- Home

- State Earned Income Tax Credits

Policy Basics: State Earned Income Tax Credits

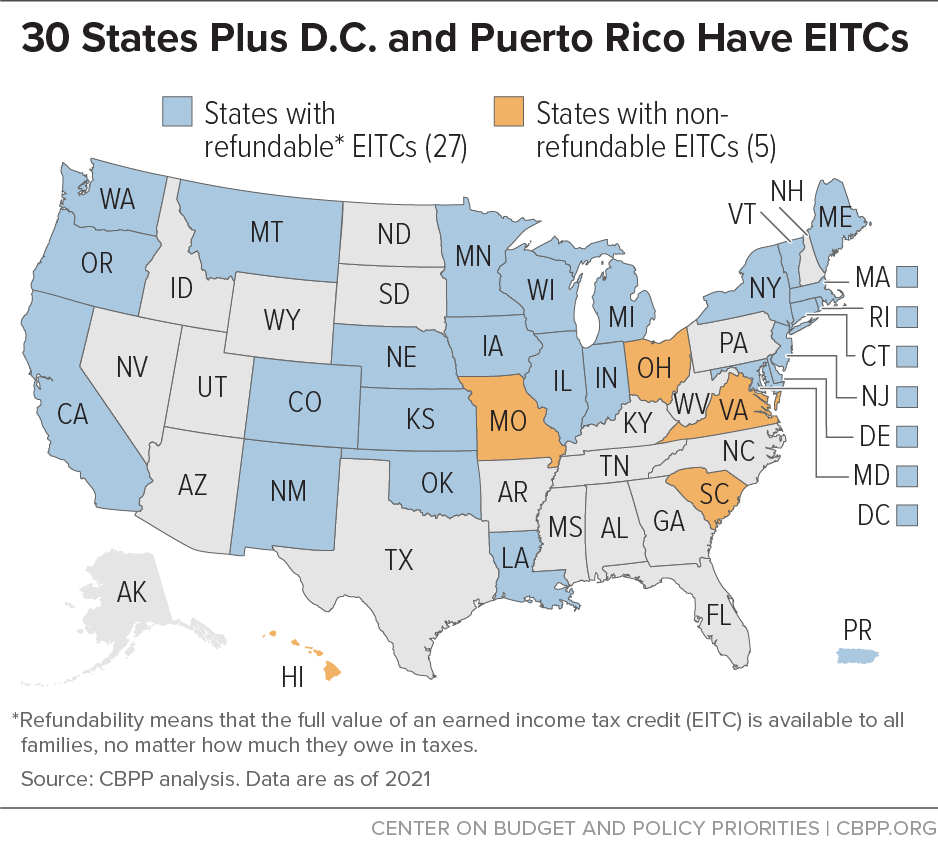

Thirty states plus the District of Columbia and Puerto Rico have enacted their own version of the federal Earned Income Tax Credit (EITC) to boost the incomes of people paid low wages. State EITCs build on the success of the federal credit by helping families afford the basics, reducing poverty, and helping families thrive in the long run through improved child and maternal health, school achievement, and other benefits. Because people of color, women, and immigrants are overrepresented in low-wage work, state EITCs are an important tool for advancing equity.

Federal, State EITCs Can Ease Hardship, Promote Opportunity

Thirty states plus Washington D.C. and Puerto Rico have adopted state EITCs to boost family income. (See map.) Most state EITCs are modeled directly on the federal credit: they use federal EITC eligibility rules and match a specified percentage of the federal credit. Refundable credits range from 3 percent of the federal credit in Montana to 100 percent in the District of Columbia, when the latter’s fully phases in.

To help more families make ends meet during the pandemic and beyond, states without an EITC should adopt one and those with one should continue expanding them. States can enact new credits, those that have not yet made their credits fully available to all families (sometimes called making the credits “fully refundable”) like the federal credit should do so, and all states should expand beyond the parameters of the federal credit to provide equitable treatment for those who are currently excluded. That includes increasing the credit and eliminating age restrictions for working adults without children in the home, and ending the exclusion for individuals using Individual Tax Identification Numbers.

EITCs Boost Family Income, Communities, and Local Economies

The benefits of EITCs go far beyond the dollars that a family receives. By helping families keep up basic spending, EITCs help families build economic security, improve longer-term health and well-being, and boost state and local economies. Especially during a pandemic that is hitting workers paid low wages the hardest, EITCs are a critical lifeline to struggling families, while also helping communities and the economy.

That’s because they:

- Reduce poverty, especially in communities of color. Over 7 million children in working families lived below the official poverty line (about $26,000 for a family of four) in 2019. As described above, the federal EITC is one of the nation’s most effective tools for reducing the struggles of working families and children. While state and federal EITCs serve a larger number of white households than any other racial or ethnic group (due in part to population size), they serve a larger proportion of people of color relative to their population size, and the EITC has an outsized impact in reducing poverty rates for households of color.

- Help children and families thrive. Research suggests that the income from tax credits like the EITC helps children from birth through retirement. For instance, research indicates that children in families receiving such income do better in school, are likelier to attend college, and are likely to earn more as adults, and women especially are likely to see a more secure retirement. The EITC may play a particularly important role in helping children of color improve their math achievement, complete high school, and enroll in college, the research suggests.

- Boost local economies. Tax credits like the EITC help families who earn low wages to keep up basic spending. Families spend their EITCs partially to make bigger purchases such as a car repair or a security deposit on an apartment, and partially on routine bills and expenses. Working to raise household income and make sure families can access the supports they need is therefore a straightforward way for policymakers to foster more long-term innovation, as well as to improve children’s outcomes and their likelihood of future success more generally.

Thirty states plus the District of Columbia and Puerto Rico have enacted state EITCs to help people paid low wages meet basic needs.

States Can Help Families Claim EITCs

Given the credit’s benefits for families, communities, and local economies, states have a vested interest in assisting residents in claiming EITCs. States can take steps to lower barriers to claiming the EITC and other tax credits for which families are eligible by:

- Supporting free tax preparation through VITA (Volunteer Income Tax Assistance). VITA sites provide free, high-quality tax preparation services to people earning less than about $57,000, which includes virtually all families eligible for EITCs. The IRS coordinates the program, and VITA tax preparers maintain a high degree of accuracy in tax preparation. States can help provide matched funding and assist VITA sites with community outreach, including virtual options during the COVID-19 pandemic.

- Pre-filling and sending tax forms for families likely to be eligible for EITCs. States receive wage, withholding, and other tax information from employers. They can pre-fill a state tax form with this information and send it to families to assist in preparing their taxes.

- Educating the public. States can advertise the availability of EITCs through newspapers and social media, on the radio, and by other means.

- Conducting targeted outreach to families already enrolled in economic security programs. Many families who are eligible for SNAP, Medicaid, and other economic security programs may be eligible for the EITC and other state tax credits. State agencies can send notices and reminders, and can connect enrolled families to trusted tax preparation assistance providers like VITA and the United Way.

- Requiring employers to share information about the EITC with employees. States can require employers to send or post notices to their employees who may qualify for the EITC. States with such requirements for either the federal or state EITC include California, Illinois, Louisiana, Maryland, New Jersey, Oregon, Texas, and Virginia.

The Center on Budget and Policy Priorities is a nonprofit, nonpartisan research organization and policy institute that conducts research and analysis on a range of government policies and programs. It is supported primarily by foundation grants.