BEYOND THE NUMBERS

House Ways and Means Chairman Kevin Brady recently defended a centerpiece of the House GOP and Trump campaign tax plans — a special, much lower rate for “pass-through” business income — by citing “Michael the local plumber” as the type of small business owner it’s designed to benefit. But in reality, wealthy business owners would be far likelier to benefit from this tax cut than small business owners.

Pass-through income (so called because it “passes through” the business to the firm’s owners and is taxed at their individual income tax rates, rather than through the corporate income tax) is highly concentrated among high earners, as our recent analysis explains. About half of it flows to the top 1 percent of households, or those with incomes above $693,500 in 2016. The top 400 taxpayers had an average of $37 million apiece in net pass-through income in 2014, the most recent year for which we have these data.

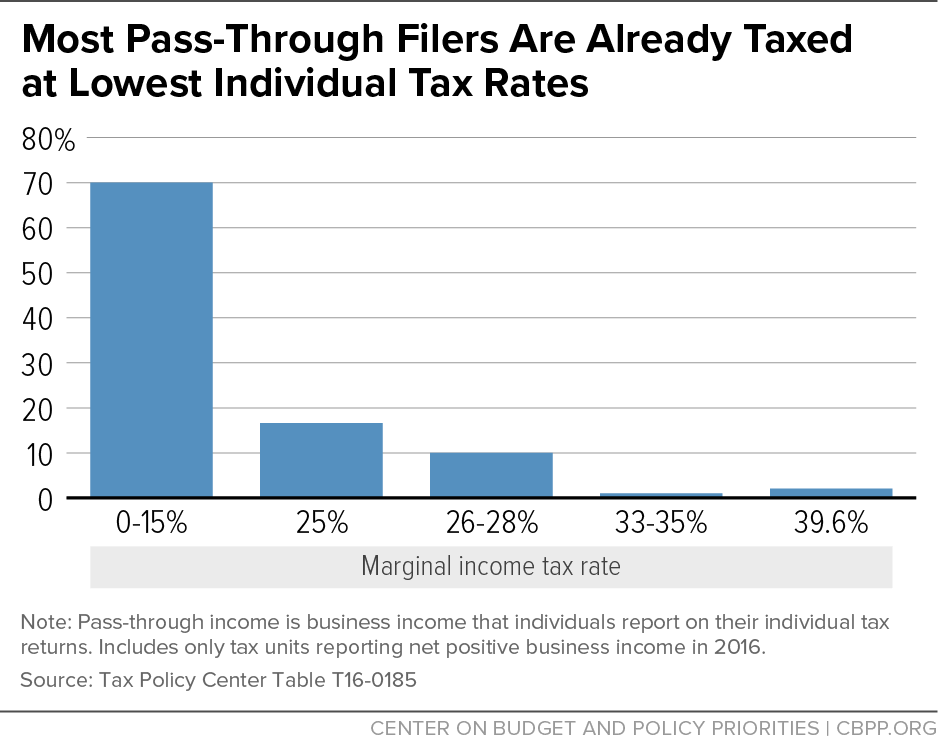

By contrast, most small business owners would get nothing from the House GOP proposal. That’s because more than 85 percent of filers with pass-through income are already taxed at rates at or below 25 percent (see chart) — the top rate for pass-through income under the House GOP plan.

President Trump better exemplifies the type of business owner who would benefit from the reduced rate. As Trump’s lawyers wrote to him last year, “[Y]ou hold interests as the sole or principal owner in approximately 500 separate entities . . . [and] operate these businesses almost exclusively through sole proprietorships and/or closely held partnerships,” which are two of the three main forms of pass-through businesses. For this reason, some have dubbed his proposal to cut the pass-through rate to 15 percent the “Trump loophole.”

Cutting the top tax rate on pass-through income below the top rate on wages and salaries wouldn’t just give those at the top a big new tax break on their existing pass-through income. It also would give them a major incentive to re-classify their non-business wage and salary income as pass-through income to take advantage of the lower rate. This tax avoidance opportunity wouldn’t benefit local small businesses that already report all their income as pass-through income.

In explaining why the House GOP tax plan includes the pass-through tax cut, Chairman Brady noted that “it’s been difficult to bring the individual [income tax] rate down over politics over wealthy earners.” His proposed tax cut on pass-through income is essentially a back-door way to cut the top tax rate deeply for wealthy business owners — and it’s a major contributor to the overall House GOP plan’s dramatic tilt to the top.