BEYOND THE NUMBERS

In Case You Missed It . . .

This week at CBPP, we focused on health, poverty and inequality, the federal budget and taxes, the economy, housing, family income support, and food assistance.

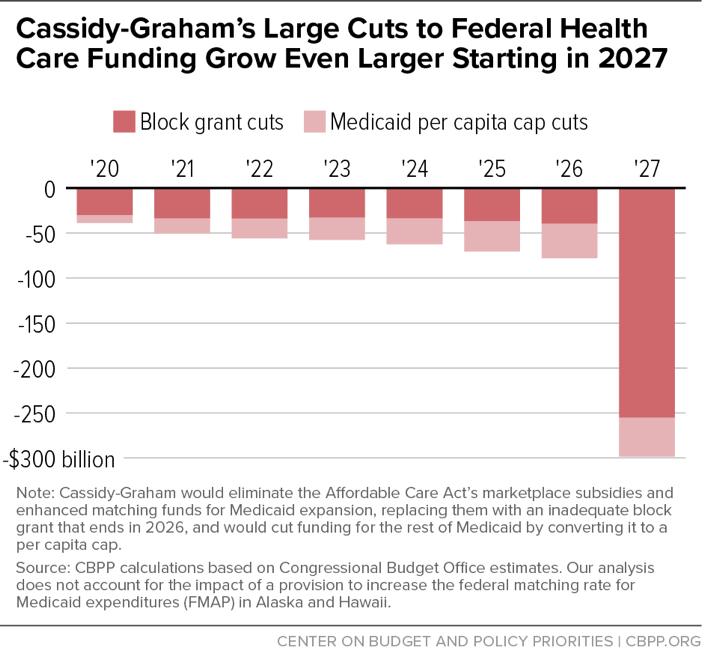

- On health, Jacob Leibenluft, Edwin Park, Matt Broaddus, and Aviva Aron-Dine analyzed how the Cassidy-Graham plan to repeal and replace the Affordable Care Act (ACA) would cause millions to lose coverage, destabilize the individual market, and cut Medicaid. Aron-Dine warned that Cassidy-Graham’s waiver authority would allow states to eliminate protections for people with pre-existing conditions. Park and Broaddus showed that the bill’s large cuts to federal health care funding would grow even deeper starting in 2027. Broaddus also highlighted how states that have adopted the ACA’s Medicaid expansion had a much lower uninsured rate than non-expansion states in 2016 and pointed out that the share and number of people without health insurance fell to a historic low.

We posted Aron-Dine’s testimony before the Senate Finance Committee on issues affecting health care cost and coverage and summarized the testimony. We also updated our ACA Sabotage Watch tracker.

- On poverty and inequality, Robert Greenstein released a statement on the new Census data for 2016, which brought good news on income, poverty, and health coverage — including the largest two-year income gain in five decades. Greenstein, Arloc Sherman, and Isaac Shapiro explained that the Census data show progress across the board, with poverty falling, median income rising, and the uninsured rate falling. Sherman detailed how the Earned Income Tax Credit (EITC) and Child Tax Credit, SNAP (formerly food stamps), Supplemental Security Income, and rent subsidies lifted millions out of poverty in 2016. We rounded up all of our same-day Census data analyses. After Census released state-specific data later in the week, Erica Williams highlighted figures showing that the 2016 improvements were widespread among states.

- On the federal budget and taxes, Robert Greenstein and John Wancheck explained how a proposal to verify the incomes of all EITC filers would delay refunds, raise administrative costs, and divert IRS resources. Chuck Marr, Brandon DeBot, and Emily Horton detailed how tax reform could raise working-class incomes. Marr also explained why unpaid-for tax cuts for the rich are even more indefensible now than they were during the Bush era. Chye-Ching Huang noted that Senator Ted Cruz’s call for “temporary,” deficit-increasing tax cuts would repeat the irresponsible Bush tax-cut model. Chloe Cho provided state-by-state data showing the very small number of estates that owe estate tax.

- On the economy, University of Chicago Professor Harold A. Pollack described how well-designed job programs can usher teens and young adults into the labor market.

- On housing, Will Fischer advocated for the reinstatement of a promising regulatory change to the Housing Choice Voucher program that aims to reduce segregation and improve program efficiency.

- On family income support, LaDonna Pavetti warned that two bills to extend effective home visiting programs contain harmful provisions.

- On food assistance, we updated our quick guide to SNAP eligibility and benefits.

Chart of the week – Cassidy-Graham’s Large Cuts to Federal Health Care Funding Grow Even Larger Starting in 2027

A variety of news outlets featured CBPP’s work and experts recently. Here are some highlights:

Trump says his tax plan wouldn’t benefit the rich, but numbers tell a different story

Think Progress

September 14, 2017

Cassidy-Graham: The last GOP health plan left standing, explained

Vox

September 13, 2017

New Trumpcare Deserves a Quick Death

New York Times

September 13, 2017

U.S. middle-class incomes reached highest-ever level in 2016, Census Bureau says

Washington Post

September 12, 2017

This nifty GOP trick will punish the poor and increase the deficit — at the same time!

Washington Post

September 11, 2017

Don’t miss any of our posts, papers, or charts — follow us on Twitter, Facebook, and Instagram.