BEYOND THE NUMBERS

Lawmakers in North Carolina, North Dakota, and Tennessee are considering a costly corporate tax giveaway in hopes of attracting or retaining manufacturing jobs. But a new study casts serious doubt on the research that has long served as the main justification for this tax break.

Called the “single sales factor formula,” the tax break enables multistate corporations to pay income taxes based only on their sales to consumers in that state. In states without this tax break, a corporation’s taxes typically reflect the shares of its property and payroll, as well as sales, located in the state.

The single sales factor formula usually results in a sharp drop in state revenue. North Carolina, for example, stands to lose more than $75 million a year.

Single sales factor proponents often cite a 2000 study by economists Austan Goolsbee and Edward Maydew finding that states can attract manufacturing jobs by giving more weight to companies’ sales — and less weight (or none) to their property and payroll — in determining their taxes. But economist David Merriman has just published a study that largely undermines that finding. When Merriman updated the 1978-1994 results in the Goolsbee-Maydew study through 2010, he found that giving extra weight to sales created many fewer jobs than Goolsbee and Maydew had found — so few, in fact, that the gains weren’t statistically significant.

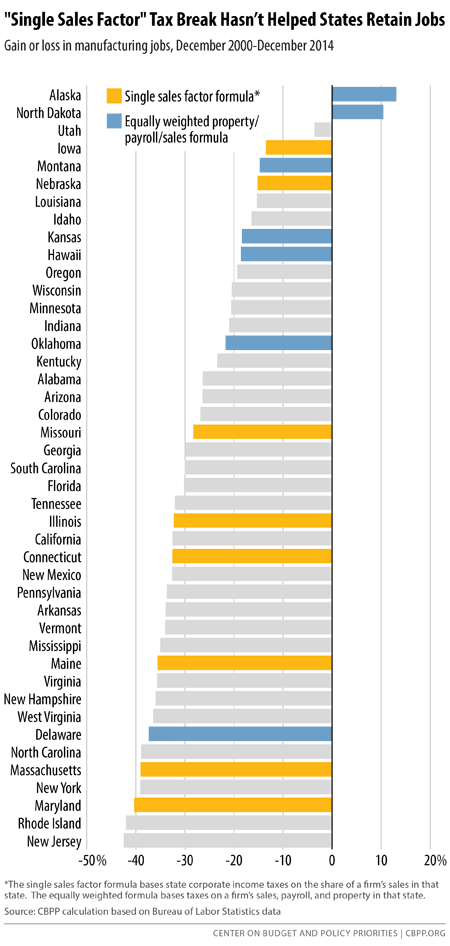

Both studies used sophisticated statistical techniques to examine the relationship between manufacturing jobs and state tax formulas. The table below shows what Merriman found in a more understandable way. It ranks the states with corporate income taxes by their success in retaining manufacturing jobs from December 2000 through December 2014. (All but two states had a net loss of manufacturing jobs in this period.)

If giving extra weight to companies’ sales in determining their taxes helped a state attract or retain manufacturing jobs, the eight states with a single sales factor formula throughout this period would be clustered toward the top of this ranking, while the seven states that gave no extra weight to sales would be clustered toward the bottom. But the table doesn’t show that; in fact, closer to the reverse is true.

Even over the shorter December 2009-December 2014 period, when more states (14) had the single sales formula, none were in the top five states in manufacturing job growth.

States should reject this misguided job-creation strategy, which loses substantial revenue that states could better use to create a more educated workforce, higher quality infrastructure, and other building blocks of a healthy economy.