BEYOND THE NUMBERS

States that slash their tax revenue find it harder to improve their schools, which Mississippi lawmakers considering huge new tax cuts would do well to remember.

Mississippi already faces a sizeable budget shortfall, yet lawmakers are considering a plan to severely cut income taxes and eliminate the business franchise tax, at an annual cost of at least $575 million when fully phased in.

Proponents claim the tax cuts will boost the state’s economy and won’t affect schools or other essential services. But states that have tried this approach have failed to see the promised economic boom. And most independent, rigorous studies have found that personal income tax levels have a negligible effect on state economic growth.

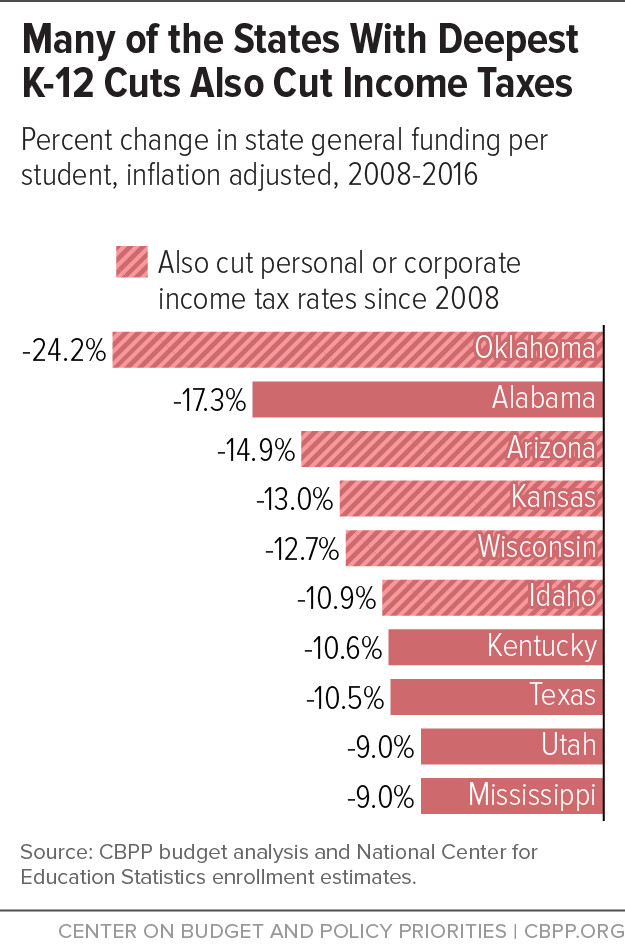

That large tax cuts won’t harm schools is particularly hard to believe in Mississippi, which already has cut general funding per student for K-12 schools by 9 percent, and funding per student for higher education by 23 percent, since 2008. Sharply reducing state revenue will make it much harder to restore these cuts, let alone build a higher-quality education system to compete in the 21st century.

For a state whose residents have among the nation’s lowest levels of educational attainment, there’s a particularly strong need for new investment.

Some of Mississippi’s tax-cut proponents are unmoved by these realities, but if the state enacts the tax cuts, it would join several other states that have slashed general K-12 funding per student since 2008 while also cutting income tax rates. (See chart.) Let’s hope Mississippi lawmakers keep their state off that dubious list.