BEYOND THE NUMBERS

Missing in the President’s Recovery Plans: Help for Families Struggling to Pay Rent

Millions of people with low incomes struggle to afford housing, which exposes them to overcrowding, homelessness, and other hardships and limits their ability to fully participate in the emerging recovery. These problems fall disproportionately on poorer households and, because of a long history of racism leading to unequal education, employment, and housing opportunities, on people of color. President Biden’s American Families Plan calls for important investments in areas such as education, child care, health care, and family-focused tax credits, but neither it nor prior Administration proposals would expand rental assistance at anywhere near the scale that is needed to help people who are struggling to afford housing. As Congress considers recovery legislation, it should prioritize including a major expansion of rental assistance — particularly Housing Choice Vouchers — to address this critical gap.

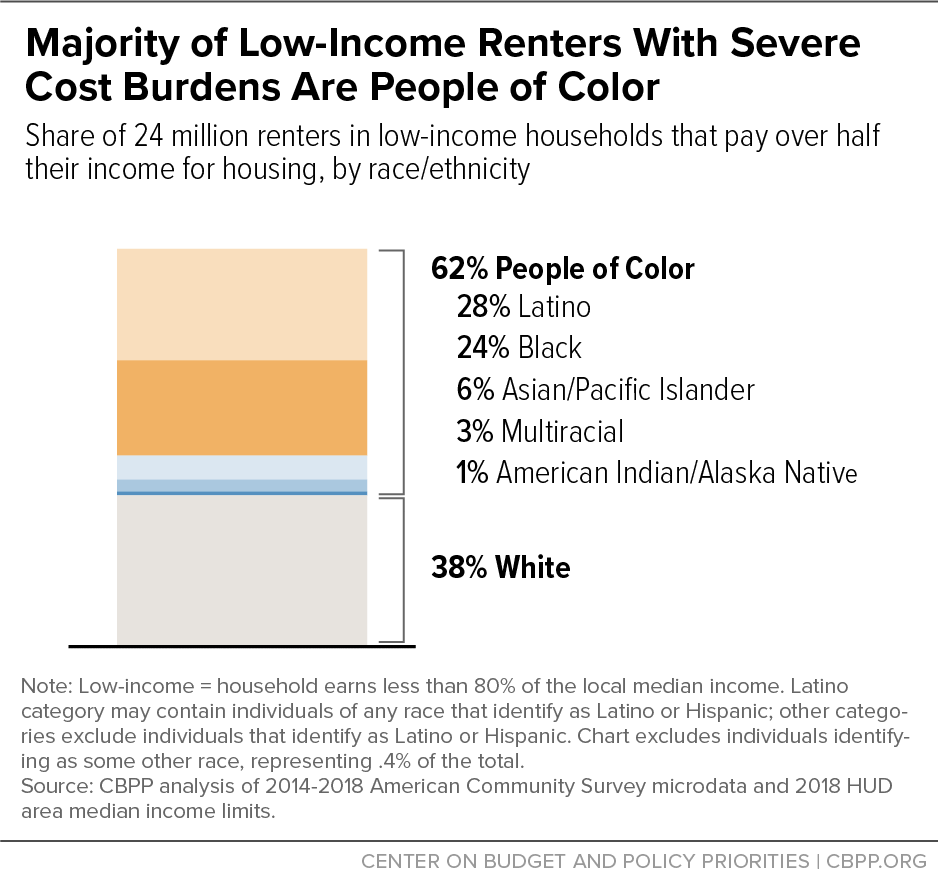

More than 24 million people live in low-income households that pay more than half their income for rent and utilities. That often forces them to divert resources from basic needs like food and medicine to pay their rent and leaves them one setback (such as a reduction in work hours or an unexpected bill) away from losing their homes. More than half of the people in these households are children, seniors, and people with disabilities. And more than 60 percent are people of color (see chart).

Millions more live in overcrowded or substandard housing, in shelters, or on the streets. Research links high rent burdens, housing instability, overcrowding, and homelessness to far-reaching adverse effects on health, education, and children’s development.

Housing vouchers and other rental assistance are highly effective at addressing these problems. But due to funding limitations, these programs only reach 1 in 4 eligible households, and households often must spend years on waiting lists before receiving assistance.

Recognizing this, President Biden proposed during the 2020 campaign to provide housing vouchers to every eligible household, a step that would do more than any other option to cut homelessness, housing instability, and overcrowding, and would reduce poverty and racial disparities as well. But the President has not yet put forward a plan to move the nation toward that goal. The Administration’s fiscal 2022 budget would add 200,000 vouchers, a beneficial proposal that Congress should enact — but one that would help only a small fraction of the millions of households that need help to afford housing.

The President’s American Jobs Plan — the first part of his recovery agenda — called for major investments in housing construction and rehabilitation, but these would do little to help the people who struggle most to afford housing. The plan would provide $40 billion to renovate existing public housing, which is urgently needed to protect residents’ health and safety but wouldn’t help people who lack rental assistance today. The plan would also invest $150 billion in affordable housing development, but such development subsidies rarely make housing affordable to people with incomes around or below the poverty line — who account for more than 70 percent of households that currently pay more than half their income for rent — unless the household also receives a voucher or similar ongoing rental assistance.

Voucher expansion will also be crucial to enabling people with poverty-level incomes to fully benefit from other components of the President’s recovery plans. For example, the Jobs Plan includes $400 billion to expand Medicaid home- and community-based services for people who would otherwise have to live in a nursing home or other institution, but without more vouchers many of the lowest-income seniors and people with disabilities won’t be able to afford the stable housing outside institutional settings needed to access these services or will pay such high shares of their income for rent that they will be vulnerable to hardships such as eviction, food insecurity, and utility cutoffs.

In addition, the American Families Plan includes major investments in child care, pre-K education, K-12 teacher preparation, community college, and Pell Grants, but families with unstable or inadequate housing will struggle to fully benefit from the opportunities these investments would create. For example, research links homelessness, housing instability, and high rent burdens to cognitive, behavioral, and health problems in preschool children that could undermine the benefits of improved child care and education for this population — and also shows that vouchers can improve a wide range of outcomes for children.

Including voucher expansion in recovery legislation would do much to ensure that people at all income levels and of all races and ethnicities are able to benefit fully from the legislation’s investments and the broad-based recovery it aims to foster.