BEYOND THE NUMBERS

House ACA Repeal Bill Would Be Largest Robin-Hood-in-Reverse Transfer in Modern U.S. History

The Trump Administration and House Republicans are reportedly discussing a deal to revive the House GOP leadership’s Affordable Care Act (ACA) repeal bill — the American Health Care Act. Press coverage of these discussions has largely focused on the possibility that the deal will add new provisions to the House bill that would let states dismantle protections for people with pre-existing conditions and eliminate requirements that health insurance plans cover basic services like maternity care, prescription drugs, and mental health and substance use treatment.

As we’ve explained, such changes could be devastating for millions of Americans, especially the 52 million with pre-existing conditions that would have made them uninsurable under pre-ACA law. But even without these additions, the House bill, if enacted, would represent the greatest assault on low- and moderate-income Americans of any law in modern times. It would also represent the largest direct transfer from low- and moderate-income people to the very wealthy in memory.

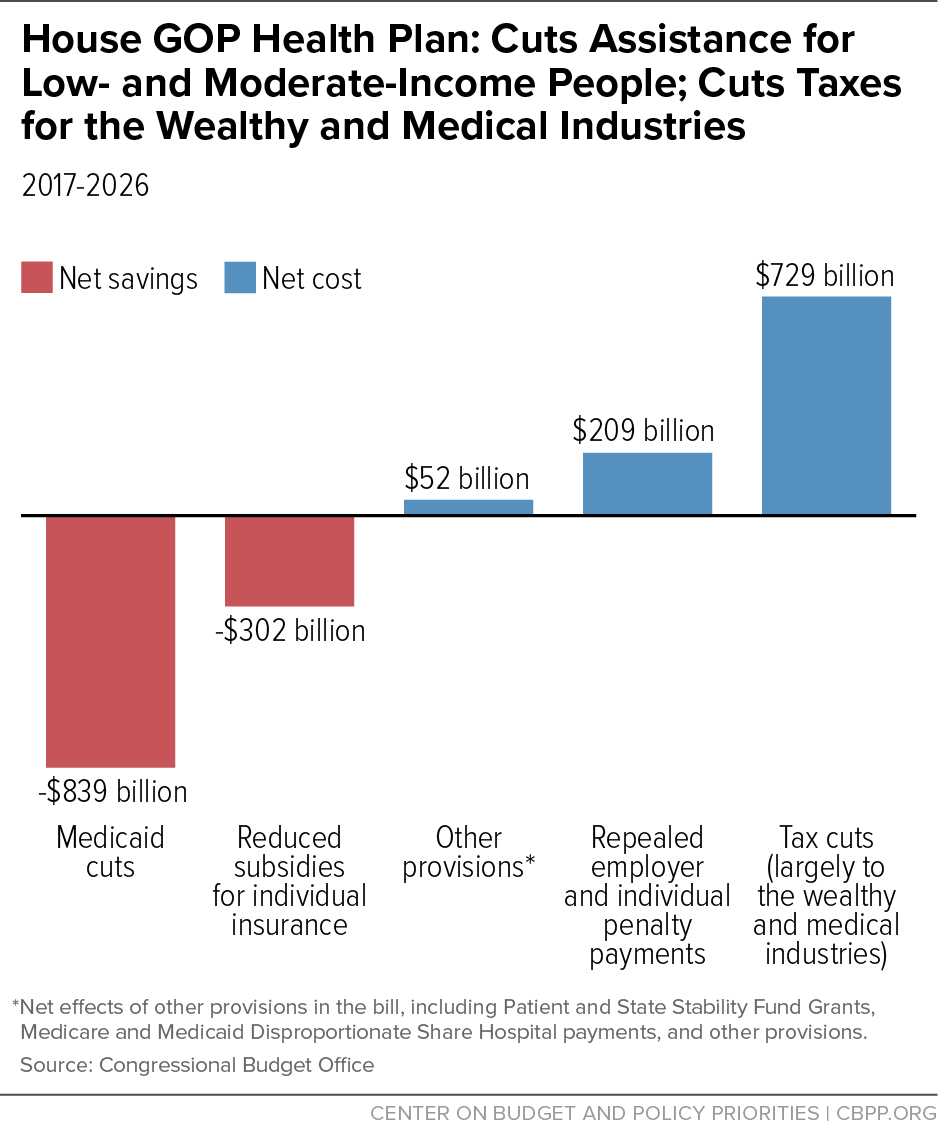

The House bill would cut more than $1.1 trillion from Medicaid and from subsidies that help moderate-income people afford health coverage and dedicate most of the savings to tax cuts for high-income Americans and corporations (see chart).

As a result:

- 24 million people would lose health insurance coverage by 2026, according to Congressional Budget Office estimates. That means that 1 of every 10 non-elderly Americans who would have health insurance coverage under current law would lose it under this bill. Some 14 million people would lose Medicaid coverage, while 10 million would lose private health insurance, resulting in coverage losses for Americans of all ages and among both low- and middle-income households. Uninsured rates would increase by at least 80 percent for non-elderly people both below and above 200 percent of the poverty line, and for young, middle-aged, and older Americans.

- Millions more people would end up with skimpier or less affordable coverage. For people who currently purchase coverage through HealthCare.gov, total out-of-pocket costs (premiums minus tax credits, along with deductibles, copays, and coinsurance) would rise by an average of $3,600 under the House bill – and even more for older people, people with lower incomes, people in rural areas, and people in states with high health insurance premiums. Due to the bill’s cuts to tax credits that help low- and moderate-income people afford health insurance premiums in the marketplace, the legislation would represent the largest tax increase on low-and moderate-income people in recent decades. Meanwhile, the bill’s proposal to cap and cut federal funding for Medicaid would likely force states ultimately to cut benefits and services for many or most of the seniors, people with disabilities, and families with children for whom they would continue to provide Medicaid coverage.

- High-income households would receive billions of dollars in tax cuts. By 2025, tax cuts would average over $50,000 per year for households with annual incomes exceeding $1 million. And the 400 highest-income taxpayers — whose annual incomes average more than $300 million — would get annual tax cuts averaging nearly $7 million each starting in 2017. Overall, the fewer than 1 percent of Americans who make over $1 million a year would receive more than two-fifths of the tax cuts, according to the Tax Policy Center. Some of these tax cuts would come at the expense of the Medicare’s Hospital Insurance trust fund, hastening its insolvency and exposing seniors and people with disabilities to additional benefit cuts in the future.

The problems with the House bill are so serious and widespread that they simply aren’t fixable. Almost every provision in the bill, from its major cuts to marketplace subsidies and Medicaid to its smaller Medicaid proposals, which have received less attention, would either cause people to lose coverage, make coverage less affordable or less comprehensive, or cut taxes for high-income people.

Congressional Republicans should instead jettison the bill’s Robin-Hood-in-reserve approach, which would cause millions of their constituents to become uninsured while showering tax cuts on those at the top, go back to the drawing board, and seek bipartisan approaches.