Earnings Requirement Would Undermine Child Tax Credit’s Poverty-Reducing Impact While Doing Virtually Nothing to Boost Parents’ Employment

End Notes

[1] Letter from Hilary Hoynes, Diane Schanzenbach, and other economists to Senate Majority Leader Chuck Schumer et al., September 15, 2021, https://static1.squarespace.com/static/5ecd75a3c406d1318b20454d/t/6148f183c62fb147d0d25138/1632170373799/Economist+CTC+Letter+9-14-21+430pm.pdf.

[2] Irwin Garfinkel et al., “The Costs and Benefits of a Child Allowance,” Center on Poverty and Social Policy at Columbia University, Poverty and Social Policy Brief, Vol. 5, No. 1, February 18, 2021, https://static1.squarespace.com/static/5743308460b5e922a25a6dc7/t/602ec9c7ddddd01cd29430e1/1613679049611/Child-Allowance-CBA-brief-CPSP-2021.pdf.

[3] Chuck Marr, Kris Cox, and Arloc Sherman, “Recovery Package Should Permanently Include Families With Low Incomes in Full Child Tax Credit,” CBPP, September 7, 2021, https://www.cbpp.org/research/federal-tax/recovery-package-should-permanently-include-families-with-low-incomes-in-full.

[4] Ibid.

[5] National Academies of Sciences, Engineering, and Medicine, A Roadmap to Reducing Child Poverty, National Academies Press, 2019, https://www.nap.edu/catalog/25246/a-roadmap-to-reducing-child-poverty.

[6] Greg J. Duncan, Pamela A. Morris, and Chris Rodrigues, “Does money really matter? Estimating impacts of family income on young children’s achievement with data from random-assignment experiments,” Developmental Psychology, Vol. 47, No. 5, 2011, https://pubmed.ncbi.nlm.nih.gov/21688900/.

[7] Raj Chetty et al., “How Does Your Kindergarten Classroom Affect Your Earnings? Evidence from Project Star,” Quarterly Journal of Economics, Vol. 126, No. 4, November 2011, http://qje.oxfordjournals.org/content/126/4/1593.abstract.

[8] Martha J. Bailey et al., “Is the Social Safety Net a Long-Term Investment? Large-Scale Evidence from the Food Stamps Program,” National Bureau of Economic Research Working Paper 26942, April 2020, https://www.nber.org/papers/w26942; Hilary Hoynes, Diane Whitmore Schanzenbach, and Douglas Almond, “Long-Run Impacts of Childhood Access to the Safety Net,” American Economic Review, Vol. 106, No. 4, April 2016, pp. 903-934. An earlier version of the paper is at http://www.nber.org/papers/w18535.

[9] Figures in this and the following bullet are from CBPP analysis of U.S. Census Bureau Survey of Income and Program Participation data for 2014-2016. Families in this analysis are Census families (including families of the household head and unrelated sub-families) with related children under 18 and with earnings low enough to benefit from full refundability; that is, 15 percent of the annual earnings (in 2021 dollars) of the family head and spouse are below $3,600 per child under age 6 plus $3,000 per older child. Elderly families are those where the family head and spouse (if any) are age 65 or older. Family health/disability means the family head or spouse had a work-limiting disability or reported not working due to a chronic illness/disability in December 2015.

[10] Letter to Senate Majority Leader Chuck Schumer et al., op. cit.

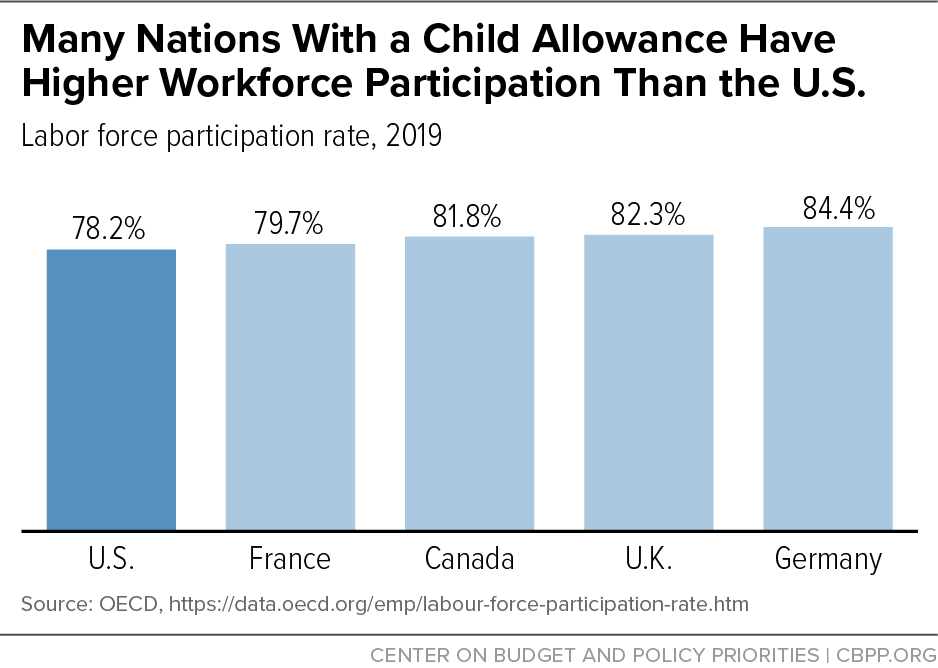

[11] National Academies of Sciences, Engineering, and Medicine, op. cit. The report estimates that 25.49 million people in families below 200 percent of the Supplemental Poverty Measure would be employed after enactment of a $3,000-per-child allowance, which is a similar proposal to the Rescue Plan’s expanded Child Tax Credit. That compares to 25.61 million people employed in such families prior to the enactment of a $3,000-per-child allowance. The report estimates that 4.55 million people in families below 200 percent of the Supplemental Poverty Measure would opt to work slightly fewer hours — an average of about one hour per week. See Danilo Trisi and Ife Floyd, “Benefits of Expanding Child Tax Credit Outweigh Small Employment Effects,” CBPP, March 1, 2021, https://www.cbpp.org/research/federal-tax/benefits-of-expanding-child-tax-credit-outweigh-small-employment-effects.

[12] Michael Baker, Derek Messacar, and Mark Stabile, “The Effects of Child Tax Benefits on Poverty and Labor Supply: Evidence from the Canada Child Benefit and Universal Child Care Benefit,” National Bureau of Economic Research Working Paper 28556, March 2021, https://www.nber.org/papers/w28556. Note that Canada’s child benefit phases out at much lower income levels than the Child Tax Credit.

[13] Peter Ganong, Twitter, August 20, 2021, https://twitter.com/p_ganong/status/1428741098848067591; Kyle Coombs et al., “Early Withdrawal of Pandemic Unemployment Insurance: Effects on Earnings, Employment and Consumption,” August 20, 2021, https://files.michaelstepner.com/pandemicUIexpiration-paper.pdf; Jed Kolko, Twitter, August 17, 2021, https://twitter.com/JedKolko/status/1427703384828637192.

[14] Arindrajit Dube, “Early impacts of the expiration of pandemic unemployment insurance programs,” July 18, 2021, https://arindube.com/2021/07/18/early-impacts-of-the-expiration-of-pandemic-unemployment-insurance-programs/; G. Elliott Morris, “So far, ending pandemic unemployment aid has not yielded extra jobs,” The Economist, August 20, 2021, https://www.economist.com/graphic-detail/2021/08/20/so-far-ending-pandemic-unemployment-aid-has-not-yielded-extra-jobs.

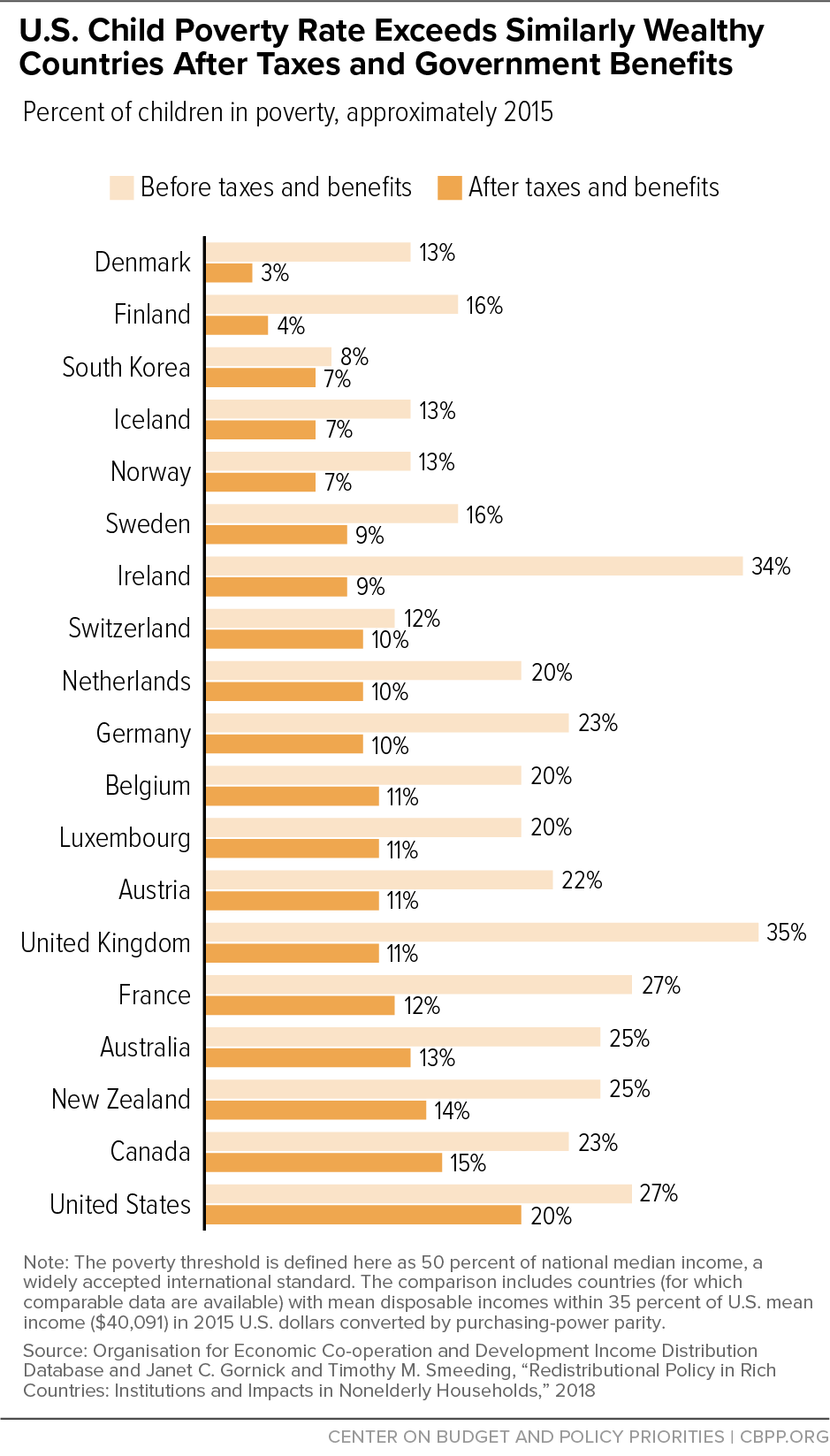

[15] Janet C. Gornick and Timothy M. Smeeding, “Redistributional Policy in Rich Countries: Institutions and Impacts in Nonelderly Households,” Annual Review of Sociology, Vol. 44, July 2018, pp. 441-468, https://www.annualreviews.org/doi/suppl/10.1146/annurev-soc-073117-041114.

[16] Claire Zippel, “After Child Tax Credit Payments Begin, Many More Families Have Enough to Eat,” CBPP, August 30, 2021, https://www.cbpp.org/blog/after-child-tax-credit-payments-begin-many-more-families-have-enough-to-eat.

[17] Lauren E. Jones, Kevin Milligan, and Mark Stabile, “Child cash benefits and family expenditures: Evidence form the National Child Benefit,” Canadian Journal of Economics, Vol. 52, No. 4, November 2019, https://doi.org/10.1111/caje.12409.

[18] Zippel, op. cit.

[19] Garfinkel et al., op. cit.

[20] Liana Fox and Kalee Burns, “The Supplemental Poverty Measure: 2020,” U.S. Census Bureau, September 14, 2021, https://www.census.gov/library/publications/2021/demo/p60-275.html.