off the charts

POLICY INSIGHT

BEYOND THE NUMBERS

BEYOND THE NUMBERS

Nine years after President Obama signed the Affordable Care Act (ACA) on March 23, 2010, the uninsured rate remains at a historic low and more than 20 million people have gained coverage — but about 30 million non-elderly people are still uninsured. Several new CBPP analyses examine the uninsured and identify policies to continue expanding coverage and making coverage and health care more affordable.

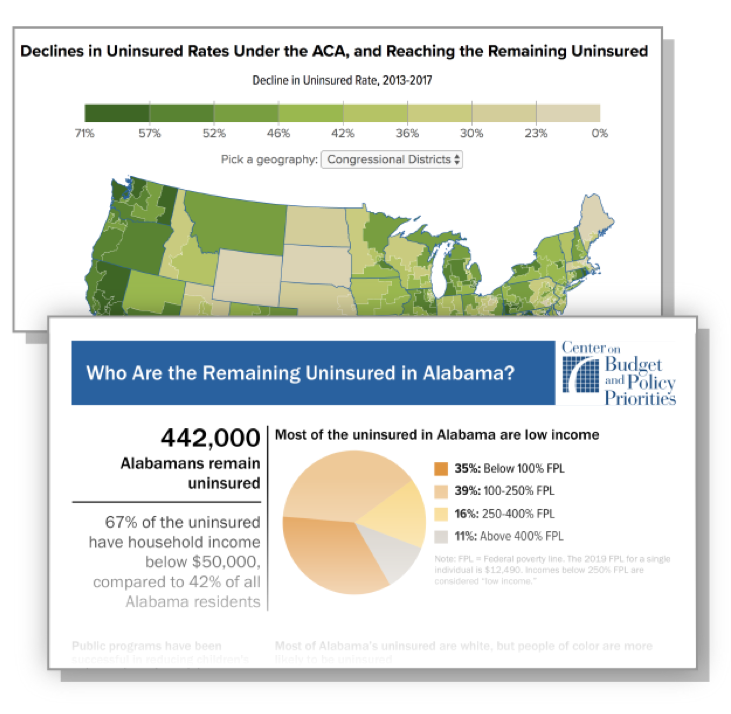

- Who Are the Remaining Uninsured? These fact sheets and interactive map provide state, county, and congressional district data on declines in uninsured rates under the ACA and who remains uninsured. The uninsured are disproportionately low- or moderate-income people, young or middle-aged adults, and people of color. And in every state, the large majority live in working families.

Image

- Policies Can Make Coverage More Affordable, Accessible to Reach the Remaining Uninsured. This fact sheet outlines policies to advance the goal of universal coverage while making coverage and health care more affordable for those already insured. These include having the remaining states that haven’t adopted the ACA’s Medicaid expansion do so, improving financial assistance, making it easier to enroll in ACA marketplace coverage and Medicaid, letting people enroll in coverage through a public plan that the federal government administers, and restoring or replacing the ACA’s penalty for individuals who don’t get coverage.

Two new analyses examine immediate steps that could significantly expand coverage and make individual market plans more affordable. (Future analyses in this series will examine other policies to advance these goals.)

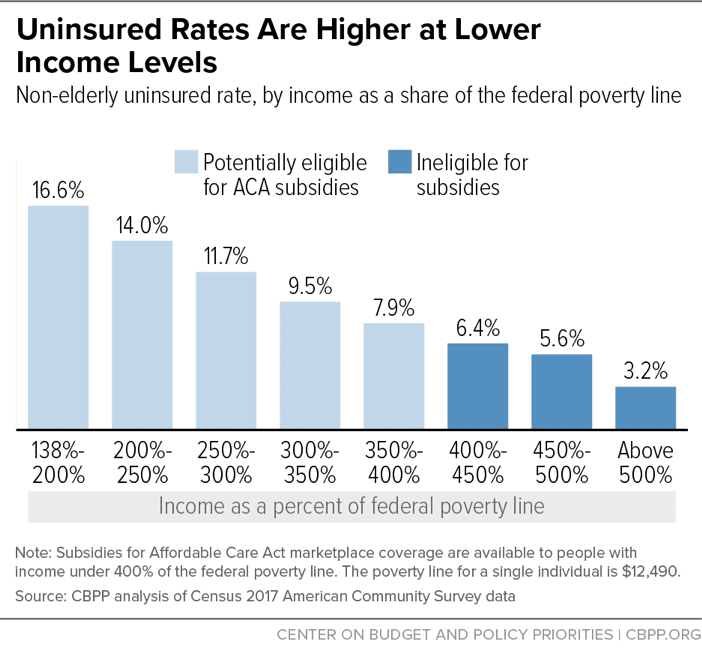

- Improving ACA Subsidies for Low- and Moderate-Income Consumers Is Key to Increasing Coverage. Even with the ACA’s financial assistance, low- and moderate-income people are likelier to be uninsured than those with higher incomes (see chart), and they comprise most of the marketplace-eligible uninsured. Improving ACA subsidies for those who already qualify for them is therefore crucial to further reducing uninsured rates.

- Making Health Insurance More Affordable for Middle-Income Individual Market Consumers. Middle-income people who buy coverage in the individual market and have incomes too high to qualify for the ACA’s premium tax credits often have difficulty affording coverage. Eliminating the income cap on premium tax credits — which would ensure that nearly all consumers have coverage options costing less than 10 percent of their incomes — is the best way to help this group. It’s much more targeted to middle-income people than a federal reinsurance program, and it would make coverage more affordable for both healthy and sick people, unlike the Administration’s proposal to expand access to non-ACA plans.

Topics:

Policy Basics

Health

Chart Book

Chart Book: The Far-Reaching Benefits of the Affordable Care Act’s Medicaid Expansion

October 21, 2020

Stay up to date

Receive the latest news and reports from the Center