BEYOND THE NUMBERS

To create jobs and build strong economies, states should focus on producing more home-grown entrepreneurs and on helping startups and young, fast-growing firms already in their state to grow ― not on cutting taxes and trying to lure businesses from other states. That’s the conclusion from a new analysis of data about which businesses create jobs and where they create them, as we explain in a new paper.

The data show that:

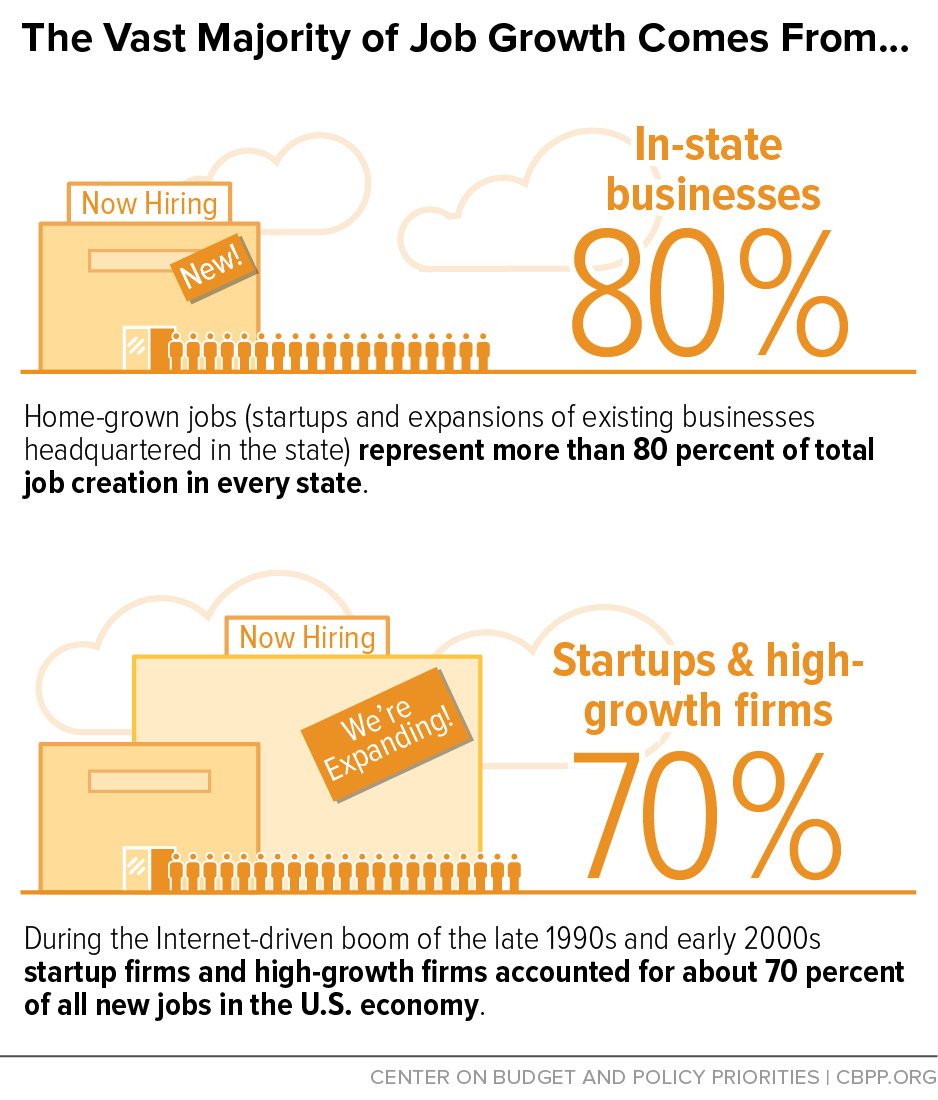

- Most jobs are created by businesses that start up or are already present in a state — not by those that relocate or branch into another state. Jobs that move into one state from another typically represent only 1 to 4 percent of total job creation each year. Jobs created by out-of-state businesses expanding into a state through new branches represent less than one-sixth of total job creation. In other words, “home-grown” jobs contribute more than 80 percent of total job creation in every state.

- During periods of healthy economic growth, startups and young, fast-growing companies create most new jobs. During the Internet-driven boom of the late 1990s and early 2000s, for example, startup firms (those less than one year old) and high-growth firms — which are likely to be young — accounted for about 70 percent of all new jobs in the U.S. economy. Firms older than one year actually lost jobs on average; any new jobs they created were more than offset by jobs they eliminated through downsizing or closure. (See graphic.)

State economic development policies that ignore these fundamental realities about job creation are bound to fail. A good example is the deep income tax cuts that many states have enacted or are proposing. Such tax cuts are largely irrelevant to owners of young, fast-growing firms because they generally have little taxable income. And, tax cuts take money away from schools, universities, and other public investments essential to producing the talented workforce that entrepreneurs need. Many policymakers also continue to focus their efforts heavily on tax breaks designed to lure companies from other states — even though startups and young, fast-growing firms already in the state are much more important sources of job creation.

Many states and localities are experimenting with various ways to boost the number and success rates of startups and young, fast-growing firms, and it’s too soon to know which strategies will work best. In the meantime, policymakers should reject major income tax cuts and new corporate relocation subsidies, and reconsider those already enacted. Public investments that help build a skilled workforce and improve the quality of life for local residents are better bets.