BEYOND THE NUMBERS

Pennsylvania Can Show It’s Serious About Ending Corporate Tax Avoidance by Eliminating Domestic Profit-Shifting

It’s well known that wealthy, multinational corporations avoid paying their fair share in state taxes by hiding profits in out-of-state affiliates, often in domestic and foreign tax havens. Pennsylvania legislators are taking steps to shut down this abuse with recent House passage of a bill that would require those corporations to honestly report for taxation far more of their true profits.

The bill would achieve this by treating a corporate group, including all of its U.S. affiliates, as what it is — an integrated business — and taxing a share of the combined profits it would now be required to report. This “combined reporting” approach differs from the state’s current practice, which effectively gives reduced-tax treatment to profits that the parent company artificially shifts to affiliates that have been engineered to pay a lower effective tax rate.

The bill represents an important step toward closing this major tax avoidance loophole entirely. It could raise hundreds of millions of dollars in revenue each year to support Pennsylvania’s vital needs, while improving tax fairness by ensuring that wealthy, multinational corporations that make money in the state — and benefit from state investments in areas such as education, transportation, and health — pay more of what they owe.

The hiding of corporate profits — often by fabricating mind-bogglingly complex schemes — creates a major problem for state budgets, costing billions of dollars every year. Those losses result in reduced funding for public services, a shift in tax responsibility toward those least able to pay, and frustrated citizens who see their tax system rigged for the powerful.

This massive loophole flourishes in Pennsylvania because its current tax laws ignore modern economic reality:

- A large multinational business enterprise conducts its business through scores of corporate affiliates operating around the country and globe.

- Together, these affiliates generate the enterprise’s total profits.

- But no single affiliate has an identifiable economic share of total profits.

- Headquarters’ ability to artificially shift profits among affiliates exacerbates the problem.

The loophole also flourishes because Pennsylvania does not make use of its full, constitutionally guaranteed taxing power: If any affiliate of a business enterprise has customers or operations in a state, the U.S. Constitution authorizes the state to tax its fair share of the enterprise’s total profits without regard to how headquarters arbitrarily divides up those total profits among affiliates.

But Pennsylvania doesn’t tax based on economic reality or to the full extent of its constitutional taxing power. Instead of taxing its fairly apportioned share of the group’s combined reporting of profits, the commonwealth requires separate filings only from those affiliates that independently have in-state operations or customers.

Like many other states, Pennsylvania thus freely allows tax-dodging corporate groups to simply drain an in-state affiliate’s already arbitrary taxable profit by shifting it to an out-of-state affiliate. Through this approach, the corporate group avoids paying the taxes it owes in Pennsylvania.

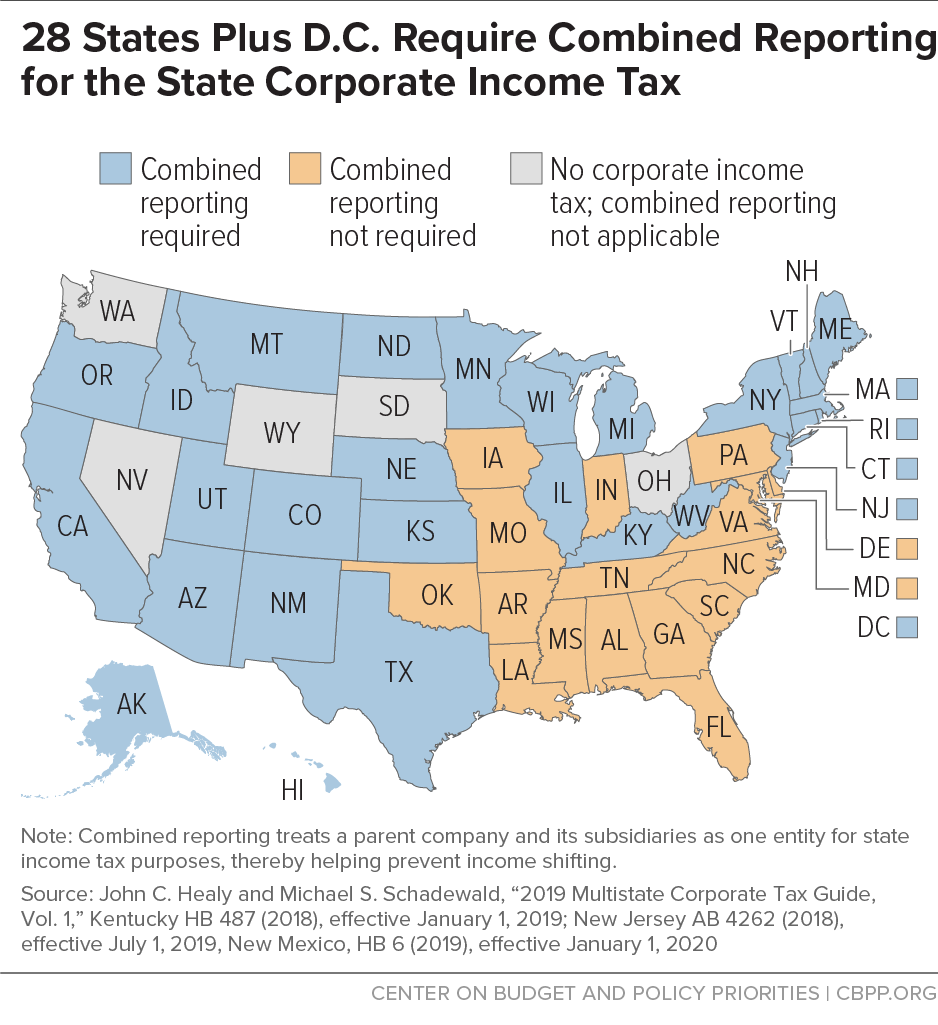

The House-passed bill, aiming to close that loophole, would require corporate groups to report their total domestic profits from all affiliates with U.S. operations. In doing so, the commonwealth would be following in the footsteps of 28 other states and the District of Columbia — including neighboring states West Virginia, New Jersey, and New York. (See map.)

In the calculation of taxes owed, the commonwealth would require use of an “apportionment formula” to determine how much of that profit was earned in Pennsylvania for tax purposes. (These formulas are in place in the 28 states and D.C. and have been shown to be workable and fair.)

This system — known as “water’s edge combined reporting” — would prevent businesses from shifting profits to other states, and thus shut down most domestic schemes for dodging state corporate income tax. The water’s edge elements of the House-passed bill are a great start toward taxing based on modern economic reality.

But they’re also only a start. As written, the bill includes some provisions that undermine its anti-abuse goals by letting banks and insurance companies continue to use separate filing and by specifically authorizing continued use of another common profit-shifting scheme.

Resolving those shortcomings would help meet the bill’s laudable but limited goal of shutting down domestic profit shifting. An even better long-term solution would be to shut down all profit shifting that affects the state by requiring a multinational corporate group doing business in Pennsylvania to report a complete picture of its total global profits, not just those of its U.S. affiliates. This system, known as “worldwide combined reporting,” would eliminate both domestic and offshore profit shifting, closing the tax avoidance loophole completely.

Taking that bold step would make Pennsylvania a national model for advancing tax fairness. If all states had worldwide combined reporting, this would eradicate virtually all corporate income tax avoidance in the states and start recovering the billions of dollars of annually misdirected revenue.

Pennsylvania’s current tax laws make it easy for wealthy multinational corporations to avoid paying their fair share of tax. But it’s just as easy for conscientious elected officials to close the loopholes in the commonwealth’s laws. And Pennsylvania is now on that path toward tax fairness.