off the charts

POLICY INSIGHT

BEYOND THE NUMBERS

BEYOND THE NUMBERS

In Case You Missed It…

| By

CBPP

This week at CBPP, we focused on food assistance, health care, the federal budget and taxes, housing, and the economy.

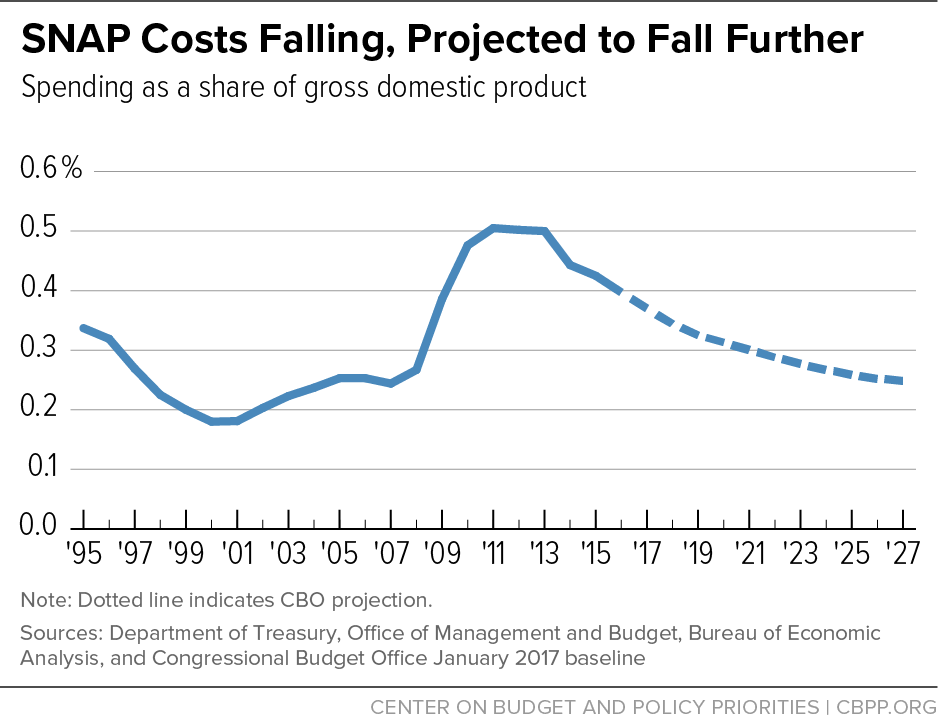

- On food assistance, Catlin Nchako and Lexin Cai updated our state-by-state fact sheets looking at who benefits from the Supplemental Nutrition Assistance Program (SNAP, formerly known as food stamps). Dottie Rosenbaum and Brynne Keith-Jennings highlighted that SNAP caseloads and spending fell in 2016 and are expected to continue falling. Rosenbaum also cited new Congressional Budget Office estimates projecting that SNAP costs are dropping and will continue to drop. We also updated our SNAP chart book.

- On health care, Judith Solomon cited a Centers for Medicare & Medicaid Services report showing that state spending per person on adults who are newly eligible for Medicaid under the Affordable Care Act’s (ACA) Medicaid expansion fell by 6.9 percent in 2016 and is expected to continue falling. Solomon and Hannah Katch explained why Medicaid incentives aren’t an effective way to improve health outcomes. Sarah Lueck outlined several reasons why the ACA replacement proposal from Senators Susan Collins and Bill Cassidy fails to measure up to the current law. Tara Straw pointed to new Urban Institute fact sheets that describe the nearly 30 million adults and children who would lose coverage in each state under ACA repeal. We created a backgrounder to explain Health Savings Accounts and why they fail to help the uninsured afford coverage. We issued a primer that shows how ACA replacement proposals fall short. Shelby Gonzales noted that enrollment in marketplace health plans remains open until January 31.

- On the federal budget and taxes, Chye-Ching Huang explained that the likely Republican bill to repeal the ACA would invite more corporate tax avoidance by eliminating provisions that help prevent business tax shelters and raise penalties on tax avoiders. Chuck Marr pointed out that President Trump’s promise to focus on working families contradicts two major pieces of tax-related legislation at the top of the Republican agenda. David Reich maintained that policymakers should provide sequestration relief equally to both defense and non-defense programs. Ahead of Earned Income Tax Credit (EITC) Awareness Day, Roxy Caines listed five ways the EITC helps families, communities, and the country.

- On housing, Douglas Rice emphasized that vouchers for more than 100,000 families would be unfunded if policymakers fail to provide a substantial funding boost to renew housing vouchers in 2017.

- On the economy, we updated our backgrounder on how many weeks of unemployment compensation are available in each state.

Chart of the week: SNAP Costs Falling, Projected to Fall Further

A variety of news outlets featured CBPP’s work and experts recently. Here are some highlights:

The Obamacare Repeal Is a Money-Grab for the Already Rich

Time

January 24, 2017

Marketplace

January 23, 2017

Trump’s health care plan would repeat the failures of welfare reform

New Republic

January 23, 2017

Republican Plan To Replace Obamacare Would Turn Medicaid Over To States

NPR

January 22, 2017

Don’t miss any of our posts, papers, or charts — follow us on Twitter, Facebook, and Instagram.

Stay up to date

Receive the latest news and reports from the Center