BEYOND THE NUMBERS

The Congressional Budget Office’s (CBO) new menu of deficit-reduction options includes one to convert the mortgage interest deduction to a tax credit worth 15 percent of mortgages up to $500,000. A mortgage interest credit offers a fairer, more efficient alternative to the current deduction. But another CBO option — eliminating the Low-Income Housing Tax Credit (LIHTC) — would be a step backward in the effort to meet the large and growing need for affordable housing.

The mortgage interest deduction is one of the largest federal tax expenditures, costing about $70 billion a year. Yet it appears to do little to achieve the goal of expanding homeownership, as our analysis explains.

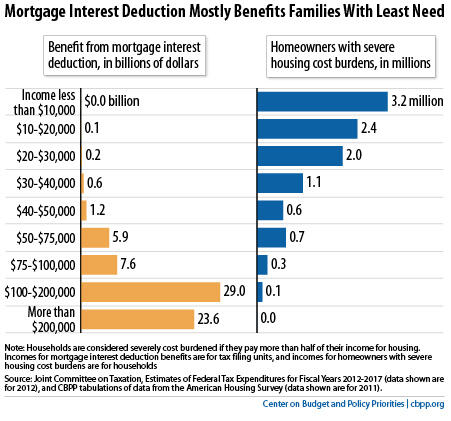

Most of the benefits go to higher-income households who generally could afford a home without assistance: in 2012, 77 percent of the benefits went to homeowners with incomes above $100,000. Meanwhile, the deduction provides little benefit to the middle- and lower-income families who are most likely to struggle to afford homeownership (see chart) — and no benefit at all to close to half of homeowners with mortgages.

A mortgage interest credit would provide more help than today’s deduction to most middle- and lower-income homeowners with mortgages, while trimming subsidies for upper-income owners. As a result, it would likely do more than the existing deduction to help families that would otherwise struggle to afford homeownership.

CBO estimates that its proposal, phased in gradually over six years, would raise $52 billion from 2014 through 2023. Policymakers could use part of the savings to help replace the harmful sequestration budget cuts and part to help address the large unmet need for assistance among low-income renters, such as by creating a

.Another CBO option would eliminate the LIHTC and use the savings for deficit reduction or to fund more Housing Choice Vouchers. CBO notes that vouchers are an efficient way to help the lowest-income families afford existing housing in the private market.

To be sure, Congress should raise voucher funding, most immediately to stem and reverse the large cuts in assistance resulting from sequestration. But it should not do so at the expense of LIHTC.

As the largest federal program supporting rehabilitation and construction of affordable housing, LIHTC serves a different purpose than vouchers, which fill the gap between modest market rents and what families can afford to pay. Before creating LIHTC, policymakers had long struggled to establish efficient, accountable subsidies for construction and renovation of affordable housing — an important need in many areas. LIHTC has performed well in this role and policymakers should retain it.