BEYOND THE NUMBERS

In Case You Missed It…

This week at CBPP, we focused on the federal budget and taxes, health care, food assistance, the economy, poverty and inequality, and Social Security.

- On the federal budget and taxes, Robert Greenstein explained that the Senate budget resolution’s regressive tax cuts would likely lead to budget cuts hitting most Americans. Chye-Ching Huang and Joel Friedman warned that Senate Republicans are planning tax-cut legislation that could lose $1.5 trillion in revenue over the next ten years. Chuck Marr broke down the key aspects of the “Big Six” Republican tax framework and explained how the plan would benefit the very wealthy while offering little for working families with modest incomes. Brendan Duke argued that corporations would be more likely to use “repatriated” profits to boost dividends or buy back stock than to invest in the United States. Huang testified on the stark difference between President Trump’s promise to raise working and middle-class families’ incomes and the reality of Republican tax plans, which prioritize corporate tax cuts.

Isaac Shapiro, Richard Kogan, and Chloe Cho reported that President Trump’s budget would get two-thirds of its cuts from programs for low- and moderate-income people. Along with the American Enterprise Institute’s Andrew Biggs, Arloc Sherman urged Congress to adequately fund the Census Bureau as it prepares for the 2020 census.

- On health care, before Senate Republicans announced they wouldn't vote on the bill from Senators Bill Cassidy and Lindsey Graham to repeal the Affordable Care Act (ACA), we issued several analyses of the bill's impact. Hannah Katch explained that like previous ACA repeal bills, the bill would cap and cut Medicaid, but it would cut Medicaid funding for certain high-cost states even more severely. Sarah Lueck warned that the bill would unravel protections for people with pre-existing conditions by allowing insurers to raise premiums and scale back coverage.

Edwin Park explained that the Congressional Budget Office’s (CBO) preliminary analysis confirmed that Cassidy-Graham would have the same harmful consequences as prior Senate and House Republican repeal bills. Greenstein warned that the lack of sufficient time for CBO to produce a comprehensive analysis underscored the dangerous and ill-advised process Senate Republican leaders were using to advance the legislation. Tara Straw highlighted the CBO’s finding that coverage for marketplace enrollees in Medicaid expansion states would be at particular risk under the bill.

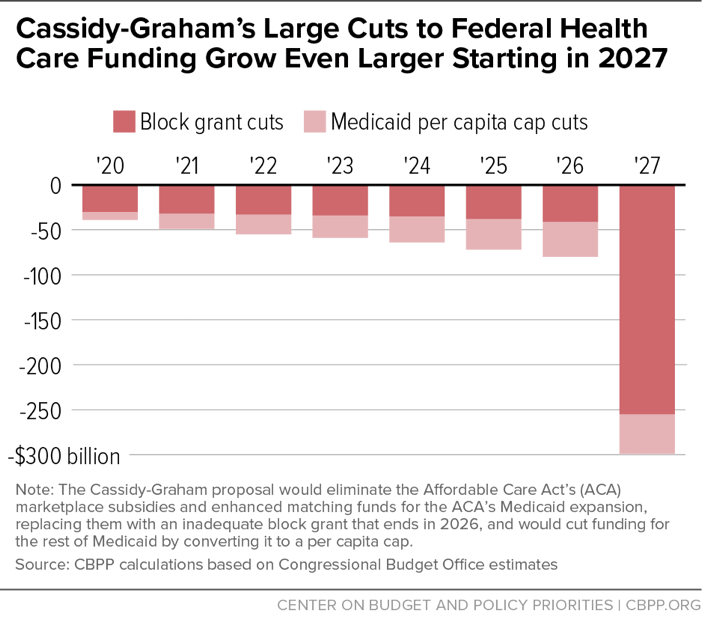

Jacob Leibenluft, Aviva Aron-Dine, and Park showed how the revised version of Cassidy-Graham has the same structure and harmful components of the original. Park and Matt Broaddus concluded that the revised bill’s damaging health care funding cuts would grow dramatically in 2027. Aron-Dine and Jesse Cross-Call noted that the bill would still hurt Alaskans despite special funding provisions for the state in the revised version. We rounded up our analyses of the revised Cassidy-Graham bill.

We also updated our Sabotage Watch tracker with news of efforts to sabotage the upcoming open enrollment period.

- On food assistance, we released a video in celebration of the 40th anniversary of the Supplemental Nutrition Assistance Program (SNAP, formerly food stamps). Greenstein explained how SNAP can serve as a model for bipartisan cooperation. We pointed to an op-ed by Norm Ornstein praising the bipartisan nature of the 1977 Food Stamp Act. Elizabeth Wolkomir detailed how SNAP is able to respond quickly and effectively to disasters while Tazra Mitchell described why the Temporary Assistance for Needy Families program is ill-equipped to do so.

- On the economy, Chad Stone detailed why it makes no economic sense to end the Deferred Action for Childhood Arrivals (DACA) program. Greenstein called on Congress to protect young undocumented immigrants. We updated our chart book on the legacy of the Great Recession.

- On poverty and inequality, Liz Schott and Dorothy Rosenbaum warned that the proposed Economic Mobility, Prosperity, and Opportunity with Waivers that Enable Reforms for States (EMPOWERS) Act would facilitate the unraveling of major federal programs that help low-income people. Rosenbaum highlighted how the EMPOWERS Act could radically change SNAP, putting benefits for low-income households at risk. We updated our guide to statistics on historical trends in income inequality.

- On Social Security, Kathy Ruffing analyzed why it’s wrong to blame Supplemental Security Income for recent declines in labor-force participation.

Chart of the week – Cassidy-Graham’s Large Cuts to Federal Health Care Funding Grow Even Larger Starting in 2027

A variety of news outlets featured CBPP’s work and experts recently. Here are some highlights:

This One Word Is Worth $500 Billion as Congress Debates Tax Cuts

NBC News

September 29, 2017

Richest Americans will see biggest windfall from any tax cuts

CNBC

September 28, 2017

A Boondoggle Masquerading as Tax Reform

New York Times

September 27, 2017

Republican rhetoric about giving states “flexibility” over health care is a sham

Vox

September 27, 2017

Count the Broken Promises in the GOP Tax Plan

Bloomberg

September 27, 2017

Don’t miss any of our posts, papers, or charts — follow us on Twitter, Facebook, and Instagram.