BEYOND THE NUMBERS

A Stronger EITC Would Boost Work, Cut Poverty

About 7.5 million childless workers aged 21 through 66 are taxed into or deeper into poverty by federal income and payroll taxes. As we explain in a new paper, several proposals — including those from President Obama and House Speaker Paul Ryan — would strengthen the Earned Income Tax Credit (EITC) and make significant progress toward meeting the core principle that no American worker should be taxed into poverty.

Here’s the opener:

Working childless adults are the lone group that the federal tax code taxes into or deeper into poverty, largely because they are also the only group largely excluded from the EITC. For low-income working families with children, the EITC encourages and rewards work and offsets federal payroll and income taxes. The EITC for childless adults, by contrast, is so small that it effectively does none of those things. Today, the federal tax code taxes about 7.5 million childless adults aged 21 through 66 into or deeper into poverty.

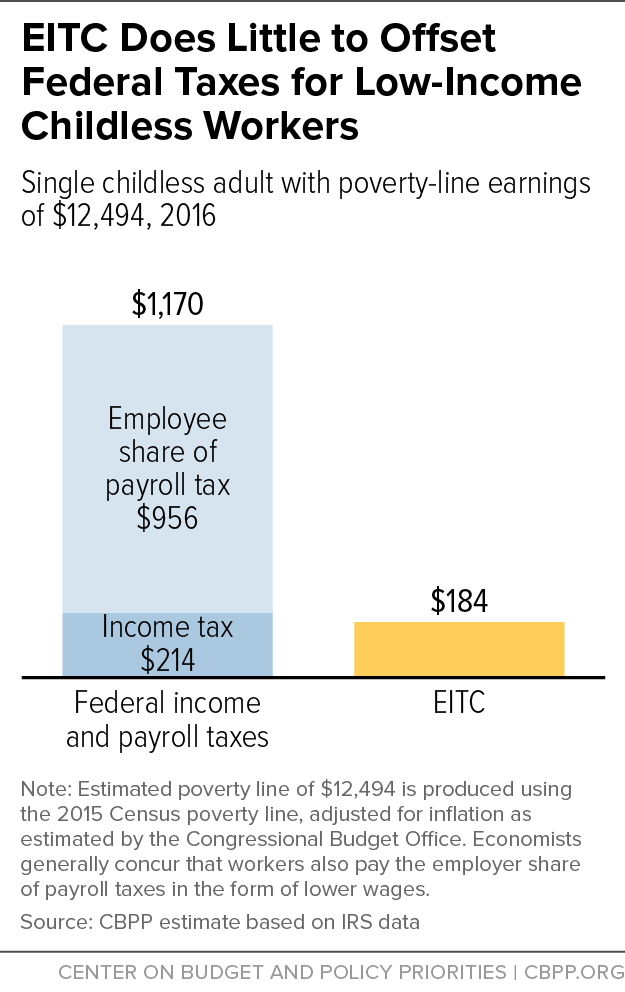

Consider, for example, a 21-year-old just starting out in the workforce and making poverty-level wages of about $12,500 for manual labor. This worker has $956 in payroll taxes deducted from his paycheck and pays $214 in federal income taxes. Because the worker receives zero EITC (childless workers under age 25 are ineligible), he is taxed $1,170 into poverty — that is, the taxes leave him $1,170 below the poverty line. A 30-year-old woman making the same low wages in a retail store owes the same taxes, and she does qualify for an EITC (she is age 25 or older), but her credit is only $184 — with the result that she, too, is taxed into poverty (see chart).

Fortunately, leading policymakers from both parties recognize this problem. President Obama and House Speaker Paul Ryan have put forth nearly identical proposals to lower the eligibility age for the childless workers’ EITC to 21 and to raise the maximum credit to roughly $1,000. These changes would make significant progress toward meeting the core principle that no American worker should be taxed into poverty, though they do not get all of the way to that goal. Senate Finance Committee member Sherrod Brown (D-OH) and House Ways and Means Committee member Richard Neal (D-MA) have introduced more robust proposals that would essentially ensure that the federal tax code doesn’t tax childless wage-earners aged 21 through 64 into poverty.

Providing a more adequate EITC to low-income childless workers and lowering the eligibility age would have important benefits beyond raising these workers’ incomes and helping offset their federal taxes. Some leading experts believe that an expanded EITC for these workers would also help address some of the challenges that less-educated young people (particularly young African American men) face including low and falling labor-force participation rates, low marriage rates, and high incarceration rates.

These proposals would reward the hard work of a broad swath of people in every state — young and older, male and female, and across all races — who do important low-paid jobs in hospitals, schools, office buildings, and construction sites. Of the 13 million workers who would benefit from the Obama and Ryan proposals, roughly 35 percent are at least 45 years old, and 1.5 million or more are non-custodial parents. About 6 million are women. Some 630,000 are veterans or military service members. Workers in a diverse range of occupations and demographic groups would benefit.

An additional 3 million workers — 16.2 million overall — would benefit from the Brown-Neal proposal. Roughly 32 percent of the workers who would benefit are at least 45 years old, and 7.2 million are women. Similar to the proposals from Obama and Ryan, workers in a diverse range of occupations and demographic groups would benefit.