- Home

- Cassidy-Graham’s Dramatic Funding Cliff ...

Cassidy-Graham’s Dramatic Funding Cliff Not Required by Budget Rules and Would Have Lasting, Negative Impact

David Kamin[1] and Richard Kogan

Senators Bill Cassidy and Lindsey Graham, along with co-sponsors Dean Heller and Ron Johnson, recently introduced a revised version of their legislation to repeal and replace the Affordable Care Act (ACA) and are pushing to enact it by the end of the month. The bill block-grants and sharply cuts funding for health coverage starting in 2020 and those cuts grow dramatically in 2027. Their bill block-grants and sharply cuts funding for health coverage starting in 2020,[2] and those cuts, already large, grow dramatically in 2027, when the block grant ends entirely.[3] The result, at that point, is larger cuts than in the previous bill adopting a “repeal-without-replace” approach — a bill that would ultimately cause 32 million more Americans to be uninsured, according to the Congressional Budget Office (CBO).

The bill’s sponsors have made two claims in defending the 2027 cliff. First, they have suggested that the cliff is necessary due to the reconciliation budget procedure they are trying to use to enact the legislation. Second, they have suggested that the cliff is unimportant since it is not their intended result and policymakers will reverse it in a later reauthorization. The first claim is false, the second highly misleading:

- There are no procedural barriers to making the block grant in Cassidy-Graham permanent. Reconciliation procedures require only that the legislation not add to the deficit after the end of the budget window in 2026, relative to existing law. Cassidy-Graham meets that requirement, since its cuts to health care funding are deeper than its tax cuts, whether or not the block grant continues.

- The uncertainty created by the cliff would likely affect health coverage and quality of care before 2027. Even if the 2027 cliff were eventually reversed, the substantial uncertainty it would create would likely affect states, as well as millions of Americans’ choice of health plans and their costs, as 2027 approached. Some states would likely be deterred from implementing new coverage expansion programs and instead use block grant funds for other health care purposes (or keep them very restrictive) due to the looming end of the block grant. Moreover, as we are finding now, uncertainty in insurance markets can cause insurers to raise prices or drop out. With the default level of block-grant funding set at zero starting in 2027, insurance markets for individuals would likely have fewer participating insurers and higher costs for consumers in the years before then, simply due to the massive uncertainty of what would happen starting in 2027. Health care providers, too, may hold back on hiring and investment until they know whether many patients could afford care in the future, undermining the quality of care in the present.

-

The cliff could constrain later congressional action and lead to much lower funding (if any is provided). Finally, the 2027 cliff would very likely result in a budget baseline that has no funding for the ACA’s health coverage expansion going forward. If the baseline had no funding whatsoever for the expansion, legislation to continue funding for the block grant would appear in budget estimates as an entirely new cost that would need to be entirely offset under budget rules. However, it would not be a new cost. Further, the ACA already more than fully paid for the costs of the coverage expansions on a permanent basis — and Cassidy-Graham maintains most of the savings and tax increases from the ACA.

Even if the baseline assumed that the block grant continues after 2026, the amount in the baseline would be frozen in nominal dollars. That means baseline funding would grow increasingly inadequate due to growth in health costs and population. Legislation increasing the block grant in line with these factors would appear in budget estimates as a large cost increase that would need to be offset — again, even though the ACA more than paid for the coverage expansions the block-grant funding would replace.

Either outcome would likely have a lasting, negative impact on the adequacy of health funding. Given that the drafters of the legislation could easily have not made the block grant temporary, it is reasonable to conclude that they preferred to set the default as they did — with funding ending altogether and future policymakers forced to come up with hundreds of billions each year to extend it, likely leading to large cuts in block-grant funding and/or other coverage programs like Medicaid (on top of the cuts Cassidy-Graham already makes).

Finally, the funding cliff’s effect on the baseline means future budget projections would show significantly lower deficits for 2027 and thereafter, which could help justify the tax cuts that many Republicans now advocate. In this way, policymakers could essentially use health cuts to finance tax cuts, even if they are not packaged together in the same bill.

Significant Cuts Leading to Cliff

Several elements in Cassidy-Graham cut funding for health coverage:

- Starting in 2020, it would repeal the ACA’s marketplace subsidies and the Medicaid expansion and replace them with an inadequate block grant lasting only seven years, through 2026.

- It would convert Medicaid’s current federal-state financial partnership to a per capita cap, which would cap and cut federal Medicaid per-beneficiary funding for seniors, people with disabilities, and families with children.

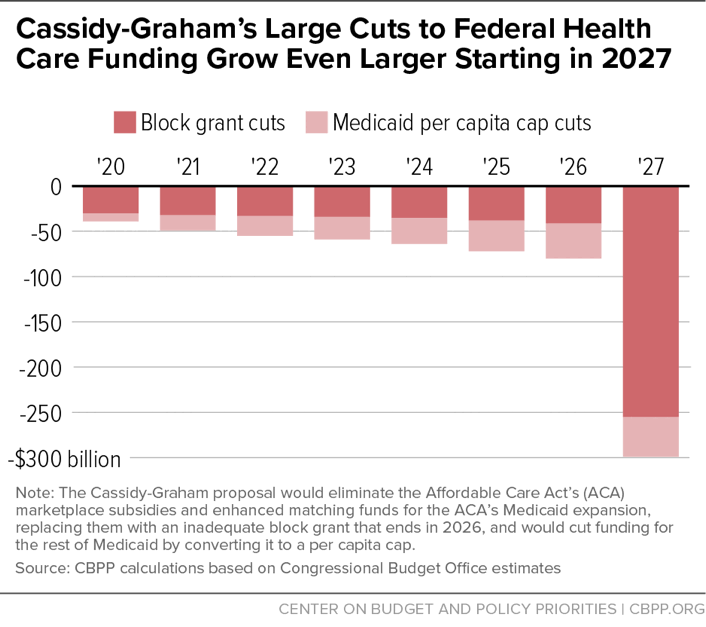

Figure 1 shows the combined effect of these two elements on funding, relative to existing law. Through 2026, they would cut funding by $418 billion. Then the cut would balloon to nearly $300 billion in 2027 alone. This is a larger cut than in the “repeal-without-replace” bill that Congress considered earlier and that CBO said would result in 32 million Americans losing coverage; that’s because Cassidy-Graham not only eliminates funding for the ACA’s health care expansion but also cuts the underlying Medicaid program through its per capita cap.

Cliff Not Required by Reconciliation Procedure

Cassidy-Graham’s sponsors have suggested that the cliff in 2027 is necessary due to the procedural requirements of the budget reconciliation process, which the Senate intends to use to give the legislation fast-track protection. However, there are in fact no such procedural barriers to providing permanent block-grant funding. And many other provisions in Cassidy-Graham — including its tax cuts and its per capita cap reducing funding for the underlying Medicaid program — are permanent.

Reconciliation requires that no reconciliation bill add to the deficit after the end of the budget window (in this case, 2026), relative to existing law — or else any senator can raise a point of order against the legislation. However, while no official CBO score is yet available, the bill’s spending cuts likely are substantially larger than its tax cuts. Thus, continuing the block grant after 2026 would still result in a bill that reduces the deficit after that point.

The sponsors of the legislation appear to be analogizing to tax cuts like those in 2001, which were enacted via reconciliation and made temporary in part due to the requirement that the bill not increase the deficit relative to existing law. But those 2001 tax cuts would have added considerably to the deficit outside the budget window (that is, after 2010) if they had continued. That’s not the case here. Cassidy-Graham would reduce projected deficits substantially even if the block grant were permanent, and much more so with the block grant expiring.

Less Coverage and Choice, Higher Prices, Lower Quality of Care Even Before 2027

The cliff’s effects would likely be felt in the years leading up to 2027. Many states would likely react to the uncertainty by restricting coverage expansions in a number of ways, knowing that the block-grant funding could disappear in six years. For instance, some states would likely establish highly restrictive programs (with enrollment caps and sharply limited eligibility and assistance) so that it would be easier to eliminate the programs in 2027. Other states would likely be encouraged to instead use the block-grant funding for other, non-coverage health purposes.

In addition, private insurers that provide coverage in the ACA’s health care exchanges would be less willing to invest resources needed to participate and compete in new exchanges if the long-term viability of those exchanges were in question.

Insurers do not make decisions on a purely year-by-year basis, as business models are often forward looking. When the ACA was created, some investors formed new insurance companies specifically to sell policies on the exchanges, and already established companies invested resources to compete. The massive uncertainty due to a default of zero funding for the block grants starting in 2027 would discourage these kinds of investments.

Providers, too, will make decisions in the coming years on investments and hiring that would likely be affected by the uncertainty that the 2027 cliff would create. Providers would not know how many people would be able to afford health care services in the future, and that would affect the kinds of decisions that affect the quality of care now.

The likely result would be a combination of less coverage, fewer insurers in insurance markets, higher prices from insurers remaining in the markets, and lower quality of care — all before 2027.

Treatment of Funding in Budget Baseline Would Inhibit Funding Extension

Cassidy-Graham’s sponsors have also suggested that policymakers will simply revisit the funding cliff later and reauthorize the block grant. But even if they do provide more funding, it could be at a much lower level. The treatment of health care expansion funding in the budget baseline could significantly constrain future funding decisions.

Specifically, the cliff means there are two bad possibilities for how the baseline treats this funding after 2026: Most likely is that Congress and the Administration assume the block grant is temporary, as the statutory language indicates. In that case, the baseline would have no further funding after 2026. Alternatively, they could assume that funding continues in the baseline but is frozen in nominal dollars at the 2026 level. Any funding extension in either scenario, however, would require further congressional action.

When it comes to expiring spending programs, the official baseline has special rules regarding the treatment of the programs that have sunset dates. Those rules state that, if an expiring mandatory spending program costs more than $50 million per year (as the Cassidy-Graham block grant would), the budget committees and the Office and Management and Budget (OMB) are to consult and jointly decide on whether to assume that the program is permanent or temporary in the baseline. Either way, Congress would need to pass a new bill at a later time in order for funding to continue. But the choice of baseline has a large effect on the estimated costs of the program at the time it is enacted and at the time Congress is trying to continue the program.

If the budget committees and OMB decided that the block grant should be treated as temporary in the baseline (given that it clearly expires as a matter of law), this would have several key implications:

-

Further extension would be treated as an entirely new cost — despite having already been fully paid for. That’s because Cassidy-Graham, when enacted, would have been understood to eliminate the block-grant funding stream. This could make it very hard for policymakers to later provide adequate funding to continue the block grant after its expiration.

For instance, statutory and Senate pay-as-you-go (PAYGO) rules would require that funding to continue the block grant at any level be fully paid for with either entitlement cuts or revenue increases, even though the health funding that the block grant replaces was already more than paid for as part of the ACA. Health care expansion funding would essentially be separated from the measures enacted in the ACA to finance the expansion, and the official budget estimates would make it appear as if any continuation would be a major new budget commitment with nothing to pay for it. The House CUTGO rule is even more restrictive than the statutory and Senate PAYGO rules; the House rule would require offsetting any continuation of the block grant after its expiration at any level by other entitlement cuts; revenue increases would not be an acceptable offset.

- Cassidy-Graham’s large cuts to health funding would result in much lower projected deficits, which could make it easier to pass tax cuts. If the baseline treats the block grant as disappearing in 2027, policymakers could essentially use the lower projected deficits for 2027 and thereafter to help justify the tax cuts that many Republicans now advocate. Tax cuts would essentially eat up the fiscal room previously reserved for health expansion funding. In this way, policymakers could use health cuts to finance tax cuts, even if they are not packaged together in the same bill.

Alternatively, if Congress and the administration treated the block grant as permanent in the baseline despite the expiration, it would be frozen at the 2026 nominal level. That is because Cassidy-Graham simply provides fixed dollar amounts, and 2026 is the last year of funding. The effects of a frozen nominal baseline would be similar to a baseline with zero funding, though not as dramatic. Any additional funding above the frozen 2026 levels needed to keep up with health cost and population growth would appear as a major new cost — even though the ACA coverage expansions that the block grant would replace have been fully paid for in the ACA.

So far, neither Congress nor the Trump Administration has indicated how Cassidy-Graham would be treated in the baseline. Given that the authors of the legislation made the explicit decision to sunset the funding (as clearly indicated in the bill language), it seems likely that they intend the baseline to follow what the law does: zero out funding after 2026. If so, extending the funding past 2026 would be scored as costing hundreds of billions per year.

Conclusion

The Cassidy-Graham cliff represents a policy choice by the bill’s drafters that would create substantial uncertainty, discourage states from using the block grant to provide coverage, and weaken health insurance markets and quality of care even before the block grant expires at the end of 2026. The cliff would also make it very difficult for future policymakers to provide adequate block-grant funding going forward. In the meantime, the appearance of lower deficits due to the cliff could further the enactment of tax cuts or other Republican legislative priorities.

Commentary: Rushed Senate Consideration of Cassidy-Graham Would Be Designed to Hide Bill’s Severe Flaws

Policy Basics

Health

End Notes

[1] David Kamin is Professor of Law at New York University School of Law.

[2] Jacob Leibenluft et al., “Like Other ACA Repeal Bills, Cassidy-Graham Plan Would Add Millions to Uninsured, Destabilize Individual Market,” Center on Budget and Policy Priorities, updated September 18, 2017, https://www.cbpp.org/research/health/like-other-aca-repeal-bills-cassidy-graham-plan-would-add-millions-to-uninsured.

[3] Edwin Park and Matt Broaddus, “Cassidy-Graham Plan’s Damaging Cuts to Health Care Funding Would Grow Dramatically in 2027,” Center on Budget and Policy Priorities, updated September 16, 2017, https://www.cbpp.org/research/health/cassidy-graham-plans-damaging-cuts-to-health-care-funding-would-grow-dramatically-in.

More from the Authors

David Kamin is Professor of Law at New York University School of Law.

Kamin was a Research Assistant with the Center from 2003 through July 2005. Kamin's focus was on federal tax and budget policy, especially with regards to the cost and impact of federal tax bills. Kamin graduated from Swarthmore College with a B.A. in Economics and Political Science. Prior to joining the Center, he worked as a Research Associate at the Committee for Economic Development focusing on federal budget policy.