More Funds Needed to Avert Housing Voucher Cuts as COVID-Related Job Losses Increase Costs

As policymakers negotiate fiscal year 2021 spending and COVID relief, they must address a significant funding shortfall in the nation’s largest rental assistance program, the Housing Choice Voucher program.[1] The COVID-19-related economic recession has caused a sharp drop in the incomes of families using housing vouchers, which in turn is driving up voucher subsidy costs. To cover these costs and avert substantial cuts in the number of housing vouchers available to low-income families in 2021, policymakers should provide at least $600 million in supplemental renewal funds for housing vouchers in the forthcoming spending package. (These funds are in addition to the $22.9 billion in voucher renewal funds that the House and Senate appropriations committees included in their respective fiscal year 2021 spending bills for the Department of Housing and Urban Development (HUD).)

"If policymakers fail to provide these additional funds, as many as 50,000 housing vouchers currently used by low-income households will not receive renewal funding next year."If policymakers fail to provide these additional funds, as many as 50,000 housing vouchers currently used by low-income households will not receive renewal funding next year, causing a substantial drop in rental aid for families, seniors, and others at time when millions are struggling to pay rent and remain stably housed during the pandemic.

To be sure, addressing the shortfall in housing voucher renewal funding is only one of many urgent actions that policymakers should take in coming weeks. Because millions of people continue to experience severe hardship as they struggle to pay rent and remain safely in their homes during the pandemic, it is essential that policymakers substantially expand rental assistance (as well as provide additional unemployment benefits, food assistance, and other measures) in year-end legislation.[2] This includes aid for people who are homeless as well as for those with very low incomes who have fallen behind on rent and are at risk of eviction and homelessness when the Centers for Disease Control and Prevention eviction moratorium expires on December 31.[3] The robust housing assistance provisions included in both House-passed versions of the Heroes Act — which include substantial resources to provide families at risk of eviction or homelessness with temporary or longer-term rental assistance, to help communities to safely re-house people who are living on the streets or in congregate shelters, and to protect renters who have fallen behind on their rent from eviction during the pandemic — provide a strong starting point for negotiations.

Job Losses Driving Sharp Increase in Cost of Existing Housing Vouchers

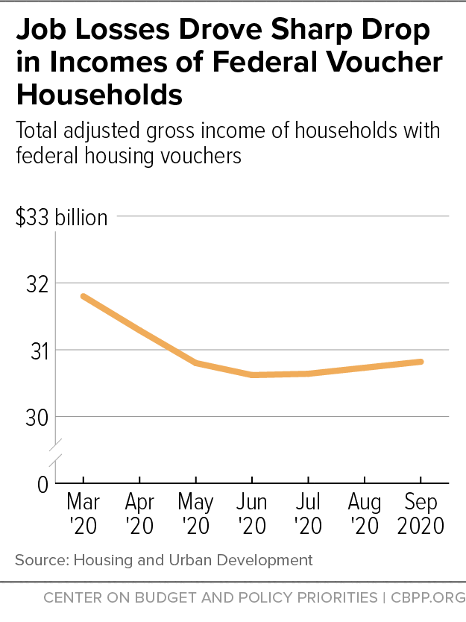

The steep job losses caused by COVID-19 have fallen disproportionately on people who work in low-paid industries. Not surprisingly, these losses have affected many of the working families that use Housing Choice Vouchers to afford their rent. (About 30 percent of households using vouchers are working families; most of the remainder are households headed by people who are elderly or have disabilities.) From March to June, total adjusted gross income of voucher-assisted households fell by $1.2 billion (3.7 percent). (See Figure 1.) Tenant incomes recovered somewhat in the subsequent three months — most likely because more households received unemployment benefits, HUD data suggest — but remained $1.0 billion below the March level as of September.

Declines in household income increase voucher subsidy costs. Households with housing vouchers typically pay 30 percent of their income for rental costs, and the voucher subsidy fills the gap between their contribution and the rent, within reasonable limits set by HUD and the local housing agency. When voucher households experience income losses, they can request a proportional adjustment in their rent to ensure that it remains affordable to them. The voucher subsidy rises automatically to fill the gap created by a reduction in tenant rent.

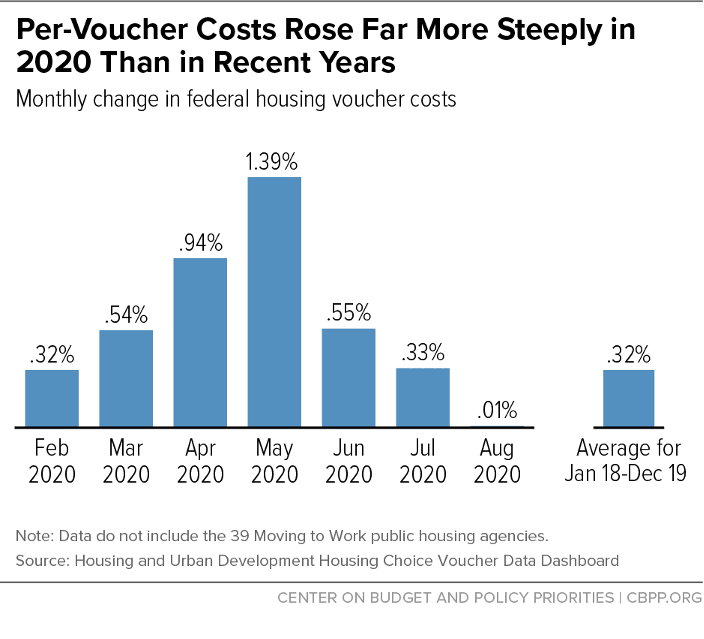

The resulting increase in voucher costs is clearly visible in recent HUD per-voucher cost data. (See Figure 2.) Per-voucher subsidy costs rose sharply from February to June, particularly in April and May, when large numbers of people lost their jobs. Over the four-month period ending in June, per-voucher costs rose 3.4 percent or nearly 1 percent per month. This rate of increase is unusually steep — equivalent to an annualized rate of more than 10 percent, and more than 2.5 times the average monthly rate of change in per-voucher costs through all of 2018 and 2019.

Additional Funding Needed to Avert Housing Voucher Cuts

We estimate that to maintain current voucher levels, the COVID-related spike in voucher subsidy costs will increase total program costs by about $350 million in 2020 and close to an additional $600 million in 2021. These estimates are based on actual program spending data through August, as well as projections of likely spending (based in part on projections of per-voucher costs) for the remaining four months of 2020 and the entirety of 2021.[4] Fortunately, the CARES Act of March included $400 million in supplemental funding for housing voucher subsidies, which will likely be enough to cover the 2020 gap caused by COVID-related income declines, although more may be needed if our projections for the remainder of this year turn out to be too optimistic.

However, policymakers should provide at least $600 million in additional funds to ensure that housing vouchers will be fully renewed in 2021. For nearly all housing agencies, voucher renewal funding eligibility in 2021 will be based on their actual voucher costs in 2020, adjusted for likely inflation in the coming year. So COVID-related cost increases affect 2021 renewal funding eligibility in two ways: first, the 2020 cost basis used in the renewal formula will be much higher (by roughly $400 million) than it otherwise would have been; and, second, cost inflation is also likely to be higher due to weakness in tenant income growth. (We estimate that per-voucher cost inflation will be 1 to 2 percentage points higher in 2021 because of continuing weakness in tenant incomes.)

Both the House and Senate COVID relief bills (the Heroes Act and HEALS Act, respectively) include substantial supplemental funding for voucher subsidies, more than enough to cover the additional 2021 costs we have identified. However, the House and Senate appropriations committees did not include funding for these costs in their draft fiscal year 2021 HUD funding bills. The House and Senate HUD 2021 funding bills provide $22.85 billion and $22.89 billion for voucher renewals, respectively, about $580 million and $540 million less than will be needed after accounting for the COVID-related cost increases.

It does not matter which vehicle policymakers use to address the voucher funding shortfall, but the timing of the appropriation does matter. Specifically, whenever policymakers enact a final fiscal year 2021 HUD funding bill, they must approve sufficient funding to renew all housing vouchers either within the bill itself or in combination with additional funding provided in a COVID relief package that is adopted at the same time. Delaying action to provide supplemental voucher funding until next year will have harmful consequences. State and local housing agencies typically receive their renewal funding allocations within 60 days of the enactment of the final fiscal year HUD funding bill. If agencies receive significantly less than the amount for which they are eligible under the HUD renewal formula, many will immediately begin to reduce the number of households they assist (by not reissuing vouchers when families exit the program). While agencies could restore these vouchers to use if they later received supplemental funds, a significant number of needy households will have gone without assistance in the intervening months, an unacceptable outcome in the current economic and health crisis.

If policymakers fail to provide the additional voucher renewal funds needed, the consequences will be severe: approximately 50,000 housing vouchers that families are currently using would not receive renewal funding in 2021. The result would be a sharp drop in the number of families receiving aid at a time when millions of low-income households are struggling to pay rent and remain stably housed during the pandemic.

Tracking the COVID-19 Economy’s Effects on Food, Housing, and Employment Hardships

End Notes

[1] For background on the Housing Choice Voucher program, see “Policy Basics: The Housing Choice Voucher Program,” CBPP, May 3, 2017, https://www.cbpp.org/research/housing/policy-basics-the-housing-choice-voucher-program.

[2] CBPP, “Tracking the COVID-19 Recession’s Effects on Food, Housing, and Employment Hardships,”, updated November 20, 2020, https://www.cbpp.org/research/poverty-and-inequality/tracking-the-covid-19-recessions-effects-on-food-housing-and.

[3] Peggy Bailey and Douglas Rice, “Pandemic Relief Must Include Comprehensive Housing Assistance for People Experiencing the Most Severe Hardship,” CBPP, July 27, 2020, https://www.cbpp.org/research/housing/pandemic-relief-must-include-comprehensive-housing-assistance-for-people.

[4] These estimates assume that per-voucher costs will rise at a rate of 5.4 percent for the remainder of 2020 and through 2021. This rate is somewhat higher than pre-COVID-19 rates of inflation, but well below the rate of increase from February through August of this year.

More from the Authors