BEYOND THE NUMBERS

In Case You Missed It…

This week at CBPP, we focused on health care, federal taxes, housing, food assistance, family income support, and state budgets and taxes.

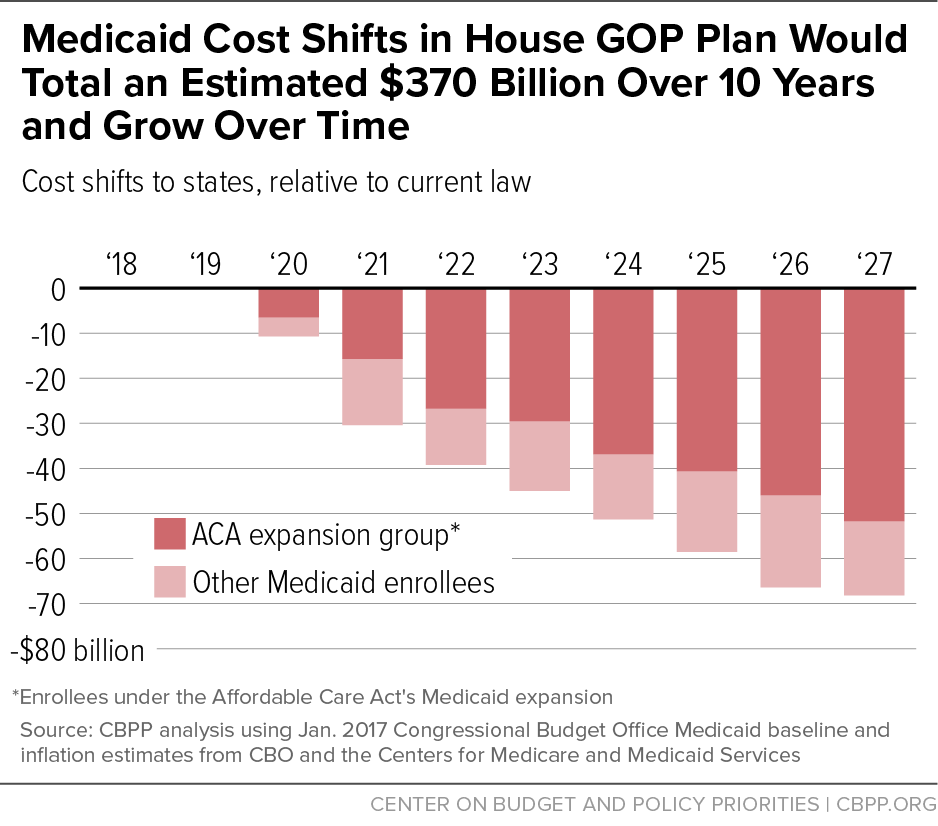

- On health care, Edwin Park warned that the new House Republican health plan would shift $370 billion in Medicaid costs to the states over the next ten years. Park, Aviva Aron-Dine, and Matt Broaddus explained that the cost shift would force states to end the Affordable Care Act’s (ACA) Medicaid expansion and cut coverage and services for other vulnerable groups. Park corrected the history on proposed Medicaid per capita caps. Sarah Lueck noted that the House Republican plan’s continuous coverage provision falls far short of the current individual penalty in encouraging people to get health coverage and keep it over time. Aron-Dine and Tara Straw explained that the tax credits in the House plan would fail to make health insurance more affordable, especially in high-cost states. Aron-Dine also pointed out that the Medicaid expansion has been a big success in Kentucky. We showed that a Medicaid per capita cap has the same damaging effects as a block grant.

- On federal taxes, Chye-Ching Huang explained the various ways House Republicans’ ACA repeal plan would benefit the wealthy, insurers, and drug companies rather than low- and middle-income Americans. Chuck Marr pointed out that, despite Republican leaders’ claims, wealthy business owners would be far likelier than small business owners to benefit from cutting the tax rate on “pass-through” business income.

- On housing, Alicia Mazzara illustrated the fact that 3 out of 4 at-risk renters don’t get federal rental assistance. Douglas Rice outlined how cuts to non-defense discretionary spending could affect the Department of Housing and Urban Development and detailed how the Trump Administration’s likely 2018 budget request would slash housing aid. Will Fischer and Barbara Sard updated our chart book on how federal housing spending is poorly matched to need. Fischer, Sard, and Mazzara proposed a renters’ credit to help vulnerable groups afford housing, and Fischernoted that the proposal would begin addressing the imbalance in federal housing spending. We summarized the proposed credit’s key features.

- On food assistance, Jared Bernstein cautioned about the dangers of block granting SNAP (formerly food stamps) benefits, noting SNAP’s success and efficiency. Dottie Rosenbaum listed possible dangers of a SNAP block grant.

- On family income support, Liz Schott explained that Arizona’s proposed time limit extension on aid through Temporary Assistance for Needy Families (TANF) wouldn’t help those who need it most. Ife Floyd cited Arizona’s TANF experience as evidence why policymakers shouldn’t block-grant safety net programs.

- On state budgets and taxes, Eric Figueroa pointed to a new report showing that unauthorized immigrants pay a larger share of their income in state and local taxes than the nation’s top earners. Elizabeth McNichol subscribed much of Oklahoma’s budget problems to numerous harmful tax cuts.

Chart of the week: Medicaid Cost Shifts in House GOP Plan Would Total an Estimated $370 Billion Over 10 Years and Grow Over Time

A variety of news outlets featured CBPP’s work and experts recently. Here are some highlights:

The Republican plan to slash Medicaid, explained

Vox

March 10, 2017

Fair-housing advocates call potential HUD cuts “devastating”

Washington Post

March 9, 2017

No Wonder the Republicans Hid the Health Bill

New York Times

March 7, 2017

What to Know about Donald Trump’s Budget Proposal

Teen Vogue

March 7, 2017

Don’t miss any of our posts, papers, or charts — follow us on Twitter, Facebook, and Instagram.