BEYOND THE NUMBERS

In Case You Missed It…

This week at CBPP, we focused on the federal budget and taxes, and the economy.

- On the federal budget and taxes, Jacob Leibenluft counted Republicans’ broken promises on the tax bill, and he detailed the last-minute changes to the Senate tax bill that made it even worse. Chye-Ching Huang listed Republican statements that make it clear that after enacting costly tax cuts for the wealthy, they will turn next to cuts to programs that help families of limited means, and she pointed to a new Tax Policy Center analysis showing that the tax bills would leave the vast majority of low- and middle-income families worse off if GOP policymakers pay for tax cuts with the types of spending cuts they’ve included in recent budget plans.

Huang also explained why both weakening and repealing the estate tax is a bad idea. Chuck Marr explained that the House-Senate conference committee should prioritize fixing the problems in the bills over cutting the estate tax. Joel Friedman and Chad Stone clarified that the Republican tax plans would cost more and add less to growth than proponents claim.

Marr also argued that Senators Marco Rubio and Mike Lee’s Child Tax Credit proposal should be in the final tax bill, and he cautioned that the conference committee should not produce a final tax bill tilted even more against working families. Michael Leachman illustrated how the tax bills’ partial repeal of the deduction for state and local taxes kills the most valuable part of the deduction. Stone explained that policymakers shouldn’t tax college endowment income to pay for regressive tax cuts.

Paul N. Van de Water pointed out that delaying the fee on health insurance providers would give a windfall to insurers while doing little to reduce premiums. David Reich argued that policymakers should raise the appropriation caps for 2018 and beyond and also divide the funds equitably and avoid harmful offsets.

- On the economy, we updated our backgrounder on how many weeks of unemployment compensation are available and our chart book on the legacy of the Great Recession.

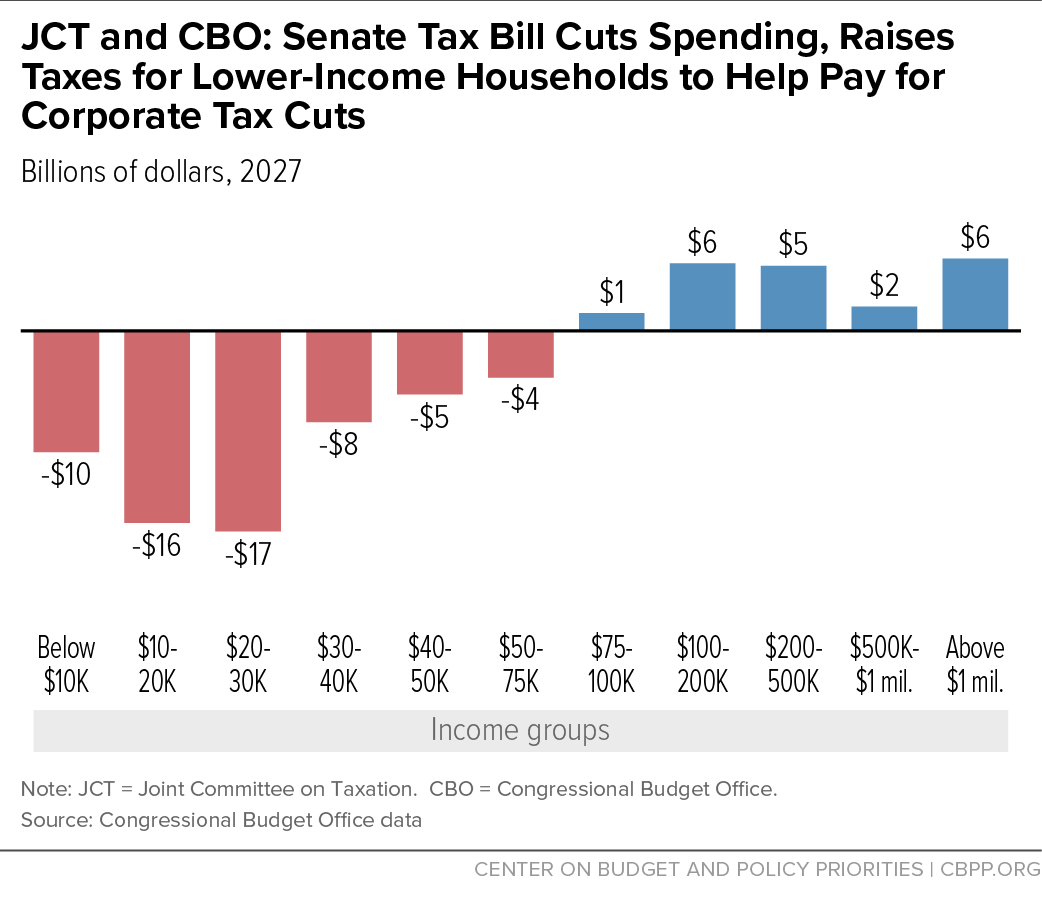

Chart of the Week – JCT and CBO: Senate Tax Bill Cuts Spending, Raises Taxes for Lower-Income Households to Help Pay for Tax Cuts

A variety of news outlets featured CBPP’s work and experts recently. Here are some highlights:

This Is the Long Game of Republican Economics

The Atlantic

December 7, 2017

Will The Tax Plan Put More Money In My Pocket?

WAMU

December 6, 2017

Republican officials say targeting welfare programs will help spur economic growth

The Washington Post

December 6, 2017

GOP Tax-Plan Measures Lead to Concerns About School Funding

The Wall Street Journal

December 6, 2017

Q&A: Tax bill impacts ‘Obamacare’ and potentially Medicare

Associated Press

December 5, 2017

Don’t miss any of our posts, papers, or charts — follow us on Twitter, Facebook, and Instagram.