BEYOND THE NUMBERS

Hardship rates fell sharply in late March, according to Census Bureau data released this week. But millions of people are still without their pre-pandemic income sources and are borrowing to get by. So while the latest figures are a welcome improvement, they show that many Americans will need more help to enable them to climb out of debt and to return the nation to pre-pandemic levels of hardship — let alone to reach a more equitable recovery that reduces hardship further.

The share of adults whose household didn’t have enough to eat sometimes or often in the last seven days dropped to 8.8 percent in Household Pulse Survey data collected in late March (March 17-29), down from 10.7 percent in the previous Pulse survey (March 3-15). The share of adults whose household had difficulty covering usual expenses fell from 33.8 percent to 28.9 percent. These improvements followed enactment of the American Rescue Plan — which provided more than $310 billion in Economic Impact Payments between March 13 and March 29, among other relief — as well as prior relief legislation and a continuing economic recovery.

Nonetheless, far too many adults are struggling to put food on the table and cover bills. In late March, 18 million adults lived in households that didn’t have enough to eat, and the 8.8 percent figure above was several times the share of adults who reported their household didn’t have enough to eat at any point in 2019. (For more of the latest hardship data, see our updated tracker.)

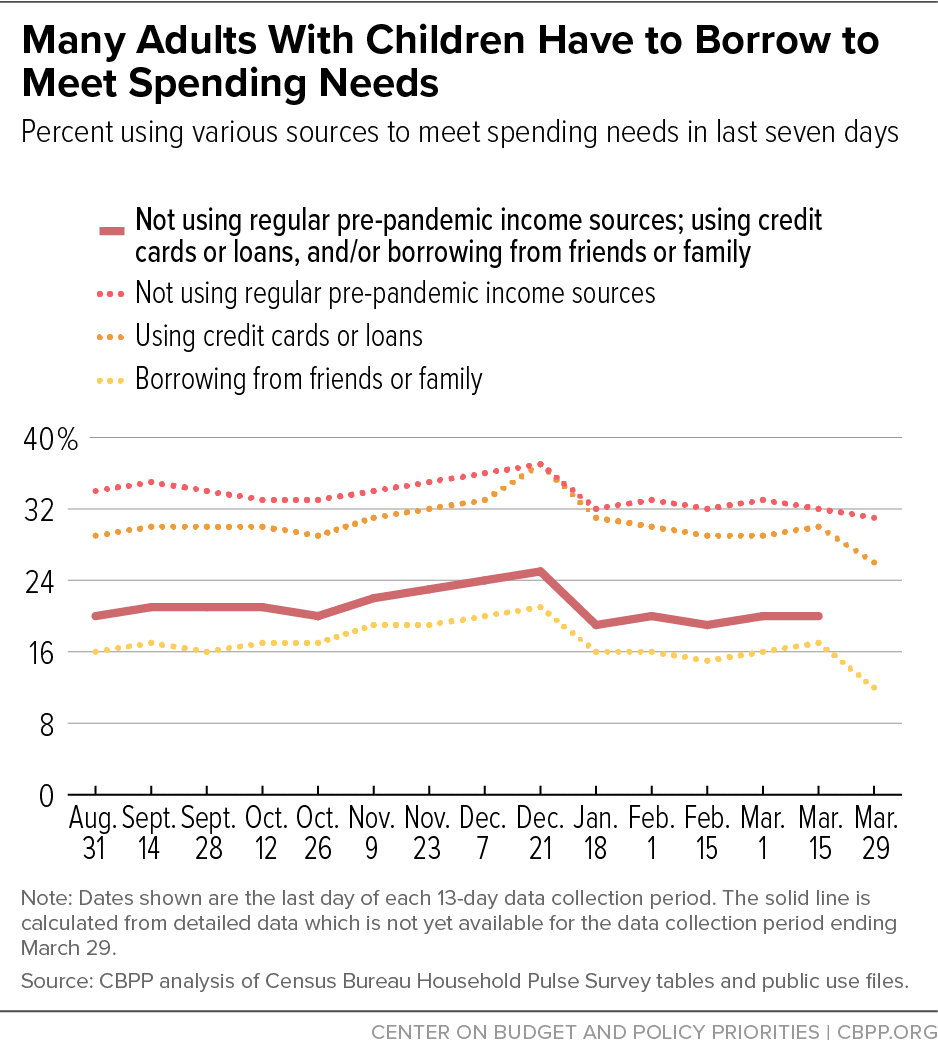

Moreover, millions of adults are still without their pre-pandemic income sources and have turned to borrowing to get by. In late March:

- 54 million adults said they didn’t use regular income sources like those received before the pandemic to meet their spending needs in the last seven days.

- 50 million used credit cards or loans to meet spending needs.

- 20 million borrowed from friends or family. (These three groups overlap.)

While the number of adults borrowing from friends or family is down from nearly 27 million in early March — and a peak of 34 million in late December — these 20 million adults are still struggling. Thirty-eight percent of adults who borrowed in this way also said their household didn’t have enough to eat.

The Census Bureau also released detailed data this week for early March that provide a closer look at adults in households that lack their pre-pandemic income sources and rely on various forms of borrowing. Some 34 million adults said they used some form of borrowing — credit cards, loans, or borrowing from friends or family — rather than their regular pre-pandemic income sources to meet their spending needs in the last seven days, according to Pulse data collected March 3-15.

The share of adults using some form of borrowing and not their regular pre-pandemic income sources in early March was higher among adults with children (20 percent; see chart) than those without children (14 percent). Among adults with children, it was much higher for renters (30 percent) than homeowners (15 percent), and higher for Black (26 percent), Latino (33 percent), or Asian (21 percent) adults than for white (13 percent) adults.

Similar to the less-detailed data for late March, the early March data show that households that borrow often face other hardships. For example, 37 percent of adults with children that used credit cards, loans, or other borrowing to meet spending needs, rather than regular pre-pandemic income sources, also reported not having enough to eat in the last seven days. That’s more than four times the rate among those who had income from their regular income sources or who didn’t use borrowing (9 percent).

Reliance on borrowing is especially closely tied with problems paying rent. Forty-seven percent of the 4.5 million adult renters with children who said they weren’t caught up on rent also said they were using borrowing and not regular pre-pandemic income sources.

The high rate of borrowing among renters not caught up on rent suggests that many may be falling even further behind on rent payments and may need time to fully pay off their rental arrearages even as the economy improves. It’s important to note that these estimates largely predate the American Rescue Plan, enacted March 11; its renter aid will help millions pay back rent but will likely be enough to help only a fraction of those who’ve fallen behind.