Tracking the COVID-19 Economy’s Effects on Food, Housing, and Employment Hardships

In April 2020, the Census Bureau began the Household Pulse Survey to collect nearly real-time data on how families were faring during this unprecedented crisis. At the end of 2021, the Census Bureau had released data from 39 Pulse surveys on household well-being. CBPP and others used this data to assess hardship and the impact of relief measures.

With the end of bi-weekly Pulse data releases in October 2021, this tracker will no longer be updated. The Census Bureau will continue to release Household Pulse data on a monthly basis, and CBPP will continue to analyze and write about the effects of pandemic-relief measures, including the important role of government policies in reducing hardship and poverty.

The COVID-19 pandemic and resulting economic fallout caused significant hardship. In the early months of the crisis, tens of millions of people lost their jobs. While employment began to rebound within a few months, unemployment remained high throughout 2020. Improving employment and substantial relief measures helped reduce the very high levels of hardship seen in the summer of 2020. Nonetheless, considerable unmet need remained near the end of 2021, with 20 million households reporting having too little to eat in the past seven days and 10 million households behind on rent. In early 2022, some 3 million fewer people are employed than before the pandemic, though steady progress has been made, including in recent months.

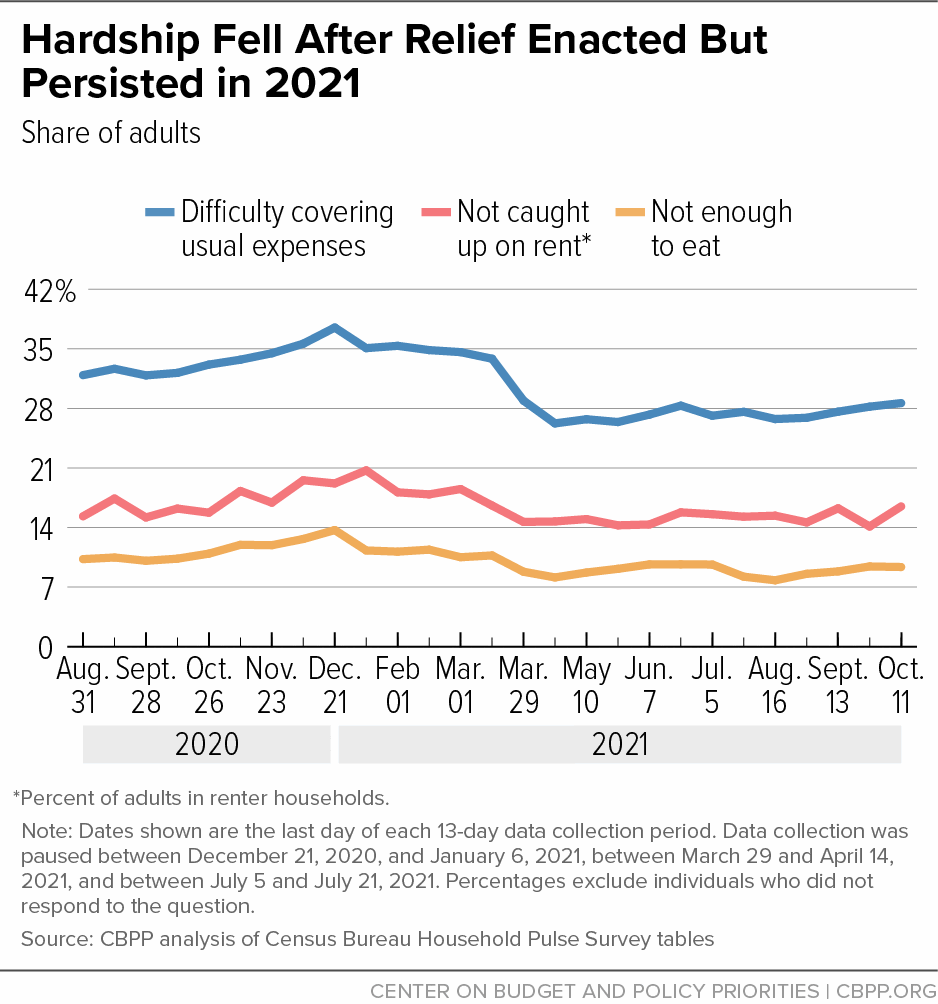

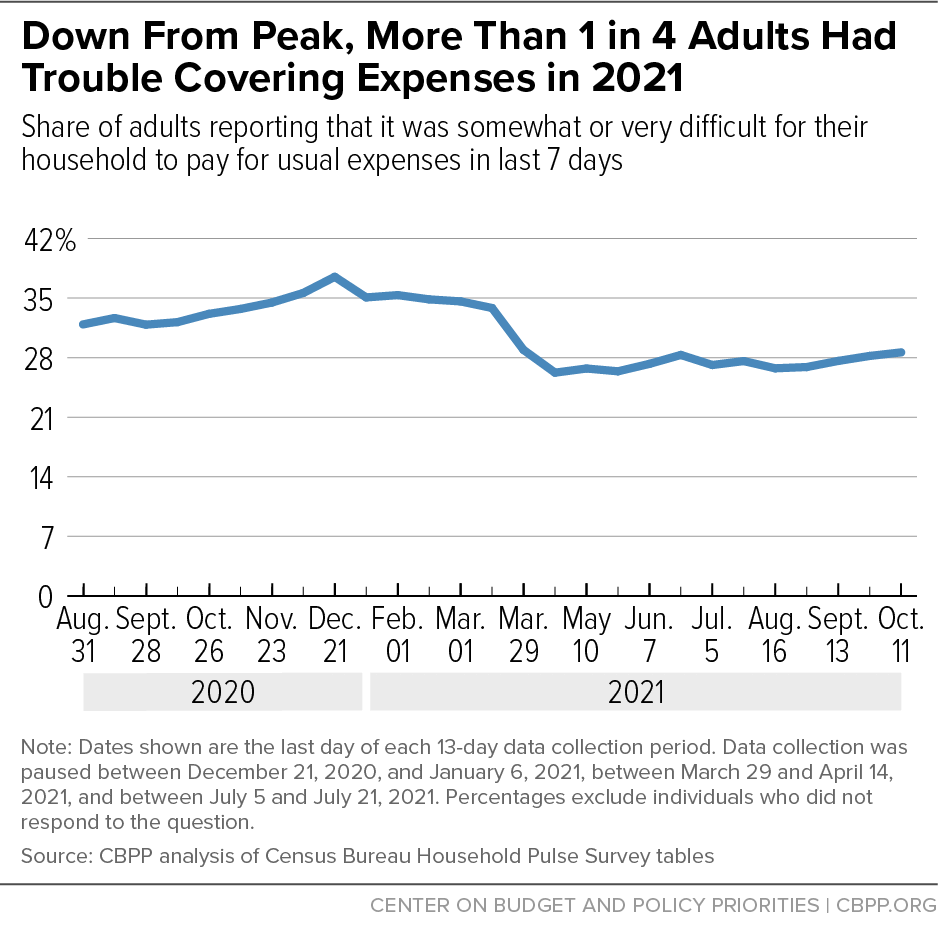

Hardship in 2020 and 2021 would have been far worse without extraordinary steps taken by the federal government, states, and localities to respond to the pandemic and its economic fallout. Key hardship indicators showed strong improvement during early 2021, aided by job growth and government benefits. Hardship rates fell especially fast after the enactment of the American Rescue Plan Act on March 11, 2021, which included $1,400 payments for most Americans as well as other assistance to struggling households. (See Figure 1.) Food hardship among adults with children also fell after the federal government began issuing monthly payments of the expanded Child Tax Credit on July 15, 2021, along with improvements in food assistance.

Still, according to the Pulse survey, in October 2021, nearly 20 million adults lived in households that did not get enough to eat, 12 million adult renters were behind on rent, and some of the progress from late March appeared to have stalled as other troubles continued to affect the economy, including expiring unemployment benefits and supply chain problems that contributed to rising prices for many goods.

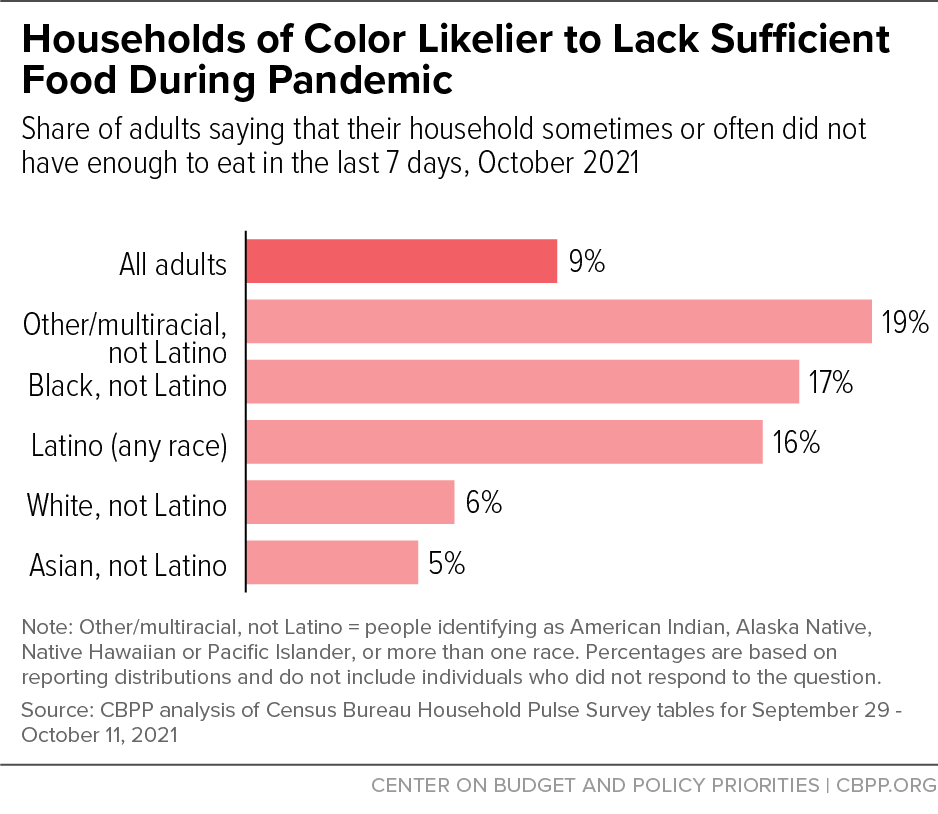

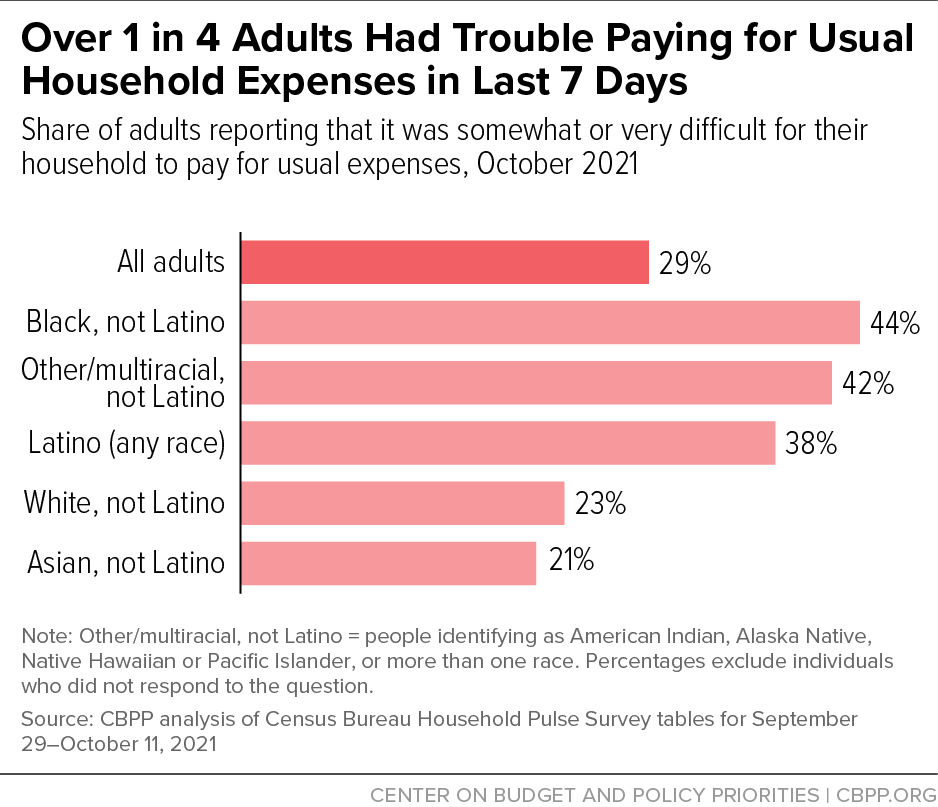

The impacts of the pandemic and the economic fallout have been widespread, but remain particularly prevalent among Black people, Latino people,[1] and other people of color. These disproportionate impacts reflect harsh, long-standing inequities — often stemming from structural racism — in education, employment, housing, and health care that the crisis exacerbated. Households with children also continue to face especially high hardship rates. Considerable evidence suggests that reducing childhood hardship and poverty would yield improvements in education and health, higher productivity and earnings, less incarceration, and other lasting benefits to children and society.[2]

High Hardship Rates Fell as Relief Arrived, Census Bureau Data Show

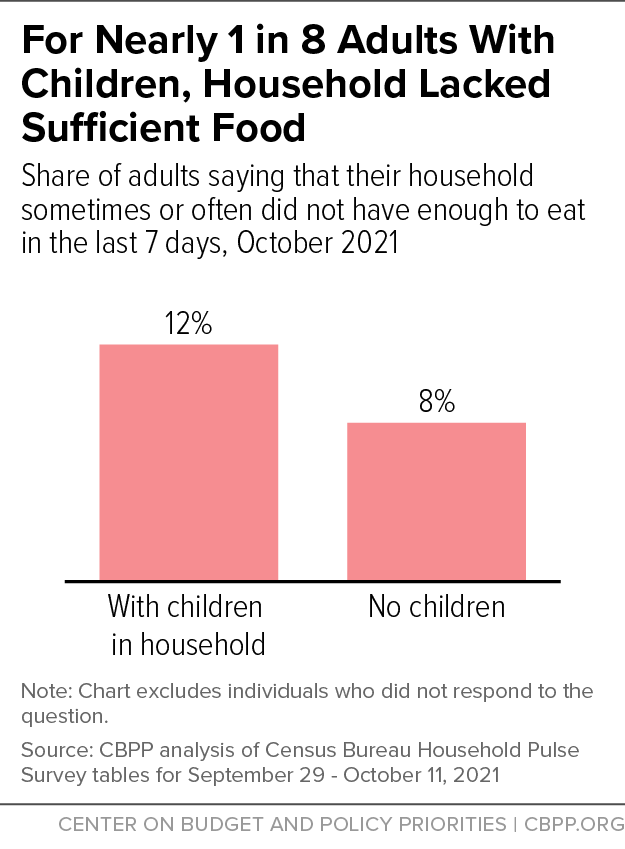

Millions of people were out of work and struggled to afford adequate food and pay the rent through 2021, data from the Census Bureau’s Household Pulse Survey and other sources, such as unemployment data from Census’ Current Population Survey and the Department of Labor, show. The impacts on those with children have been especially large (see Figures 3, 7, and 8). Still, hardship would have been far worse without the substantial relief measures taken to respond to the pandemic’s economic fallout.

For more on our methodology and data by state, see tables 1-4 at the end of this document.

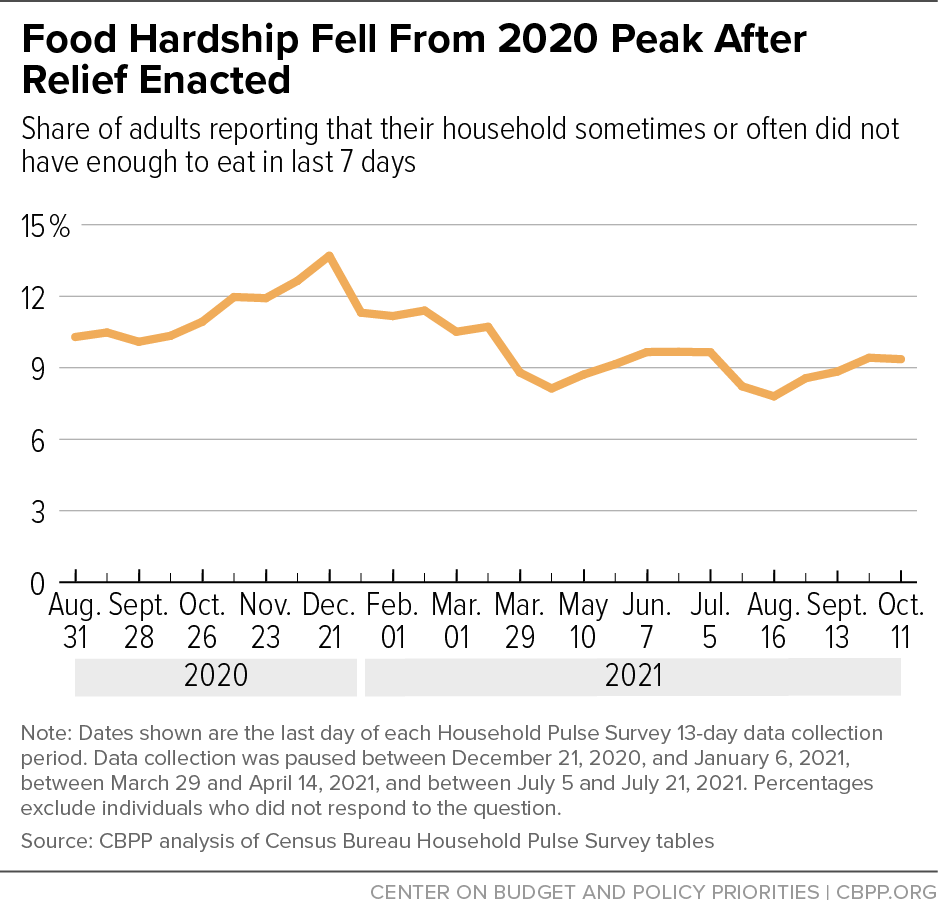

Difficulty Getting Enough Food

The number of adults reporting that their households did not get enough to eat in the last seven days fell from a peak of nearly 30 million — 14 percent — in December 2020 to nearly 20 million — 9 percent — in the fall of 2021, according to Pulse data.[3] (See Figure 2.) It fell sharply in March 2021 after the enactment of the December 2020 relief package and the mid-March enactment of the Rescue Plan, which included Economic Impact Payments of $1,400 for most individuals that month. Food hardship among adults with children improved significantly following the issuance of the first monthly Child Tax Credit payment (up to $300 monthly per child) on July 15, 2021.[4]

Nearly 20 million adults — 9 percent of all adults in the country — reported that their household sometimes or often didn’t have enough to eat in the last seven days, according to Household Pulse Survey data collected September 29–October 11, 2021. When asked why, 82 percent said they “couldn’t afford to buy more food,” rather than (or in addition to) non-financial factors such as lack of transportation or safety concerns due to the pandemic.

Adults in households with children were likelier to report that the household didn’t get enough to eat: 12 percent, compared to 8 percent for households without children. (See Figure 3.) And 7 to 13 percent of adults with children reported that their children sometimes or often didn’t eat enough in the last seven days because they couldn’t afford it. Households typically first scale back on food for adults before cutting back on what children have to eat. (The 7-13 percent range reflects the different ways to measure food hardship in the Household Pulse Survey.)

Also, analysis of more detailed data from the Pulse Survey shows that between 5 and 9 million children lived in a household where children didn’t eat enough because the household couldn’t afford it. These figures are approximations; the Pulse Survey was designed to provide data on adult well-being, not precise counts of children.

Black and Latino adults were more than twice as likely as white adults to report that their household did not get enough to eat: 17 percent for Black adults and 16 percent for Latino adults, compared to 6 percent of white adults. Adults who identify as American Indian, Alaska Native, Native Hawaiian, Pacific Islander, or as multiracial, taken together,[5] were more than three times as likely than white adults to report that their household did not get enough to eat, at 19 percent. (See Figure 4.)

Inability to Pay Rent or Mortgage

Millions were not caught up on their rent or mortgage payments in late 2021, the Household Pulse data also showed, but fewer than earlier in the year.

The December 2020 relief package and the Rescue Plan included over $46 billion in emergency rental assistance, designed to help people struggling to pay their rent and avoid eviction. Getting this emergency aid to people behind on rent took time, as many communities did not have adequate systems in place to distribute emergency rental assistance funds quickly. An August 2021 Supreme Court ruling ended the Centers for Disease Control and Prevention’s eviction moratorium, heightening the urgency to quickly distribute rental assistance to people in need. Once states and localities built the necessary infrastructure for people to apply for and receive emergency assistance, however, disbursement of funds accelerated in the fall of 2021. Over 3.2 million households received emergency aid from January to November 2021, according to Treasury Department data, with over half of these households receiving aid between September and November.[6]

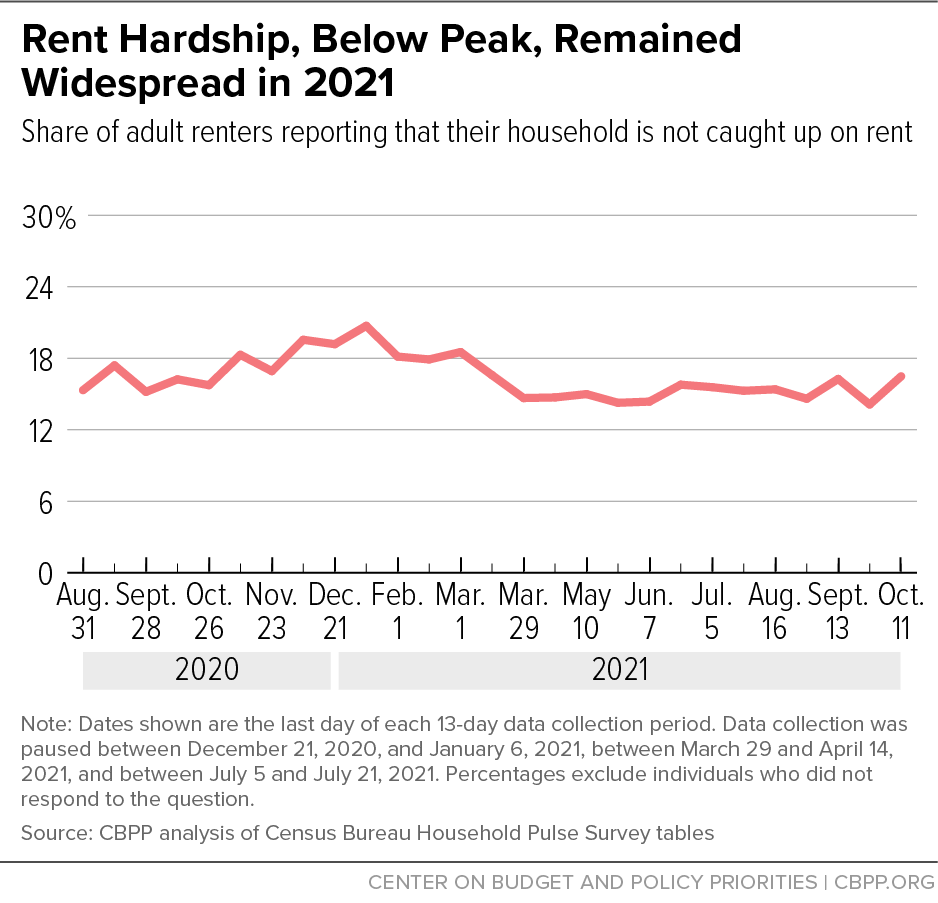

The number of adult renters reporting to the Census Bureau that their household was not caught up on rent fell from a peak of 15 million people — 1 in 5 adult renters — in January 2021 to more than 10 million people — about 1 in 7 adult renters — in the fall of 2021. (See Figure 5.) These households, particularly those who lost employment during the pandemic, may have accumulated debt from multiple months of back rent and late fees. Renters of color and families with children consistently reported higher rates of rent hardship throughout 2020 and 2021.

The Pulse data likely understated the number of people struggling to pay rent because many respondents skipped questions toward the end of the survey, including the housing questions. This “non-response” was higher among groups that are younger, have lower levels of education, and identify as Black or Latino — groups that are also more likely to struggle to afford rent, due to long-standing inequities often stemming from structural racism in education, employment, and housing.

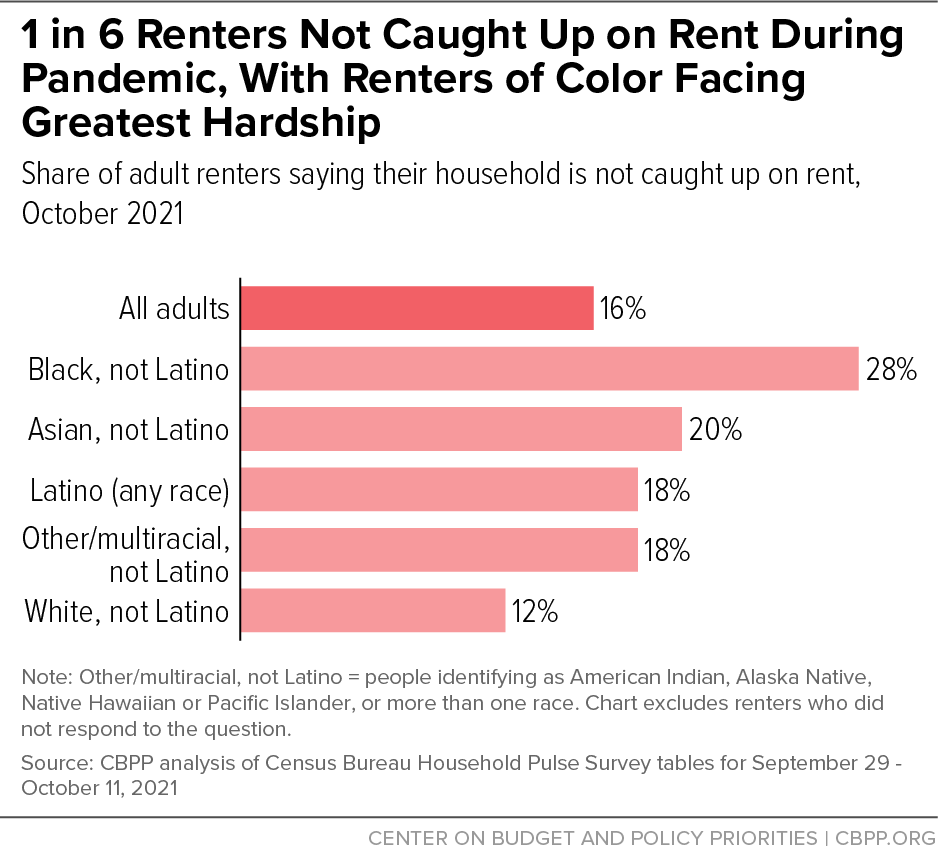

Despite these measurement challenges, the slow rollout of emergency rental assistance and high pre-pandemic levels of housing hardship meant that millions still had difficulty paying rent late in 2021. An estimated 12 million adults living in rental housing — 16 percent of adult renters — were not caught up on rent, according to data collected September 29–October 11, 2021.[7] Here, too, renters of color were more likely to report that their household was not caught up on rent: 28 percent of Black renters, 18 percent of Latino renters, and 20 percent of Asian renters said they were not caught up on rent, compared to 12 percent of white renters. The rate was 18 percent for American Indian, Alaska Native, Native Hawaiian, Pacific Islander, and multiracial adults taken together. (See Figure 6.)

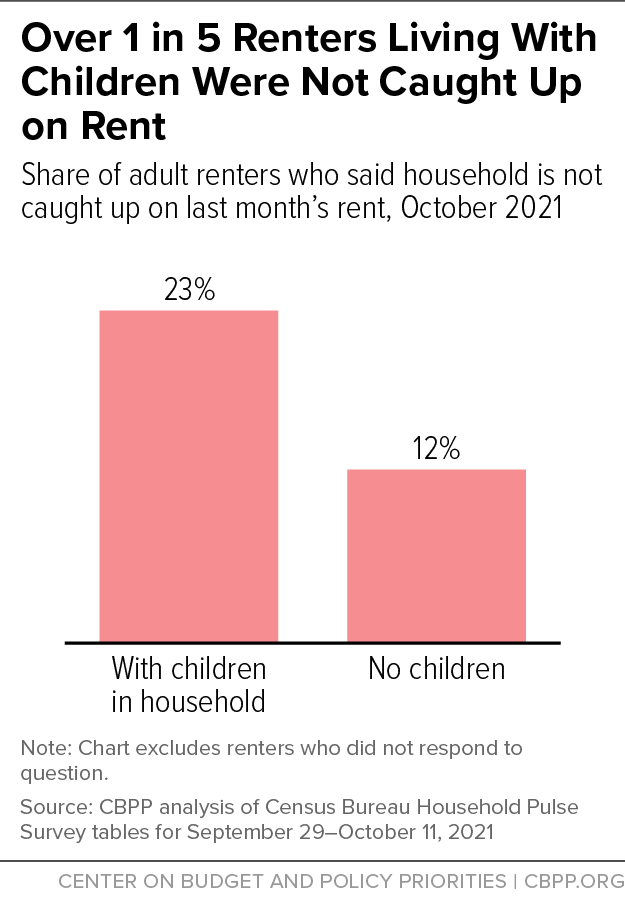

In addition, 23 percent of renters who are parents or otherwise living with children reported that they were not caught up on rent, compared to 12 percent among adults not living with anyone under age 18. (See Figure 7.)

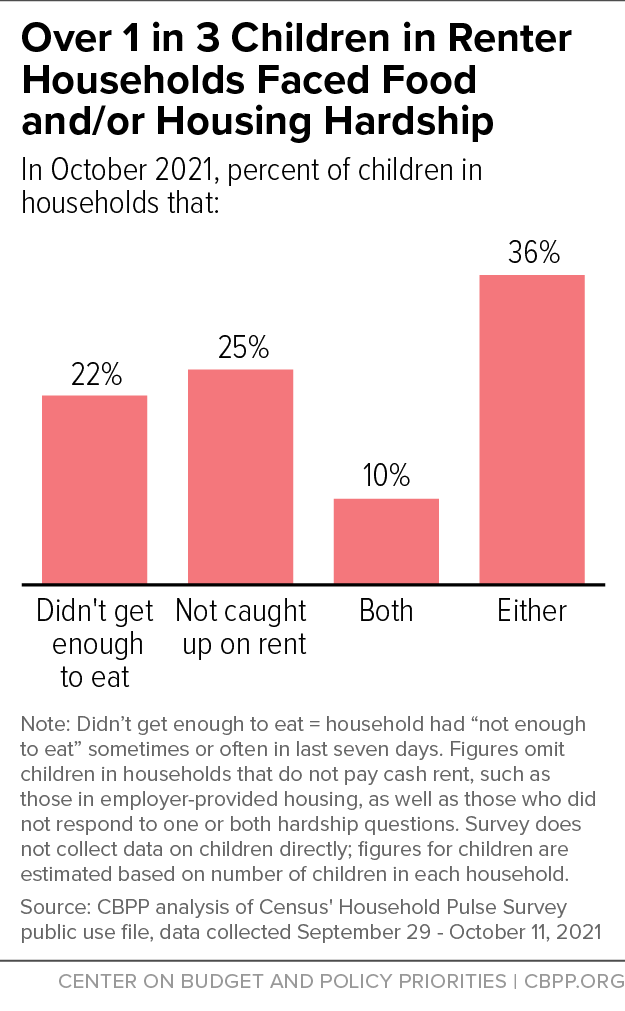

Children in renter households also faced high rates of food hardship. Over 1 in 5 children living in rental housing lived in a household that didn’t have enough to eat, according to detailed Pulse data. And over 1 in 3 children living in rental housing lived in a household that either wasn’t getting enough to eat or was not caught up on rent. (See Figure 8.)

While households that don’t rent their homes but have mortgage payments typically have higher incomes than renters, some of them also faced difficulties, especially if they lost their jobs or their incomes fell significantly. An estimated 7.5 million adults are in a household that was not caught up in its mortgage payment in the fall of 2021.[8]

Difficulty Covering Household Expenses

The Household Pulse Survey provided data on the number of adults struggling to cover usual household expenses such as food, rent or mortgage, car payments, medical expenses, or student loans. Some 63 million adults — 29 percent of all adults in the country — reported it was somewhat or very difficult for their household to cover usual expenses in the past seven days, according to data collected September 29–October 11, 2021. That was down from a peak of 38 percent in mid-December 2020. (See Figure 9.)

In early 2021, the share of adults with trouble covering expenses stabilized as employment rose and aid from the December 2020 relief package — including renewed jobless benefits and another round of stimulus payments — reached households.

Following the March 2021 enactment of the Rescue Plan, and as the economy continued to add jobs, the share of adults who had trouble covering usual expenses fell sharply. The share ticked upward in May, likely due to the fading impact of the third round of stimulus payments, but it remained statistically unchanged in the subsequent months as other troubles continued to affect the economy, including expiring unemployment benefits, a resurging virus, and supply chain problems that contributed to rising prices for many goods.

Adults in households with children were more likely to report difficulty paying for usual expenses than those without children: 36 percent, compared to 24 percent. Financial hardship can have serious effects on children’s long-term health and education, research shows.[9]

Black and Latino adults reported difficulty covering expenses at higher rates: 44 percent and 38 percent respectively, compared to 23 percent for white adults and 21 percent for Asian adults. (See Figure 10.) The rate was 42 percent for American Indian, Alaska Native, Native Hawaiian, Pacific Islander, and multiracial adults taken together.

Adults with a disability[10] were more than twice as likely to report difficulty paying for usual expenses than adults without a disability: 54 percent compared to 23 percent, according to detailed Pulse data. In addition, LGBT[11] adults were likelier than non-LGBT adults to live in households with difficulty covering expenses: 34 percent compared to 27 percent.

An estimated 38 percent of children lived in households that have trouble covering usual expenses, according to detailed data from the Pulse Survey. They included 57 percent of children in Black households, 46 percent of children in Latino households, 30 percent of children in white households, and 24 percent of children in Asian households. (The Pulse Survey asks the race of the adult respondent, not the children.)

Many Workers Remained Sidelined, With Job Losses Concentrated in Low-Paid Industries

The unemployment rate jumped in April 2020 to a level not seen since the 1930s — and stood at 4.9 percent in October 2021, compared with 3.5 percent in February 2020. That official unemployment rate, moreover, understated job losses.

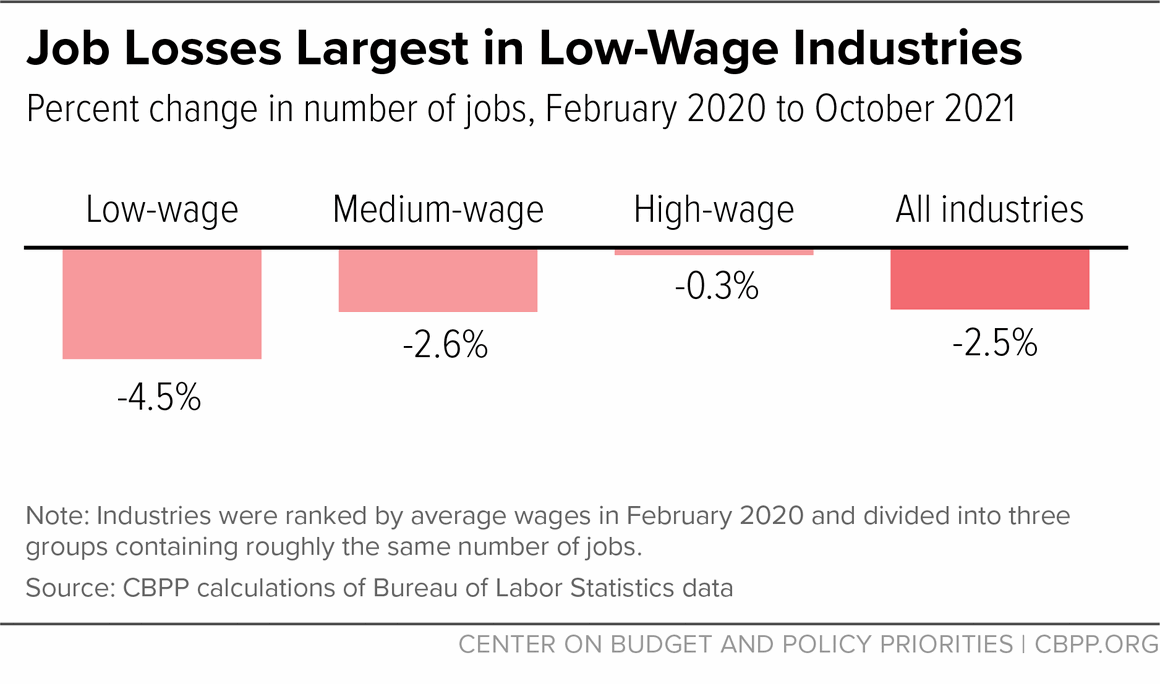

There were still 4.2 million fewer jobs in October 2021 than in February 2020. The majority of jobs lost in the crisis have been in industries that pay low average wages, with the lowest-paying industries accounting for 30 percent of all jobs but 59 percent of the jobs lost from February 2020 to October 2021, according to Labor Department employment data. Jobs were down nearly twice as much in low-paying industries (4.5 percent) as in medium-wage industries (2.6 percent) and roughly 15 times as much as in high-wage industries (0.3 percent) during this period. (See Figure 11.)

Black and Latino workers have experienced a far slower jobs recovery than white workers — reflecting historical patterns rooted in structural racism.[12] Some 7.9 percent of Black workers and 5.9 percent of Latino workers were unemployed in October 2021, compared to 4.0 percent of white workers. Workers who were born outside the U.S. (this includes individuals who are now U.S. citizens) have experienced larger job losses than U.S.-born workers.

Data from the Census Bureau’s basic monthly Current Population Survey released November 10, 2021, provided more detail on unemployed workers and their family members. Some 17.9 million people either met the official definition of unemployed (meaning they had actively looked for work in the last four weeks or were on temporary layoff) or lived with an unemployed family member in October. This figure included 4.4 million children.

The official definition of unemployed leaves out many workers deprived of pay amid the pandemic,[13] including some 1.3 million workers in October 2021 who reported they did not look for work because of the pandemic, according to the Labor Department. The official definition also omitted some 200,000 workers who reported that they had a job but that they were absent from work without pay and lost pay in the last four weeks “because their employer closed or lost business due to the coronavirus pandemic,” according to our calculations.

When family members were considered, some 21.3 million people in October 2021, including 5.3 million children, lived in a family where at least one adult did not have paid work in the last week because of unemployment or the pandemic, we estimated.

During 2021, a large share of people getting jobless benefits only qualified because of the temporary eligibility expansions enacted in response to the pandemic. Permanent reforms are needed to fix an underlying system in which too many unemployed workers get inadequate benefits or no benefits at all.[14]

State-by-State Food, Housing, and Employment Hardship Data

Data by state show that hardship was widespread in the fall of 2021. The following tables provide state-level data on:

- the share of adults reporting that their household didn’t have enough to eat (Table 1);

- the share of adults saying children in their household were not eating enough because they couldn’t afford enough (Table 1);

- the share of adults not caught up on rent (Table 2);

- the share of adults saying their household had difficulty paying for their usual expenses (Table 3); and

- the three-month moving average unemployment rate and recent jobless claim data (Table 4).

For data from the Pulse Survey, we averaged data collected September 15-27, 2021 and September 29–October 11, 2021 to improve the accuracy of the state estimates.

Differences in Pulse hardship rates between states may reflect sampling error, so we suggest not drawing strong conclusions from modest differences between states. The data do show, however, that high levels of hardship remained widespread across the country.

Difficulty Getting Enough Food

The Pulse Survey asks adult respondents if their household did not have enough to eat and if children in the household were not eating enough because the household couldn’t afford it.

| TABLE 1 | ||||

|---|---|---|---|---|

| High Shares of Households Report Difficulty Getting Enough Food | ||||

|

Among adults; data collected September 15–October 11, 2021. How to read this table: In the U.S., some 20 million adults reported that their household sometimes or often didn’t have enough to eat in the last seven days. This represented 9 percent of all adults in the country. Some 9 million adults living with children reported that “the children were not eating enough because we just couldn’t afford enough food.” This represented 12 percent of adults living with children. |

||||

| Adults Reporting That Household Didn’t Have Enough to Eat | Adults Reporting That Children in Household Weren’t Eating Enough Because Household Couldn’t Afford Enough | |||

| State | Number | As a Percent of Adults | Number | As a Percent of Adults Living with Children |

| United States | 20,008,000 | 9% | 9,346,000 | 12% |

| Alabama | 341,000 | 11% | 163,000 | 15% |

| Alaska | 53,000 | 11% | 15,000 | 8% |

| Arizona | 410,000 | 8% | 235,000 | 12% |

| Arkansas | 196,000 | 10% | 95,000 | 13% |

| California | 2,424,000 | 10% | 1,180,000 | 13% |

| Colorado | 263,000 | 7% | 128,000 | 10% |

| Connecticut | 183,000 | 8% | 90,000 | 11% |

| Delaware | 87,000 | 13% | 29,000 | 12% |

| District of Columbia | 40,000 | 8% | 23,000 | 15% |

| Florida | 1,610,000 | 11% | 613,000 | 12% |

| Georgia | 897,000 | 13% | 507,000 | 18% |

| Hawai’i | 100,000 | 11% | 68,000 | 19% |

| Idaho | 81,000 | 7% | 35,000 | 8% |

| Illinois | 621,000 | 8% | 406,000 | 15% |

| Indiana | 397,000 | 9% | 132,000 | 9% |

| Iowa | 181,000 | 9% | 47,000 | 7% |

| Kansas | 187,000 | 10% | 59,000 | 9% |

| Kentucky | 313,000 | 11% | 109,000 | 11% |

| Louisiana | 414,000 | 14% | 213,000 | 19% |

| Maine | 64,000 | 7% | 19,000 | 6% |

| Maryland | 312,000 | 8% | 213,000 | 14% |

| Massachusetts | 371,000 | 8% | 119,000 | 8% |

| Michigan | 534,000 | 8% | 273,000 | 12% |

| Minnesota | 198,000 | 5% | 132,000 | 10% |

| Mississippi | 253,000 | 14% | 112,000 | 16% |

| Missouri | 418,000 | 10% | 124,000 | 9% |

| Montana | 58,000 | 8% | 23,000 | 10% |

| Nebraska | 74,000 | 6% | 42,000 | 9% |

| Nevada | 143,000 | 7% | 102,000 | 13% |

| New Hampshire | 57,000 | 6% | 28,000 | 9% |

| New Jersey | 464,000 | 8% | 291,000 | 14% |

| New Mexico | 132,000 | 9% | 52,000 | 10% |

| New York | 1,400,000 | 12% | 628,000 | 15% |

| North Carolina | 698,000 | 10% | 321,000 | 13% |

| North Dakota | 39,000 | 8% | 17,000 | 8% |

| Ohio | 587,000 | 8% | 224,000 | 8% |

| Oklahoma | 347,000 | 13% | 147,000 | 15% |

| Oregon | 266,000 | 9% | 84,000 | 8% |

| Pennsylvania | 656,000 | 8% | 305,000 | 11% |

| Rhode Island | 63,000 | 9% | 32,000 | 13% |

| South Carolina | 308,000 | 9% | 123,000 | 11% |

| South Dakota | 45,000 | 8% | 25,000 | 12% |

| Tennessee | 426,000 | 10% | 168,000 | 11% |

| Texas | 2,079,000 | 12% | 1,145,000 | 17% |

| Utah | 151,000 | 7% | 47,000 | 6% |

| Vermont | 20,000 | 5% | 7,000 | 6% |

| Virginia | 336,000 | 6% | 144,000 | 8% |

| Washington | 405,000 | 8% | 146,000 | 8% |

| West Virginia | 108,000 | 9% | 31,000 | 8% |

| Wisconsin | 177,000 | 5% | 70,000 | 6% |

| Wyoming | 22,000 | 6% | 8,000 | 5% |

Not Caught Up on Rent

Table 2 shows the estimated number of adults whose household was not caught up on rent by state. The Pulse data likely understated the number of people struggling to pay rent because many respondents skipped questions toward the end of the survey, including the housing questions. This “non-response” was higher among groups that are younger, have lower levels of education, and identify as Black or Latino — groups that are more likely to struggle to afford rent, due to long-standing inequities often stemming from structural racism in education, employment, and housing.

| TABLE 2 | ||

|---|---|---|

| One in 6 Renters Nationwide Were Not Caught Up on Rent Among adults in rental housing; data collected September 15–October 11, 2021 |

||

| Not Caught Up on Rent | ||

| Estimated Number | Percent | |

| Alabama | 150,000 | 17% |

| Alaska | 20,000 | 13% |

| Arizona | 159,000 | 9% |

| Arkansas | 101,000 | 16% |

| California | 1,557,000 | 13% |

| Colorado | 106,000 | 8% |

| Connecticut | 118,000 | 15% |

| Delaware | 52,000 | 28% |

| District of Columbia | 39,000 | 13% |

| Florida | 912,000 | 18% |

| Georgia | 542,000 | 23% |

| Hawai’i | 41,000 | 11% |

| Idaho | 21,000 | 7% |

| Illinois | 463,000 | 17% |

| Indiana | 187,000 | 15% |

| Iowa | 91,000 | 16% |

| Kansas | 44,000 | 7% |

| Kentucky | 192,000 | 22% |

| Louisiana | 163,000 | 18% |

| Maine | 28,000 | 12% |

| Maryland | 265,000 | 20% |

| Massachusetts | 188,000 | 11% |

| Michigan | 241,000 | 14% |

| Minnesota | 115,000 | 12% |

| Mississippi | 111,000 | 20% |

| Missouri | 137,000 | 11% |

| Montana | 16,000 | 8% |

| Nebraska | 53,000 | 13% |

| Nevada | 79,000 | 9% |

| New Hampshire | 26,000 | 11% |

| New Jersey | 328,000 | 15% |

| New Mexico | 99,000 | 24% |

| New York | 1,257,000 | 21% |

| North Carolina | 397,000 | 17% |

| North Dakota | 15,000 | 8% |

| Ohio | 329,000 | 13% |

| Oklahoma | 202,000 | 24% |

| Oregon | 123,000 | 12% |

| Pennsylvania | 274,000 | 11% |

| Rhode Island | 71,000 | 28% |

| South Carolina | 180,000 | 19% |

| South Dakota | 29,000 | 18% |

| Tennessee | 202,000 | 14% |

| Texas | 1,401,000 | 21% |

| Utah | 31,000 | 6% |

| Vermont | 8,000 | 7% |

| Virginia | 213,000 | 11% |

| Washington | 178,000 | 9% |

| West Virginia | 32,000 | 12% |

| Wisconsin | 125,000 | 10% |

| Wyoming | 8,000 | 8% |

Difficulty Covering Usual Household Expenses

The Pulse survey asks adult respondents if their household had difficulty paying for usual expenses such as food, rent or mortgage, car payments, medical expenses, or student loans in the last seven days. Table 3 shows the estimated number and percent of adults reporting that it was somewhat or very difficult for their household to pay for their usual expenses in the last seven days.

| TABLE 3 | ||

|---|---|---|

| Over 1 in 4 Adults Nationwide Had Difficulty Covering Usual Household Expenses Among adults; data collected September 15–October 11, 2021 |

||

| Difficulty Covering Usual Household Expenses | ||

| Number | Percent | |

| United States | 62,845,000 | 28% |

| Alabama | 1,046,000 | 33% |

| Alaska | 150,000 | 31% |

| Arizona | 1,476,000 | 29% |

| Arkansas | 674,000 | 34% |

| California | 7,970,000 | 30% |

| Colorado | 963,000 | 24% |

| Connecticut | 646,000 | 26% |

| Delaware | 221,000 | 31% |

| District of Columbia | 119,000 | 24% |

| Florida | 4,852,000 | 32% |

| Georgia | 2,308,000 | 33% |

| Hawai’i | 304,000 | 31% |

| Idaho | 271,000 | 22% |

| Illinois | 2,142,000 | 26% |

| Indiana | 1,155,000 | 26% |

| Iowa | 489,000 | 23% |

| Kansas | 451,000 | 23% |

| Kentucky | 822,000 | 28% |

| Louisiana | 1,100,000 | 37% |

| Maine | 239,000 | 24% |

| Maryland | 1,142,000 | 28% |

| Massachusetts | 1,173,000 | 25% |

| Michigan | 1,757,000 | 27% |

| Minnesota | 651,000 | 17% |

| Mississippi | 723,000 | 38% |

| Missouri | 1,231,000 | 29% |

| Montana | 207,000 | 27% |

| Nebraska | 303,000 | 23% |

| Nevada | 622,000 | 28% |

| New Hampshire | 202,000 | 21% |

| New Jersey | 1,667,000 | 29% |

| New Mexico | 438,000 | 30% |

| New York | 3,793,000 | 30% |

| North Carolina | 2,072,000 | 29% |

| North Dakota | 102,000 | 20% |

| Ohio | 1,815,000 | 23% |

| Oklahoma | 958,000 | 36% |

| Oregon | 813,000 | 27% |

| Pennsylvania | 2,319,000 | 26% |

| Rhode Island | 210,000 | 29% |

| South Carolina | 980,000 | 29% |

| South Dakota | 143,000 | 25% |

| Tennessee | 1,465,000 | 32% |

| Texas | 6,095,000 | 32% |

| Utah | 493,000 | 23% |

| Vermont | 72,000 | 16% |

| Virginia | 1,477,000 | 26% |

| Washington | 1,244,000 | 23% |

| West Virginia | 347,000 | 29% |

| Wisconsin | 825,000 | 21% |

| Wyoming | 106,000 | 27% |

Unemployment

Table 4 provides state-by-state data on the unemployment rate over the August–October 2021 period and data on unemployment benefit claims.

| TABLE 4 | ||

|---|---|---|

| Unemployment, Jobless Claims Remained Elevated Across Most of the Country | ||

| States | Unemployment rate (August–October average)a | Jobless benefits claims for week ending October 30b |

| Alabama | 3.1 | 7,000 |

| Alaska | 6.3 | 7,000 |

| Arizona | 5.7 | 21,000 |

| Arkansas | 4.0 | 14,000 |

| California | 7.4 | 1,265,000 |

| Colorado | 5.6 | 24,000 |

| Connecticut | 6.8 | 24,000 |

| Delaware | 5.3 | 5,000 |

| District of Columbia | 6.4 | 20,000 |

| Florida | 4.8 | 53,000 |

| Georgia | 3.3 | 45,000 |

| Hawai’i | 6.6 | 14,000 |

| Idaho | 2.9 | 3,000 |

| Illinois | 6.6 | 134,000 |

| Indiana | 3.8 | 38,000 |

| Iowa | 4.0 | 10,000 |

| Kansas | 3.9 | 7,000 |

| Kentucky | 4.3 | 18,000 |

| Louisiana | 5.8 | 24,000 |

| Maine | 4.9 | 5,000 |

| Maryland | 5.8 | 40,000 |

| Massachusetts | 5.2 | 56,000 |

| Michigan | 5.1 | 52,000 |

| Minnesota | 3.7 | 43,000 |

| Mississippi | 5.8 | 7,000 |

| Missouri | 3.8 | 21,000 |

| Montana | 3.3 | 4,000 |

| Nebraska | 2.0 | 3,000 |

| Nevada | 7.5 | 26,000 |

| New Hampshire | 2.9 | 3,000 |

| New Jersey | 7.1 | 124,000 |

| New Mexico | 6.9 | 12,000 |

| New York | 7.1 | 214,000 |

| North Carolina | 4.2 | 26,000 |

| North Dakota | 3.5 | 1,000 |

| Ohio | 5.3 | 65,000 |

| Oklahoma | 3.0 | 15,000 |

| Oregon | 4.7 | 35,000 |

| Pennsylvania | 6.2 | 107,000 |

| Puerto Rico | 8.2 | 36,000 |

| Rhode Island | 5.5 | 8,000 |

| South Carolina | 4.1 | 13,000 |

| South Dakota | 2.9 | 1,000 |

| Tennessee | 4.4 | 23,000 |

| Texas | 5.6 | 130,000 |

| Utah | 2.4 | 6,000 |

| Vermont | 2.9 | 2,000 |

| Virgin Islands | 9.3 | 1,000 |

| Virginia | 3.8 | 115,000 |

| Washington | 5.0 | 50,000 |

| West Virginia | 4.6 | 7,000 |

| Wisconsin | 3.7 | 29,000 |

| Wyoming | 4.5 | 2,000 |

| United States | 4.9 | 3,017,000 |

End Notes

[1] Federal surveys generally ask respondents whether they are “of Hispanic, Latino, or Spanish origin.” This report uses the term “Latino.”

[2] Claire Zippel and Arloc Sherman, “Bolstering Family Income Is Essential to Helping Children Emerge Successfully From the Current Crisis,” CBPP, updated February 25, 2021, https://www.cbpp.org/research/poverty-and-inequality/bolstering-family-income-is-essential-to-helping-children-emerge.

[3] According to annual food insecurity data from the December 2020 Food Security Supplement of the Current Population Survey (CPS-FSS), 10.5 percent of U.S. households were food insecure in 2020. While the overall prevalence of food insecurity was unchanged from 2019, it increased for households with children and Black households. The number of individuals in food-insecure households also increased by 3 million, from 35.2 million in 2019 to 38.3 million in 2020. The CPS-FSS includes a measure of food insecurity, based on ten to 18 questions about conditions and behaviors related to difficulty meeting food needs. This measure is different from the food insufficiency measure in the Household Pulse Survey, which is based on a single question about the household having enough food to eat in the past seven days. While the food insecurity figures from the CPS-FSS appear to show lower rates of food hardship during 2020 than the Household Pulse Survey, more research is needed to assess the impact of differences in reference periods, mode of data collection, response rates, and other factors on reported food hardship. See Alisha Coleman-Jensen et al., “Household Food Security in the United States in 2020,” U.S. Department of Agriculture, September 2021, https://www.ers.usda.gov/publications/pub-details/?pubid=102075.

[4] Claire Zippel, “After Child Tax Credit Payments Begin, Many More Families Have Enough to Eat,” CBPP, August 30, 2021, https://www.cbpp.org/blog/after-child-tax-credit-payments-begin-many-more-families-have-enough-to-eat.

[5] The Pulse Survey does not provide data for these groups individually.

[6] U.S. Department of the Treasury, “November Emergency Rental Assistance Program Interim Report,” January 7, 2021, https://home.treasury.gov/system/files/136/November-ERA-Data.xlsx.

[7] In Pulse survey data collected September 29–October 11, 2021, 8.4 million adults lived in households not caught up on rent. To adjust for non-response in the survey, we applied the share not caught up on rent (16.5 percent) to the total number of adult renters (73 million) in the March 2020 Current Population Survey to calculate an adjusted estimate.

[8] In Pulse survey data collected September 29–October 11, 2021, 6.5 million adults were in households not caught up on their mortgage. To adjust for non-response in the survey, we applied the share not caught up on their mortgage (7.5 percent) to the total number of adult homeowners (about 100 million) in the March 2020 Current Population Survey to calculate an adjusted estimate.

[9] Ajay Chaudry and Christopher Wimer, “Poverty is Not Just an Indicator: The Relationship Between Income, Poverty, and Child Well-Being,” Academic Pediatrics, Vol. 16, Issue 3, April 1, 2016, https://www.academicpedsjnl.net/article/S1876-2859(15)00383-6/fulltext.

[10] Starting in mid-April 2021, the Pulse survey asks respondents whether they have difficulty seeing, hearing, remembering or concentrating, or walking or climbing stairs. In this report, adults with a disability are those who reported “a lot of difficulty” with, or “could not do at all”, one or more of these four activities. This definition, like others, may not accurately reflect the identities and experiences of all disabled people.

[11] Starting in late July 2021, the Pulse survey asks respondents about their sex assigned at birth, gender identity, and sexual orientation. The Census Bureau categorizes Pulse respondents as LGBT if they identify as gay, bisexual, transgender, or as having a gender identity that doesn’t align with the sex they were assigned at birth. Respondents whose sex at birth aligns with their gender identity and who identify as straight are categorized as non-LGBT.

[12] Chad Stone, “Robust Unemployment Insurance, Other Relief Needed to Mitigate Racial and Ethnic Unemployment Disparities,” CBPP, August 5, 2020, https://www.cbpp.org/research/economy/robust-unemployment-insurance-other-relief-needed-to-mitigate-racial-and-ethnic.

[13] Many analysts reach a similar conclusion using a slightly different approach, noting that the official unemployment rate is too low because it omits workers who have exited the labor force in the last 12 months and are no longer looking for work, and because it ignores workers whom the Labor Department says are improperly classified as employed in its survey data but are in fact absent from work. When these two factors are corrected using an approach recommended by Federal Reserve Chair Jerome Powell, the unemployment rate for October 2021 could be as high as 7.2 percent. Jerome H. Powell, “Recent Economic Developments and the Challenges Ahead,” speech at the National Association for Business Economics Virtual Annual Meeting, October 6, 2020, https://www.federalreserve.gov/newsevents/speech/powell20201006a.htm.

[14] Chad Stone, “Congress Should Heed President Biden’s Call for Fundamental UI Reform,” CBPP, May 5, 2021, https://www.cbpp.org/research/economy/congress-should-heed-president-bidens-call-for-fundamental-ui-reform.