BEYOND THE NUMBERS

In Case You Missed It...

This past week at CBPP, we focused on federal tax, health, the federal budget, food assistance, family income support, housing, poverty and inequality, and the economy.

-

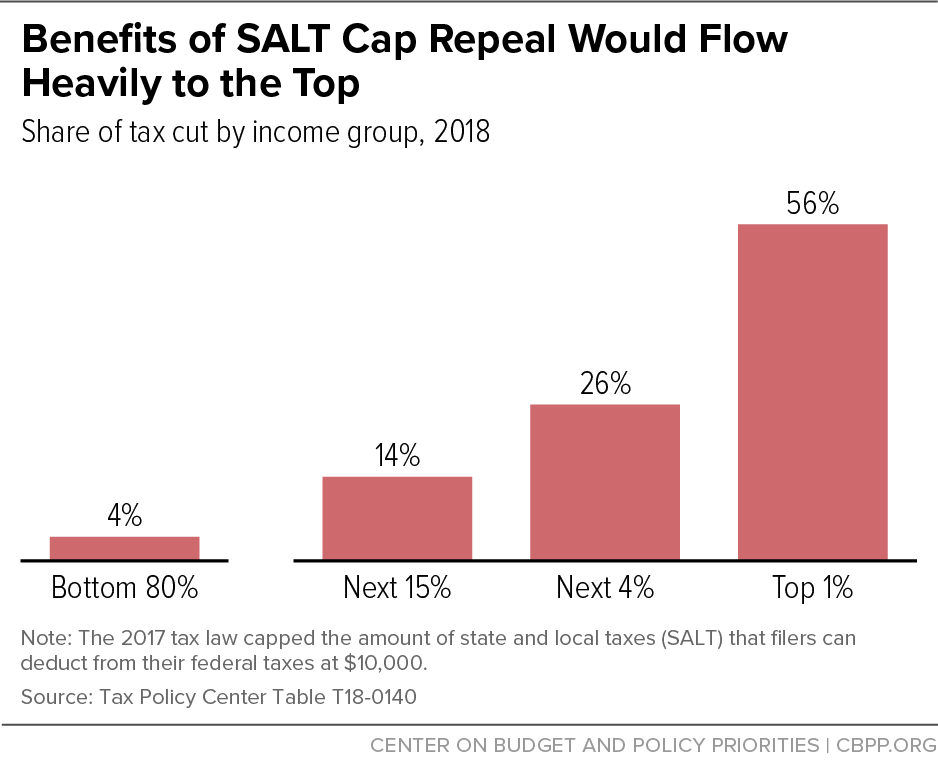

On federal tax, Chuck Marr, Kathleen Bryant, and Michael Leachman reported that repealing the 2017 tax law’s cap on the federal deduction for state and local taxes would be regressive and that the proposed offset would use up needed progressive revenues. We updated our backgrounders on the Child Tax Credit and Earned Income Tax Credit.

-

On health, Paul N. Van de Water cautioned against delaying or repealing health-related taxes. Judith Solomon argued that policymakers should quickly give a much-needed Medicaid funding boost to U.S. territories. We answered frequently asked questions about “partial” Medicaid expansion. We explained that the Trump Administration’s stance on repealing the Affordable Care Act is in line with other Trump Administration efforts to undermine access to affordable, comprehensive care.

-

On the federal budget, Richard Kogan and Joel Friedman pointed out that a budget process bill from Senate Budget Committee Chairman Mike Enzi and committee member Sheldon Whitehouse includes a harmful provision for automatic reconciliation. Van de Water explained how the Enzi-Whitehouse bill would threaten Medicare and Medicaid.

-

On food assistance, Chad Stone showed how the Trump Administration’s new SNAP rule weakens the program’s recession-fighting power. Zoë Neuberger highlighted new research showing that states can improve outcomes for low-income women and young children by boosting WIC.

-

On family income support, Ashley Burnside and Ife Floyd reported that more states are raising Temporary Assistance for Needy Families (TANF) benefits to boost families’ economic security, but noted that states need to do more for TANF to fulfill its purpose of helping families in need. Floyd suggested that states should build on momentum to boost TANF benefits.

-

On housing, Alicia Mazzara noted that rents have risen more than incomes in nearly every state since 2001. We updated our national and state housing fact sheets and related data. Ife Floyd laid out how the emergency assistance fund in the newly proposed Evictions Crisis Act is a promising approach to reducing evictions.

-

On poverty and inequality, we updated our chart book illustrating how economic security and health insurance programs reduce poverty and provide access to needed care.

-

On the economy, we updated our chart book tracking the post-Great Recession economy.

Chart of the Week — Benefits of SALT Cap Repeal Would Flow Heavily to the Top

A variety of news outlets featured CBPP’s work and experts these past two weeks. Here are some of the highlights:

How other states spent federal funds for working families as Tennessee stockpiled its share

Tennessean

December 13, 2019

Trump Tax Break’s Hidden Frenzy: Corporate Giants are Rushing In

Bloomberg

December 12, 2019

The Ripple Effects of Taking SNAP Benefits From One Person

The Atlantic

December 10, 2019

Vouchers can help the poor find homes. But landlords often won’t accept them.

Vox

December 10, 2019

Don’t miss any of our posts, papers, or charts — follow us on Twitter, Facebook, and Instagram.