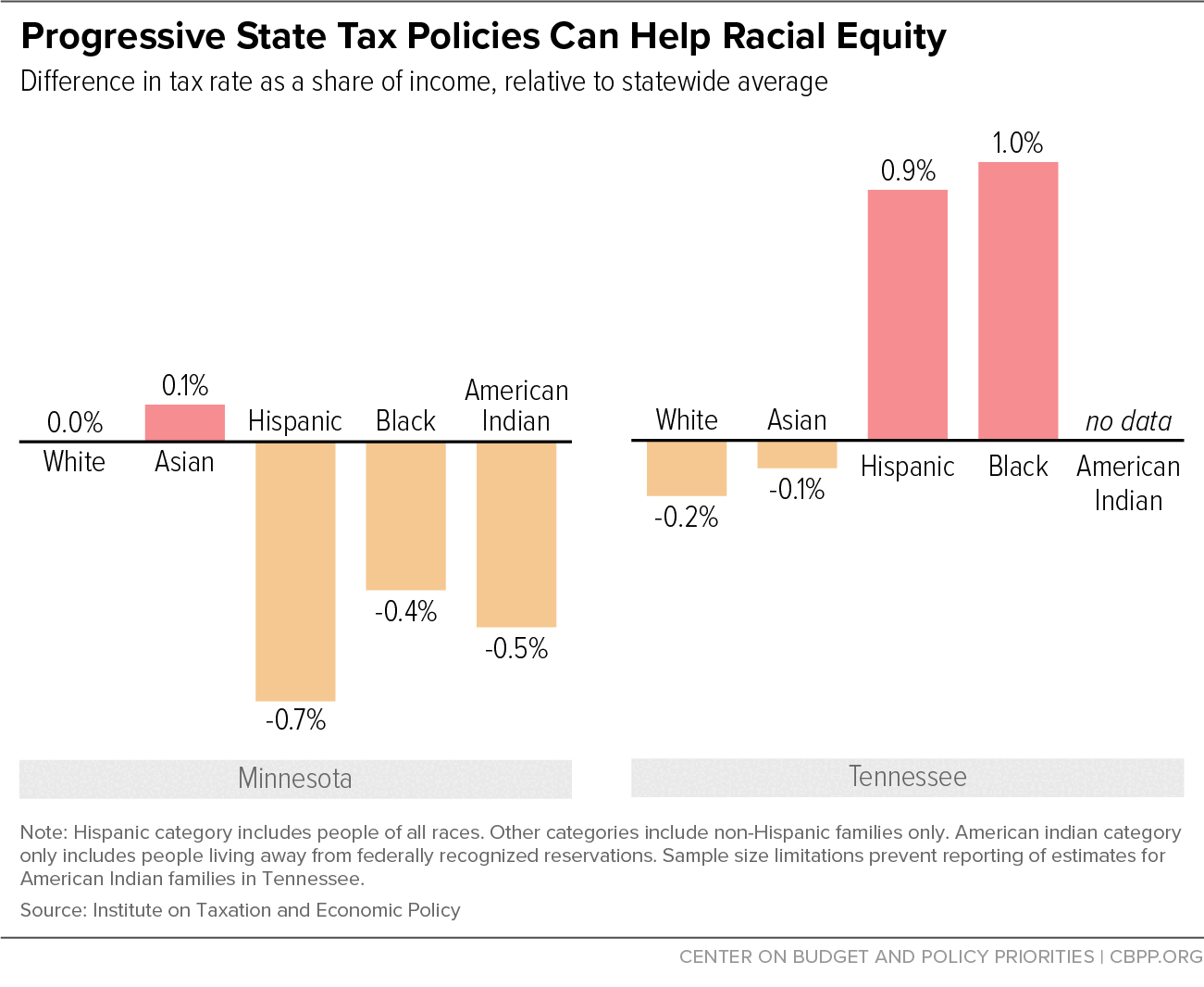

ITEP’s case study of Minnesota and Tennessee illustrates how state tax systems can affect racial inequities (see chart). In Minnesota, which raises significant revenue through a progressive personal income tax, Hispanic, Black, and Native American families pay tax rates that are 0.7, 0.5, and 0.4 percent below the state average, respectively, because their incomes are lower than the average in the state. In Tennessee, which raises most of its revenue through a regressive and high general sales tax (including a sales tax on food), Hispanic and Black families pay tax rates that are 0.9 and 1 percent above the state average, respectively.

State lawmakers cannot afford to ignore the racial and economic inequities that are built into their tax systems. To reduce inequities and make the sorts of antiracist and forward-thinking investments needed for this recovery and the future, lawmakers should:

- Reform sales and excise taxes, for example by reducing or eliminating taxes on groceries, modernizing them to include services and digital purchases, and creating refundable tax credits;

- Strengthen progressive income taxes by increasing tax rates on higher-income earners (such as through millionaires’ taxes), eliminating tax subsidies on investment or pass-through business income, and more;

- Tax wealth by raising estate or inheritance taxes, strengthening taxes on capital gains and business income, and increasing taxes on high-value homes (mansion taxes);

- Offer refundable tax credits to people with low incomes, like the Earned Income Tax Credit and Child Tax Credit;

- Ensure corporations pay their fair share by raising corporate income taxes and combating tax avoidance through combined reporting;

- Reduce criminal legal fees and fines, which take more from low-income communities of color due to America’s discriminatory criminal justice system.

In addition to making their tax systems more equitable, states should also advance racial justice by:

- Removing revenue-raising barriers, such as supermajority vote requirements, and reforming or repealing restrictions on local government revenue-raising;

- Targeting federal and state aid to those most in need; and

- Investing in or strengthening programs and policies that can dismantle persistent inequities, like unemployment insurance, higher education for students of color and those with low incomes, rental assistance, child care, and paid leave policies.

States must design their tax systems to work for everyone — especially the communities of color that government policies have too often ignored, and disproportionately harmed.