BEYOND THE NUMBERS

Massachusetts Should Focus on Building an Equitable Recovery, Not Tax Cuts for the Wealthy

Like many states, Massachusetts is experiencing temporary revenue surpluses due to better-than-expected revenue growth following the COVID-19 recession. The state has an opportunity to set a course toward an antiracist and equitable recovery that includes all people, no matter their race, gender, or ZIP code. But tax cut proposals in Governor Charlie Baker’s budget — combined with a costly charitable deduction that will phase in unless lawmakers act — will mainly benefit wealthy households while further widening racial and economic inequities. Lawmakers should instead prioritize efforts to support people and communities hit hardest by the pandemic and its economic fallout.

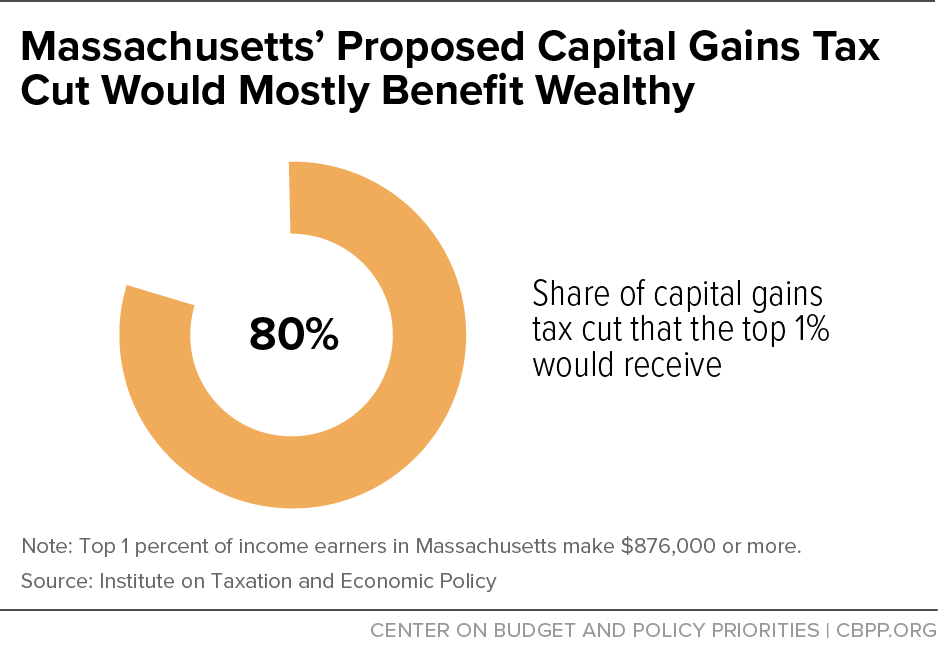

Two of the proposed tax changes in the governor’s budget would overwhelmingly benefit wealthy people and worsen the state’s already high racial inequality in income and wealth. The first would cut the tax rate on short-term capital gains (like for selling a stock held less than a year) from 12 percent to 5 percent. An estimated 80 percent of the tax cut would go to the top 1 percent, people earning about $876,000 or more (see graphic). Some 91 percent would go to the top 5 percent, those making about $348,000 or more.

And although the state’s estate tax applied to only about 4,200 families in 2017 — just 7 percent of total deaths that year — the governor has also proposed raising the size of estates subject to Massachusetts’s estate tax from $1 million to $2 million and making only a portion of those estates subject to the tax (currently, the tax is calculated based on the full value of the estates that are subject to it). These changes would overwhelmingly benefit the state’s wealthiest residents, providing few if any benefits to low- and middle-income people, and few people of color would benefit. As across the country, the wealthiest families in Massachusetts are disproportionately white due to long-standing inequities — often stemming from structural racism — in education, employment, housing, health care, and other areas.

Massachusetts is also scheduled to phase in a state-level charitable deduction. People who itemize their federal taxes already receive a federal deduction for those contributions, so this less-valuable additional deduction isn’t likely to encourage much more charitable giving. This provision will also disproportionately benefit wealthy donors: about half of the resulting tax benefit will go to Massachusetts residents with earnings over $1 million, according to Massachusetts’ Department of Revenue.

Together, these three tax changes could cost Massachusetts as much as $800 million in revenue each year, or almost as much as the state’s entire public health budget. That would harm its ability to provide quality schools, health care, roads, and other services and programs state residents need.

It would also be a misstep for a state that’s on the cusp of a transformative tax policy reform. An amendment to the state’s constitution on the November ballot would levy an additional 4 percent tax on income over $1 million. The measure would direct an estimated $2 billion each year — raised entirely from the state’s wealthiest residents — to the state’s public schools and transportation infrastructure, and would make meaningful progress toward reducing racial disparities in income and wealth.

Cutting taxes for the wealthiest state residents won’t deliver significant economic benefits, nor will it likely help attract or retain wealthy residents. There’s little evidence to support claims that estate or inheritance taxes cause large numbers of elderly people to leave their state. Things like being close to family, warmer weather, and lower housing costs play much bigger roles in people’s relocation decisions than a state’s tax levels. Furthermore, the proposed capital gains tax cut would largely reward short-term speculation in things like stocks and cryptocurrency, not the kind of long-term investments in small businesses and local communities that would help to grow the state’s economy.

Enacting costly and permanent tax cuts based on temporary budget surpluses (which are due in significant part to temporary federal aid) would be a mistake. Instead, the state should prioritize the people hit hardest by the pandemic and chart a course toward an inclusive recovery by protecting and strengthening its revenue system and using those dollars to sustain investments that expand opportunity and grow the economy.

There are many options to do so. The state could make needed investments in early childhood, K-12, and higher education. Massachusetts should also increase its Earned Income Tax Credit and make it available to immigrants who file taxes with an Individual Tax Identification Number, as seven states have already done. The governor’s budget proposal would also double the state’s dependent care tax credit and would increase a refundable tax credit for low-income seniors. Unlike some of the governor’s other proposals, these would help families struggling on low incomes better meet their basic needs.

Massachusetts has a choice: to improve families’ economic well-being and make progress on racial and gender equity by protecting — and enhancing — its ability to raise adequate and fair revenues and to use those resources for initiatives that help more people share in the state’s prosperity, or to compromise the state’s future through misguided tax cuts for the wealthy. The first choice would enable the state’s leaders to prioritize those hit hardest by the pandemic, while also bolstering the state’s long-term ability to provide good schools, health care, and other services.