- Home

- Options To Reduce State Medicaid Costs: ...

Options to Reduce State Medicaid Costs: Managed Care Medical Loss Ratio

Health plans’ spending on services has declined significantly during the COVID-19 pandemic as many enrollees delay non-urgent care, resulting in significant overpayments. As states seek cost-saving options to address their substantial budget shortfalls due to the COVID-19 economic crisis, they should consider options to recoup these overpayments rather than cut benefits or provider reimbursement rates, which could harm enrollees by reducing access to care.

One way states can do this is to require managed care plans to repay the state if they don’t meet a “medical loss ratio” (MLR) — a certain percentage of premium revenue that insurers must spend on health care services rather than administrative costs and profits. Federal regulations require states to set plans’ rates so that they are expected to meet an MLR of 85 percent for plan years starting in 2019. Yet most states don’t require plans to send back (or “remit”) overpayments if they fail to meet the MLR.

What Is Medicaid Managed Care?

Nearly all states contract with managed care plans to provide some or all covered benefits to some or all enrollees, with the state paying the plan a set monthly amount per enrollee (called a capitation payment) to cover the cost of those benefits plus the plan’s administrative costs. Under this arrangement, managed care plans profit when they keep their costs within their capitation payments and suffer a loss when they don’t.

Nationally, over two-thirds of Medicaid beneficiaries received most or all covered benefits through managed care in 2017. About 45 percent of Medicaid spending goes to managed care plans.

What Federal Medicaid Funds Do States Receive?

The federal government contributes at least $1 in matching funds for every $1 a state spends on Medicaid. The fixed percentage the federal government pays a state, known as the federal medical assistance percentage (FMAP), depends on state income levels and ranges from 50 percent to 78 percent.

The federal government pays a higher matching rate of 90 percent for services provided to individuals covered by the Affordable Care Act’s Medicaid expansion.

What Medical Loss Ratio Requirements Must Plans Meet?

Federal law requires large-group commercial health plans to maintain an MLR of 85 percent, meaning that they must spend at least 85 percent of the money they collect in premiums on health care services. If they fail to meet the 85 percent MLR, insurers must provide rebates to their customers to make up the difference. (Commercial health plans in the small-group and individual markets must meet an 80 percent MLR, with similar rebate requirements.)

Federal regulations finalized in 2016 require Medicaid managed care plans to calculate and report their MLR to the state annually for contracts that take effect on or after July 1, 2017. An MLR reporting requirement encourages plans to keep their administrative costs low and gives states important information to help them set appropriate rates for the plans.

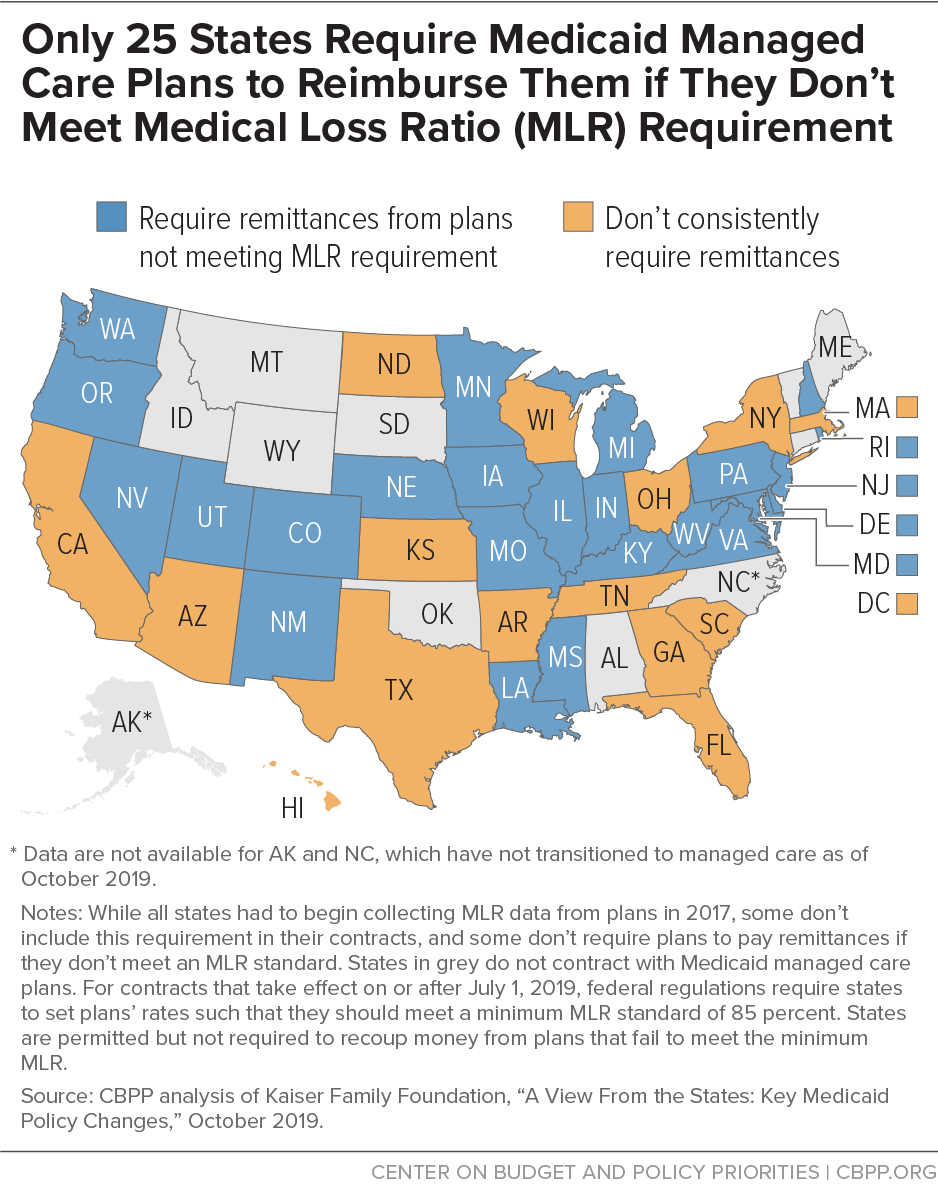

States are permitted but not required to include an MLR in their contracts with plans and recoup money from plans that fail to meet the minimum MLR. If a state sets such an MLR target, it must be at least 85 percent. For managed care plan years beginning July 1, 2019, federal regulations require states to set capitation rates in such a way that the plan is expected to meet an 85 percent MLR. However, only 25 states currently include a minimum MLR in their contracts and require the plans to provide remittances if they fail to meet the state’s MLR (see map), though some states have adopted other cost-control strategies, such as profit caps for managed care plans.

How Can States Obtain Savings?

Before considering Medicaid cuts that would likely harm beneficiaries, states should explore options to recoup overpayments to their managed care plans to help address their budget shortfalls. All states that contract with managed care plans to serve Medicaid beneficiaries should require that plans meet the minimum annual MLR of at least 85 percent in their contracts and require plans that miss that threshold to remit the difference to the state.

In 2018 Congress created an additional incentive for expansion states to take this step. Generally, states must share MLR remittances with the federal government at the rate that the state’s Medicaid program is funded, so until recently, they had to share remittances for the expansion population at the enhanced FMAP that applies to the expansion group. However, the 2018 Support Act allows states to share MLR remittances for the expansion population at the state’s regular FMAP, rather than the higher expansion FMAP. This should generate substantial savings in expansion states with mandatory remittances.

For example, New Hampshire’s FMAP is 50 percent. Without the Support Act, if New Hampshire required remittances, it could keep 50 percent of the remittances for its traditional Medicaid population in 2020 but only 10 percent of remittances for the expansion population (since the federal match for expansion enrollees is 90 percent). With the Support Act, it can keep 50 percent of all remittances.

States that do not currently require remittances can implement them mid-year by amending their managed care plan contracts. However, the Centers for Medicare & Medicaid Services must approve these updated contracts before states can finalize them. States can also consider other risk mitigation strategies and options for recouping overpayments to managed care plans. And all states should regularly audit their managed care plans to ensure that they are accurately calculating their MLRs.