BEYOND THE NUMBERS

Growing income inequality is a huge challenge facing the nation, and a new study by the Federal Reserve Bank of Boston shows that state earned income tax credits (EITCs) can play a major role in addressing it.

The study first shows that the federal income tax code works to close the income gap between the top and bottom by taxing households based on their income. It then measures how much state tax systems either widen or narrow that gap. The authors find that, on average, state taxes widen inequality. In half of the states, however, the tax system narrows the gap — and state EITCs play an important role in that narrowing.

In the 17 states with EITCs between 2003 and 2007, the authors find that:

- 15 states had tax systems that narrowed the gap.

- In six of the 15, the state EITC did 50 percent or more of the work to narrow the gap.

- In another three, the state EITC did more than 25 percent of the work. (In just one state — Wisconsin — the EITC had no impact.)

- In the two states with tax systems that widened the gap, state EITCs lessened the rise in inequality.

- Bigger state EITCs tended to reduce the income gap by more than smaller EITCs.

Why the big impact? When state EITCs are refundable — meaning families get the credit’s full value even if it exceeds the income taxes they owe — they help to offset other state and local taxes that fall hardest on low-income households. Sales and excise taxes (like gas taxes) in particular eat up a big share of low-income households’ earnings.

Moreover, this study excludes many taxes that boost inequality, including taxes that businesses pass on to consumers and local property taxes that tend to hit low-income households hardest. Another study that includes these taxes finds that all state and local tax systems worsen inequality — but EITCs improve the situation. EITCs reduce inequality in part by helping offset these other taxes for low-income families.

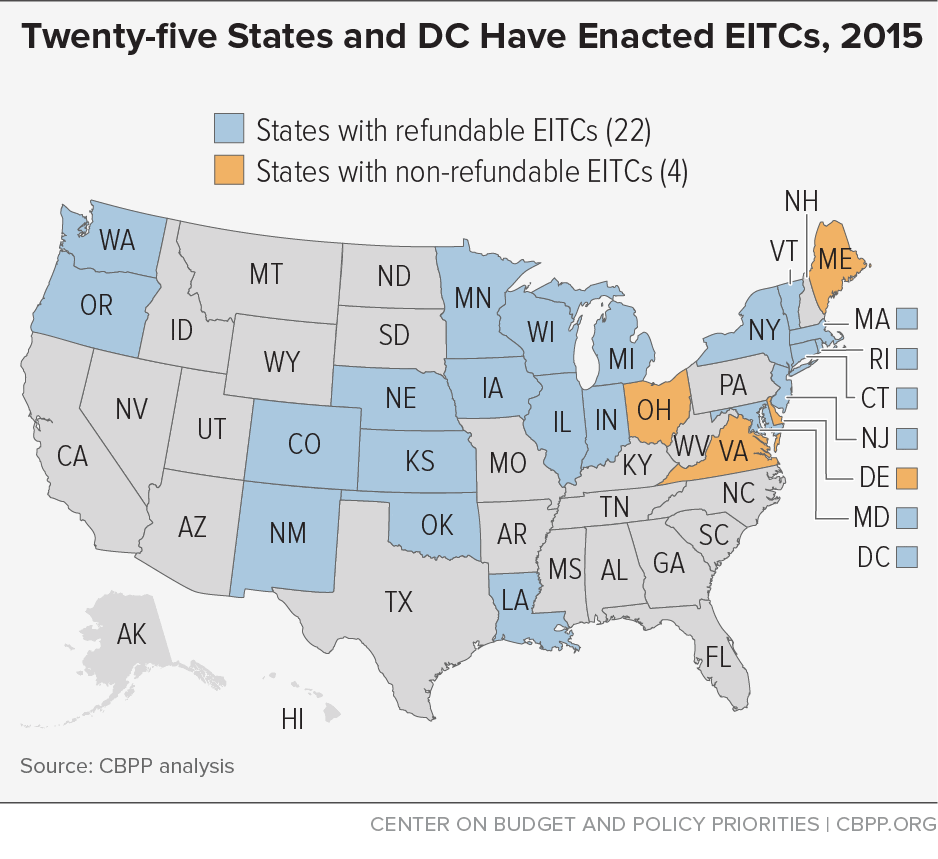

Twenty-five states and the District of Columbia currently have their own EITCs; all but four are refundable (see map). These states should consider expanding their credits, while the 25 states without an EITC should note how such a credit could help to spread the benefits of prosperity more broadly among their residents.