BEYOND THE NUMBERS

Yesterday’s post in this series focused on where federal tax dollars go. Today we examine where they come from.

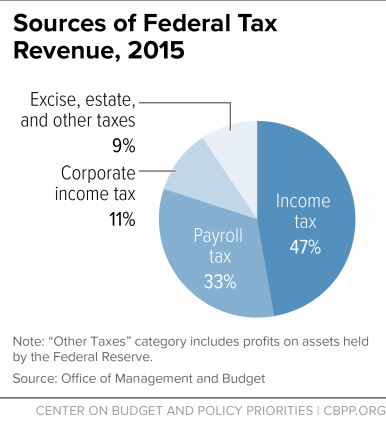

The individual income tax is the largest federal tax, generating close to half of federal revenues. It’s progressive, meaning that tax rates generally rise as income rises.

The second largest category is payroll taxes to fund Social Security and Medicare, which account for a third of federal revenue. Payroll taxes as a whole are regressive: lower-income people pay a larger share of their incomes in tax than higher-income people do. (That’s because people pay Social Security tax only on their first $118,500 in wages.) Most lower- and middle-income people pay more in payroll taxes than federal income taxes.

But, while payroll taxes are regressive, Social Security and Medicare overall are progressive when you account for the benefits they provide as well as the taxes they collect.

Corporate taxes provide just 11 percent of federal revenue. The remaining 9 percent comes from various excise taxes on tobacco, alcohol, and other goods, as well as the estate tax on large inheritances. Despite growing evidence — and public awareness — of the high concentration of income and wealth at the top, policymakers have shrunk the estate tax dramatically since 2001. Consequently, only about 2 of every 1,000 estates have to pay any estate tax.