BEYOND THE NUMBERS

Today’s job numbers are a welcome indication that the economy is moving in the right direction, but the labor market is far from fully recovered. And, after a pandemic whose economic fallout has affected key economic sectors in dramatic ways, some months ahead will likely show weaker job growth than others, amid ongoing improvement. Yet Republican governors in many states are prematurely cutting off emergency federal unemployment assistance programs, which will leave unemployed workers at the mercy of weak, outdated state unemployment insurance (UI) systems. Policymakers should act on President Biden’s call to work with him to fundamentally reform the permanent federal-state UI system.

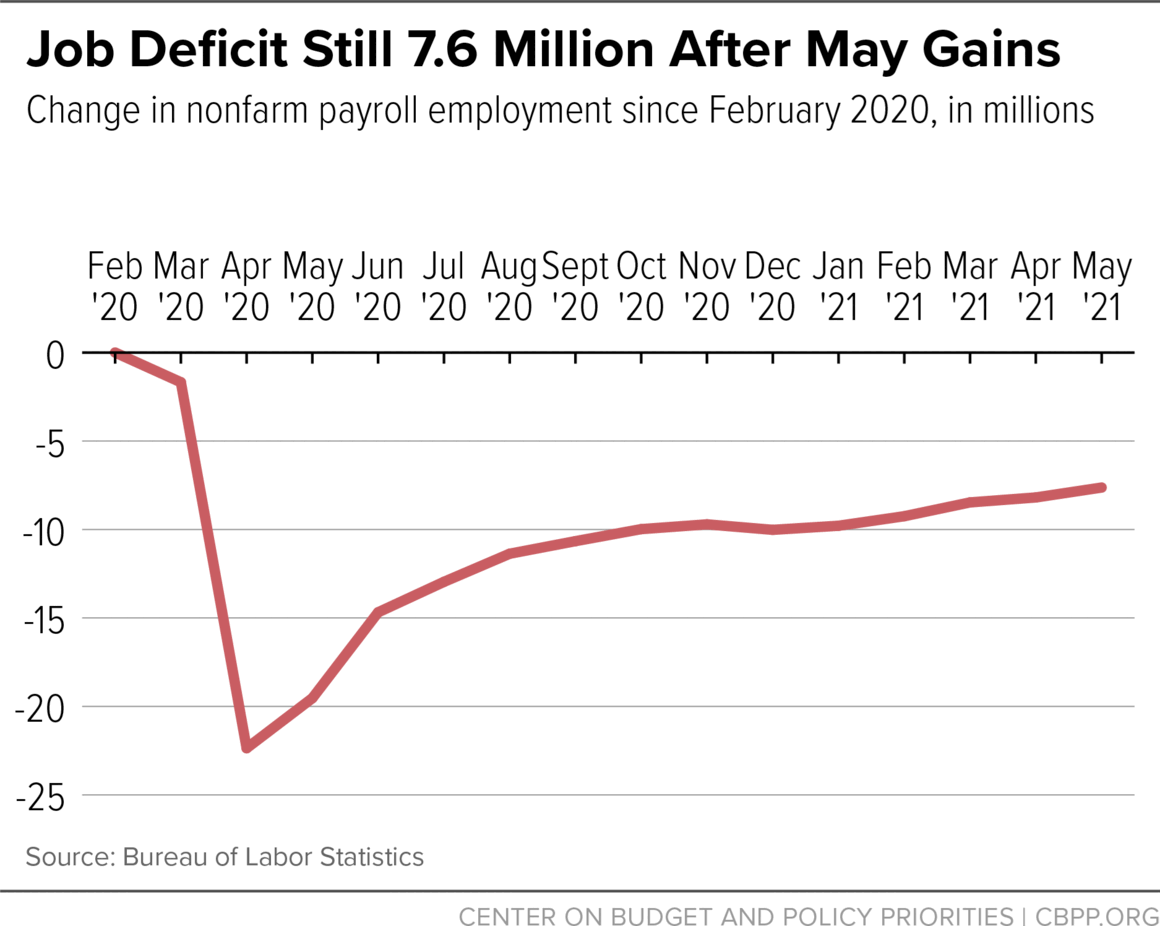

Job growth, which stalled in the second half of last year, has picked up strongly, today’s Labor Department figures show. Private and government employers added 559,000 jobs to their payrolls in May, and revisions to March and April numbers raised payroll gains in those months by another 27,000 jobs. May’s official unemployment rate of 5.8 percent is less than half of last April’s 14.8 percent.

However, employment at nonfarm businesses and government agencies is still 7.6 million jobs lower than when the recession began in February 2020. And long-standing racial and ethnic disparities remain large, as the unemployment rates for Black (9.1 percent), Latino (7.3), Asian (5.5), and white (5.1) workers show. Also, overall unemployment could be over 8½ percent using a more realistic measure that accounts for the pandemic-related, above-normal exits from the labor force and the misclassification of some unemployed workers as employed in the survey data from which the unemployment rate is estimated.

Losing one’s job can be a devastating blow to workers with limited means, and millions of unemployed and underemployed workers and their families are by no means out of the woods yet.

That hasn’t stopped many Republican governors — driven by exaggerated claims about how unemployment insurance affects the labor supply in an improving economy — from denying unemployed workers federal jobless benefits that are supposed to run through September 6.

The emergency assistance that these governors want to cut off has covered more people, and provided better benefits for a longer time, than the existing system of state laws could have. “Taken together [these UI measures and stimulus checks] have been effective at providing stimulus and lowering poverty,” according to a recent Federal Reserve literature review of their impact. The report adds, “Extended and increased UI benefits are key components of any potential stimulus bill meant to counteract the negative impact of the pandemic on the labor market.”

Three-quarters of the continuing claims for unemployment insurance in the week ending May 15 were in the two pandemic emergency programs providing additional coverage and weeks of benefits: Pandemic Emergency Unemployment Compensation (PEUC) for workers who have exhausted regular state benefits and Pandemic Unemployment Assistance (PUA) for workers who were excluded from regular state benefits. Restrictive eligibility rules in regular state UI programs mean that part-time workers, workers paid low wages, and workers who are more likely to lose jobs for caregiving-related reasons — groups that are disproportionately people of color and women — are significantly less likely to qualify for UI benefits when they lose jobs. And, if they do qualify, they receive lower benefits.

When PEUC and PUA expire, most of these unemployed workers will be left with no unemployment assistance while they continue looking for a job in an economy that still has a large jobs deficit. (The permanent, federally funded Extended Benefits program is still operating in a few states with high unemployment.) They, and many newly unemployed workers going forward, will get miserly regular state benefits in many states, if they get any benefits at all. And the UI system will still be unprepared for the next recession.

The problems with the underlying permanent UI system are too serious to ignore. Policymakers should establish federal standards that narrow disparities among states and create a meaningful floor for who is eligible for jobless benefits, the share of wages replaced, and the maximum number of weeks of benefits a worker can receive. These are critical initial steps for creating a robust 21st century UI system that gives unemployed workers in all states the financial assistance they and their families deserve when they lose a job and need to find another.

In addition to broadening eligibility and providing more adequate benefits, policymakers should create a UI system with a stronger automatic response to changes in economic conditions. This would avoid congressional delays in enacting emergency programs in the next recession and would maintain them as long as needed.