- Home

- State Budget And Tax

- Worldwide Combined Reporting Would End C...

Worldwide Combined Reporting Would End Corporate Tax Avoidance in Maryland

Testimony of Don Griswold,

Senior Fellow, Center on Budget and Policy Priorities,

Before the Maryland House Ways and Means Committee

Chair Atterbeary, Vice Chair Wilkins, and members of the House Ways and Means Committee, thank you for the opportunity to submit this testimony in favor of House Bill 1007.

My name is Don Griswold. I’m a senior fellow at the nonpartisan Center on Budget and Policy Priorities, a nonprofit research and policy institute that pursues federal and state policies designed to reduce poverty and inequality and to restore fiscal responsibility in equitable and effective ways. We apply our expertise in budget and tax issues and in programs and policies that help low-income people by informing policy debates to achieve better policy outcomes.

Prior to joining CBPP, state corporate tax avoidance was my career for three decades. I was executive tax counsel at Berkshire Hathaway, leader of a 600-person “state tax minimization” group, and adjunct professor at Georgetown University Law Center, where I taught my students that Maryland tax avoidance is perfectly legal, and very easy, for aggressive multinational corporations.

At CBPP, I analyze the policy implications for states that, like Maryland, still make corporate income tax virtually optional for powerful global corporations.

I’m here to speak specifically to the part of the Fair Share for Maryland Act that closes a massive tax loophole. This loophole disadvantages small businesses, shifts far too much tax responsibility onto hardworking Maryland families, and rigs the system in favor of a small number of immensely powerful global corporations who are abusing their power by not paying their fair share.

I educate policymakers about the one simple policy solution that closes the loophole; puts Maryland small business on a level playing field with global power players; and brings in a substantial amount of revenue to help fund programs that transform education, build inclusive prosperity, and create the opportunity for financial dignity for all Marylanders.

The solution is Worldwide Combined Reporting.

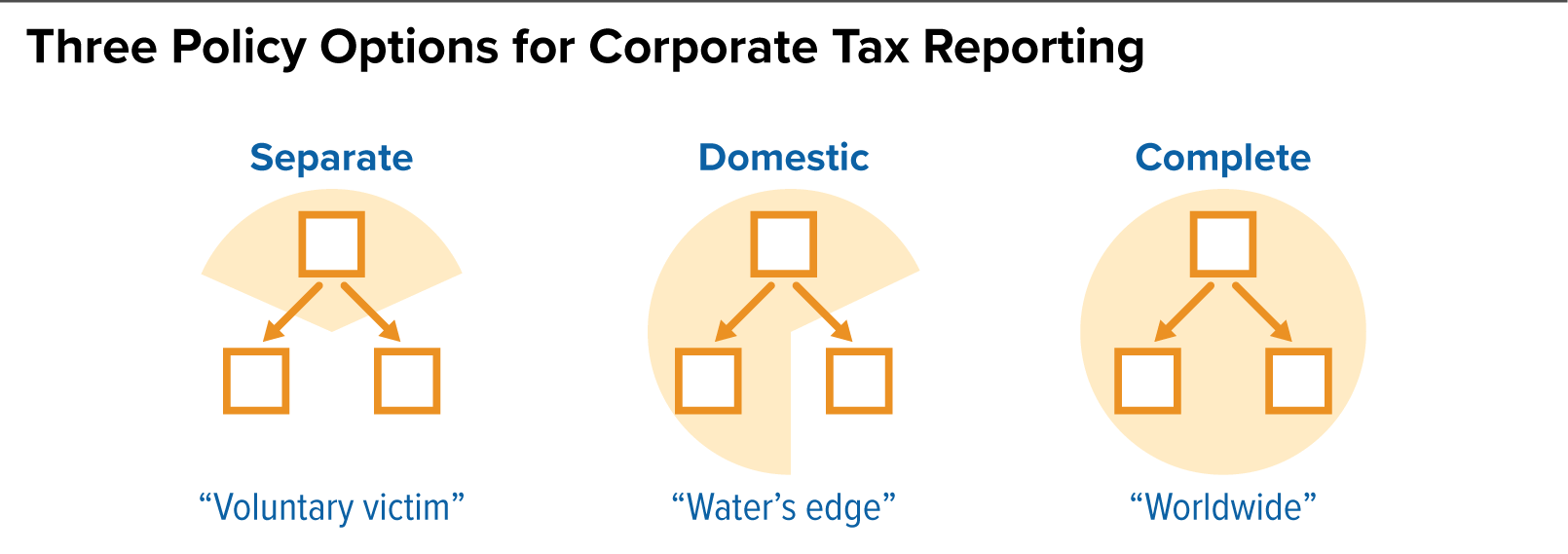

This simple snapshot illustrates the legislature’s three policy options when it comes to corporate tax reporting, which I’ll explain below.

Let’s discuss the problem, the solution, why you should care, and why this is the time to act.

The Problem Is Profit-Shifting

It’s common knowledge that powerful multinationals have avoided hundreds of billions of dollars in federal and state income tax over time. They pay huge fees to sophisticated advisers to develop a wide variety of complex schemes that shift their profits offshore ― beyond the reach of federal and state tax authorities ― into tax havens that brazenly cannibalize other jurisdictions’ revenues.

In each of the three diagrams above, a tax avoider’s profit-shifting scheme is represented by two arrows leading from the parent (top box) of the multinational enterprise down to two subsidiary shell companies:

- A shell company (each box on the lower left) exists on paper in a tax haven in a state outside Maryland (Delaware, for example). The left arrow represents profit-shifting within the U.S. — perhaps a royalty paid (and deducted) by the parent to the domestic shell company in exchange for the right to use trademarks dropped into it earlier.

- Similarly, a foreign shell company (each box on the lower right) exists on paper in an offshore tax haven (Ireland, for example). The right arrow represents offshore profit-shifting — perhaps a royalty paid (and deducted) by the parent to the foreign shell company in exchange for the right to use patents that the parent had transferred to it earlier.

Maryland corporate income tax, like that of most other states, piggybacks on federal tax calculations. The result is that profit-shifting for federal tax avoidance also produces Maryland tax avoidance. Some sobering facts, based on economic studies and forensic accounting by respected experts:

- The federal government lost $60 to $94 billion of tax revenues in 2017 to offshore profit-shifting by multinationals with U.S. parents. (That number doesn’t include offshoring by the U.S. subsidiaries of foreign multinational parent corporations — like household names Subaru, Nestle, and German-owned T-Mobile.)[1]

- Speaking of household names, U.S.-parent multinationals Apple, Cisco, eBay, Facebook, Google, and Microsoft together underpaid their U.S. corporate income taxes by $277 billion by skirting rules aimed at reducing offshore profit-shifting from 2009 through 2022. With penalties and interest, that’s nearly half a trillion dollars of tax avoidance by just six taxpayers.[2] Recall that Maryland automatically piggybacks on its apportioned share.

- Subsidiaries based in some of the world’s most notorious tax havens lurk in the organizational charts of many powerful multinationals that set up shop in this state, selling to Maryland customers and benefiting from local police and fire protection. Walmart, for example, has subsidiaries in the Cayman Islands and Singapore; Exxon in the Netherlands and Singapore; CVS in Bermuda, Ireland, Luxembourg, Puerto Rico, and Singapore.[3]

- Finally, a stunning 50 percent of the total foreign profit of U.S.-based multinationals was claimed by these companies to have been earned in just nine infamous foreign tax havens ― Bermuda, the British Virgin Islands, the Cayman Islands, Ireland, Luxembourg, the Netherlands, Puerto Rico, Singapore, and Switzerland.[4]

Inadequate Response to the Problem

In the face of all this profit-shifting, Maryland leaves itself wide open to be victimized because, like many other states, its tax law follows the “separate filing” reporting method.

Let’s back up for some quick context. Think of a multinational corporation’s profits as a pie. No state can tax the entire pie. Each can tax only its fair slice. What’s a fair slice? States divide up their portions of a multinational’s profit-pie with “apportionment” rules that (in Maryland and many states) are based simply on sales to customers. If 3 percent of the multinational’s total global sales are to Maryland customers, then the state gets to tax a 3 percent slice of that profit-pie.

But we were talking about profits, the pie itself. That’s what Figure 1 illustrates.

In the “Separate / Voluntary Victim” visual (on left in Figure 1), the grey-shaded wedge illustrates the severely incomplete picture of the taxpayer’s total profits that Maryland allows itself to apportion and tax. Contrast this to the grey-shaded full circle on the right: that’s the complete picture of the taxpayer’s total profits. Domestic and offshore profit-shifting arrows show how avoiders victimize Maryland, leaving behind for taxation only a sliver of their profits.

In this illustration, the multinational left behind just a third of its complete profits in the entity to which Maryland limits its scope. So, if Maryland is entitled to a 3 percent apportioned slice — not of the entire profit-pie but just a third of that pie — then Maryland can tax just 1 percent (a third of 3 percent) of the multinational’s total profits. What happens to the other two-thirds of profits that Maryland allows to be abusively shifted away? Those profits dodge Maryland tax entirely.

Let’s consider a second policy option that’s available to states. In contrast to Maryland, a majority of states have resisted the powerful influence of the tax avoidance industry and taken a partial step away from being voluntary victims by adopting a form of partial combined reporting.[5] With “water’s edge” combined reporting, a state allows itself to apportion the profits that have been shifted to tax havens or tax shelter vehicles within the United States.

In the “Domestic / Water’s Edge” visual (center of Figure 1), the grey-shaded Pac-Man-like area shows that these states treat the parent and the domestic tax haven shell company as a single taxpayer. This rule combines the profits (“pie”) and apportionment data (“pie-slicing” calculation) of the parent company and its domestic shell company in a single tax calculation. This partial combined reporting has been an important step on the legislative road to tax fairness.

But this visual also demonstrates that water’s edge combined reporting still leaves wide open the massive loophole for piggybacking on offshore (foreign) profit-shifting. The profits and apportionment data of the foreign shell company are still ignored. These states still start with an inaccurate and incomplete profit pie before they get to take their share for taxation.

The Complete Solution Is Worldwide Combined Reporting

As part of the Fair Share for Maryland Act, this committee is now considering closing entirely this massive tax avoidance loophole by adopting Worldwide Combined Reporting, also known by its acronym, WWCR.

Adoption of WWCR will be a major step forward for tax fairness in Maryland.

In the “Complete / Worldwide” visual (Figure 1, right), the grey-shaded area — a perfect circular pie that encompasses the corporate group’s complete profits — shows that this third policy option would make all profit-shifting (foreign or domestic) entirely ineffective. The profit-shifting arrows never leave the circle. Thus, WWCR would eradicate corporate income tax avoidance in Maryland.

WWCR eliminates the opportunity for sophisticated avoiders to manipulate the fundamental fictions on which tax avoidance is based — shell companies and sham transactions — because WWCR instead taxes based on economic reality. What is that reality? Virtually every multinational operates as a single, integrated, unitary business enterprise, where all activity — wherever that activity is conducted and in whatever legal form — aims for the singular goal of increasing shareholder value.

Put another way: WWCR makes profit-shifting as meaningless as moving your wallet from right pocket to left when the state lawfully taxes its share of all the cash in your pants.

Why You Should Care

Credible revenue estimations project that Maryland tax revenues will increase significantly once you close the massive loophole that allows a small group of the world’s largest and most aggressive multinational corporations to cheat the people of Maryland out of funds that properly belong to the public fisc. One may quibble over the precise amounts, but the order of magnitude is clear. And these funds will enable important public investments in initiatives aimed at transforming education, producing inclusive prosperity, and facilitating financial dignity for all the people of Maryland.

The problem of unfettered profit-shifting by power-abusers is not limited to reductions in public funds that could have been devoted to projects for the common good. Continued legislative policy decisions to leave such pervasive tax avoidance unchecked has consequences. This may perpetuate public distrust of a tax system that remains rigged, which in turn may undermine fiscal citizenship and sap popular confidence in government for the common good. Maryland can do better than that.

Every Marylander should be able to expect from their elected officials a tax system that fairly distributes the tax-paying responsibility. Every Marylander should be able to expect that Maryland tax will not be optional for aggressive multinational tax abusers. Every Marylander should be able to expect that their elected representatives will ensure that huge global corporations will be required to compete in this state on a level playing field with Maryland small businesses.

Why is WWCR so important? Because an unrigged tax system is an essential element of a society where the public can make investments that build inclusive prosperity. Because tax justice creates the space for Maryland families to achieve financial dignity. And because tax fairness makes Maryland more competitive.

This Is the Moment

Around the nation and around the world, policymakers are waking up to the evils of multinational profit-shifting and the terrible cost of continued failure to confront their abuse of corporate power. From the Organization for Economic Cooperation and Development to the United Nations to U.S. Treasury Secretary Janet Yellen, strong efforts are being developed to wipe out this scourge.

And across this nation, more states are waking up to the shovel-ready solution to this problem at the U.S. state level: Worldwide Combined Reporting.

Conclusion

Worldwide Combined Reporting is complete profit reporting. Require this complete reporting of all profits everywhere, and then calculate Maryland’s “apportioned” slice of those profits, and you’ll come up with a tax base that satisfies U.S. constitutional requirements,[6] eradicates avoidance of Maryland corporate income tax, and fairly represents economic reality.

“Speak truth to power” (typically legislative power), the old saying, challenges all people of good conscience. Well, you have a high-level veteran of the state tax avoidance industry sitting before you and speaking truth to you — about the obscene abuse of corporate power by global tax avoiders right here in Maryland, and about how you can stop it.

The next step is on you. And the time is now. It’s time for this body to “speak tax to power” by enacting Worldwide Combined Reporting.

Thank you for the opportunity to submit this testimony.

End Notes

[1] Kimberly Clausing, “Profit Shifting Before and After the Tax Cuts and Jobs Act,” National Tax Journal, December 2020.

[2] Reuven Avi-Yonah et al., “Commensurate with Income: IRS Nonenforcement Has Cost $1 Trillion,” Tax Notes Federal, May 22, 2023.

[3] Sources here are each of these multinationals’ most recent annual 10-K report to the U.S. Securities and Exchange Commission, exhibit 21.

[4] Javier Garcia-Bernardo, Petr Jansky and Gabriel Zucman, “Did the Tax Cuts and Jobs Act Reduce Profit Shifting by US Multinational Companies?” unpublished working paper, July 19, 2023.

[5] Michael Mazerov, “A Majority of States Have Now Adopted a Key Corporate Tax Reform—Combined Reporting,” Center on Budget and Policy Priorities, April 2009.

[6] The United States Supreme Court has considered the legality of worldwide combined reporting, twice, and each time has ruled definitively that WWCR is both constitutional and fair.