Ten Serious Flaws in the Congressional Budget Plan

End Notes

[1] A congressional budget resolution is not a law, and therefore by itself does not change any funding levels or statutory language affecting expenditures and revenues. Rather, a budget resolution is a blueprint, and its proposed policy changes can be implemented only if Congress and the President subsequently enact legislation embodying those changes.

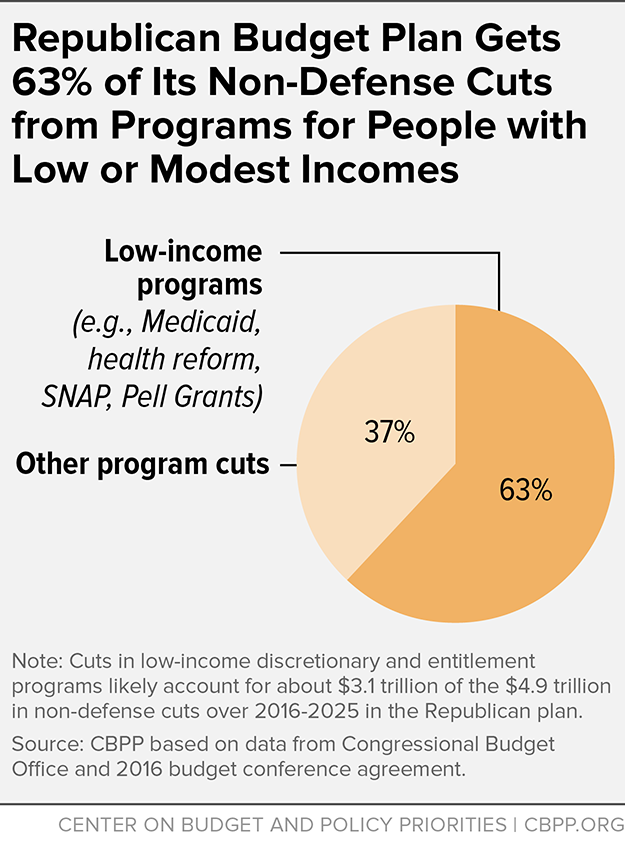

[2] The 63 percent figure is lower than CBPP’s calculation of 69 percent for the original House and Senate plans, but a portion of the difference is simply due to the increased amount of unspecified cuts in the conference agreement. CBPP assumes that unspecified cuts are allocated proportionately across both low-income programs and other programs, even though there are reasons to believe that unspecified cuts, if implemented, would likely hit low-income programs harder than other programs. In addition, the savings that the budget conference agreement attributes to repeal of health reform are estimated to be lower (and thus the overall cuts in programs for people with low or modest incomes are smaller) than the savings attributed to repealing health reform under the House and Senate budgets, because the conference agreement uses an updated, but lower, cost estimate for health reform. For CBPP’s original calculation and an explanation of the methodology used, see Richard Kogan and Isaac Shapiro, “Congressional Budget Plans Get Two-Thirds of Cuts From Programs for People With Low or Moderate Incomes,” Center on Budget and Policy Priorities, March 23, 2015, https://www.cbpp.org/cms/index.cfm?fa=view&id=5289.

[3] Bryann DaSilva, “Congressional Budget Plans Hurt Low-Income Working Families,” Center on Budget and Policy Priorities, March 19, 2015, https://www.cbpp.org/blog/congressional-budget-plans-hurt-low-income-working-families.

[4] This estimate of $496 billion in additional non-defense discretionary cuts between 2017 and 2025, which is effectively relative to the CBO baseline, understates the total funding reductions the agreement imposes. When CBPP estimates future funding for non-defense discretionary programs, it incorporates not only the non-defense activities funded under the caps set by the Budget Control Act (and lowered further by sequestration) but also activities funded outside the caps, such as program integrity and emergencies. In addition, after 2021 when the caps expire, CBPP projects that this funding will rise to take into account not only the effects of inflation, as CBO does, but also population growth. Relative to these CBPP estimates, the congressional budget plan would reduce non-defense discretionary funding by $657 billion through 2025.

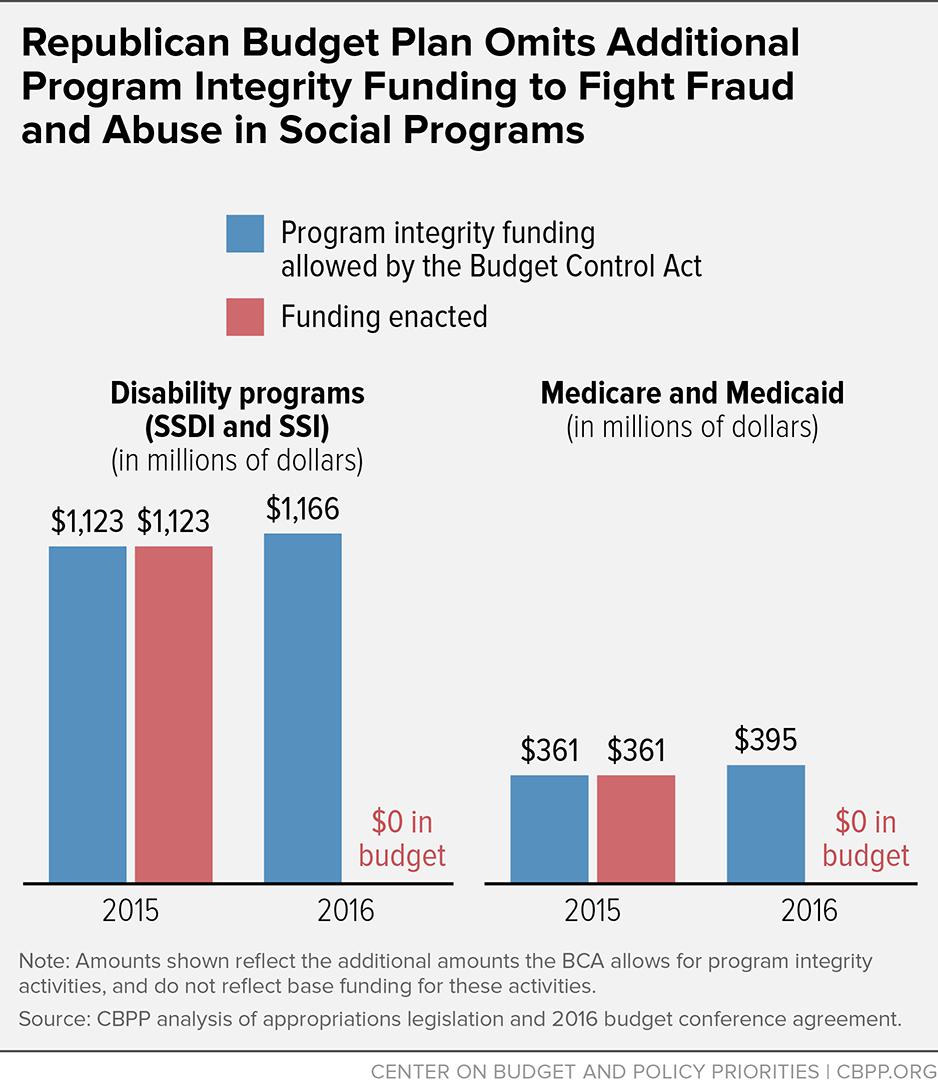

[5] Robert Greenstein, “Despite Anti-Fraud Rhetoric, Republican Budgets Omit Funding to Combat Fraud and Abuse,” Center on Budget and Policy Priorities, March 25, 2015, https://www.cbpp.org/blog/despite-anti-fraud-rhetoric-republican-budgets-omit-funding-to-combat-fraud-and-abuse. The House budget expressed support for program integrity activities but stated that they must be funded within the caps — meaning that fully funding them would require even deeper cuts in other non-defense discretionary programs, which already must adhere to the austere sequestration levels in 2016. Moreover, after 2016, the House budget — like the conference agreement — cuts non-defense discretionary programs below the sequestration levels, leaving even less room for program integrity funding. The Senate budget failed even to express support for program integrity funding.

[6] U.S. Department of Justice and U.S. Department of Health and Human Services, Annual Report of the Departments of Health and Human Services and Justice: Health Care Fraud and Abuse Control Program FY 2014, March 19, 2015, http://oig.hhs.gov/publications/docs/hcfac/FY2014-hcfac.pdf.

[7] Robert Greenstein and Joel Friedman, “Balancing the Budget in Ten Years and No New Revenue Are Flawed Budget Goals,” Center on Budget and Policy Priorities, March 13, 2015, https://www.cbpp.org/cms/index.cfm?fa=view&id=5282.