Representative John Yarmuth, chair of the House Budget Committee, unveiled a bill yesterday with Representative Nita Lowey, chair of the House Appropriations Committee, that would increase funding for both defense and non-defense discretionary (NDD) programs in 2020 and 2021 above the very low ceilings set under the 2011 Budget Control Act (BCA).[1]There is a longstanding recognition that the funding levels required under the BCA are too low to meet national needs. That’s why Congress and the President have enacted three consecutive budget deals — each covering two years — to raise funding above the austere BCA levels, with the most recent deal enacted in 2018 and covering fiscal years 2018 and 2019.[2] Absent another budget agreement that raises the BCA funding caps, non-defense discretionary programs would be cut by $54 billion and defense by $71 billion in 2020, relative to 2019 funding levels.

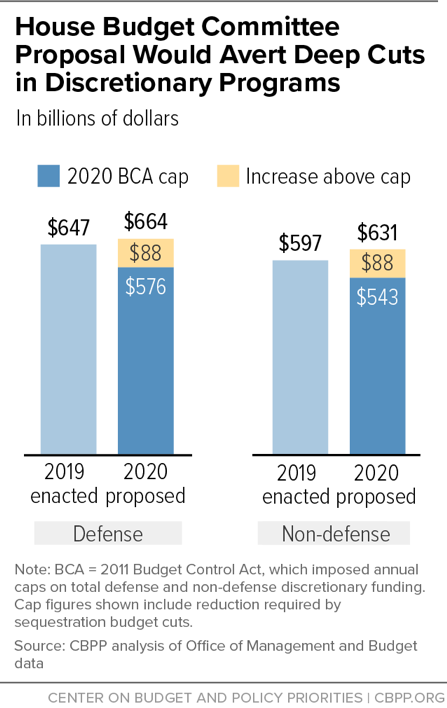

The proposal, which is scheduled to be considered by the House Budget Committee on April 3, would increase funding for defense and non-defense programs by $88 billion above the BCA levels in 2020 and $90 billion above the BCA levels in 2021. The most recent budget deal, covering 2018 and 2019, also set funding levels above the austere BCA levels, and the Yarmuth-Lowey proposal would increase funding above the 2019 funding levels. (See Figure 1.)

The BCA imposed restrictive funding limits or “caps” on defense and NDD programs. It also included a provision — known as “sequestration” — that would impose deep cuts in both defense and non-defense programs if Congress did not enact additional deficit reduction. This threat of deep cuts was supposed to prompt Congress to reach an agreement on a deficit-reduction package, but that effort failed and the automatic sequestration cuts took effect.

NDD cuts of the magnitude required by the BCA would damage key public services and investments. NDD is currently funded at a historically low level of just 2.9 percent of the economy (or GDP), even with the additional funding provided in the last budget agreement. Moreover, various important services and investments are underfunded. For example, just 1 in 4 low-income households eligible for housing assistance receives it and just 1 in 6 children eligible for child care assistance gets any help. There are large backlogs in facility maintenance in national parks, and Pell Grants, which help low- and moderate-income students afford college, now cover a smaller share of the cost of attending a four-year public college than at any time since the program was fully implemented 47 years ago. These and other areas need increased resources to meet the country’s needs, not deep cuts.

Indeed, we are just emerging from a period of disinvestment in non-defense discretionary programs. Despite the budget agreements that ameliorated the BCA’s cuts over the 2013-2017 period, overall funding for NDD fell by a total of $400 billion from 2011 through 2017, relative to the funding that these programs would have received if funding had remained at the 2010 level, adjusting only for inflation.[3] While the budget deal that increased funding in 2018 and 2019 provided significant resources above 2017 funding levels, funding in these years remained below the 2010 level adjusted for inflation.

Figure 1 also shows that the House Budget Committee bill proposes funding increases that are not excessive: in defense funding, from $647 billion in 2019 to $664 billion in 2020 — $17 billion or 2.6 percent in nominal terms, and an increase of only 0.2 percent after adjusting for inflation; and in NDD funding, from $597 billion in 2019 to $631 billion in 2020 — $34 billion or 5.7 percent in nominal terms and 3.2 percent after adjusting for inflation. Moreover, the NDD increase will need to accommodate a $10 billion increase just for veterans’ medical care, given the enactment last May of the Mission Act, which creates new options for veterans to receive medical care outside of veterans health care facilities.[4] This means that funding for NDD programs outside of veterans’ health care would increase by $24 billion from 2019 to 2020, or 4.6 percent, with about half of that being needed to cover inflation. Moreover, under the proposal, NDD funding would still be relatively low by historical standards when measured as a percent of the economy, running at or below 3 percent of GDP.[5]

While the NDD funding increase is not profligate, the additional resources will allow Congress to build on investments made following the last budget deal in high-priority areas such as child care, infrastructure, substance use disorder prevention and treatment, low-income housing, and environmental protection — as well as to begin addressing other serious unmet needs.

The House Budget Committee proposal restores the concept of “parity” by providing funding above the BCA caps in equal amounts for defense and non-defense programs. The concept of parity has its roots in the BCA, which requires sequestration cuts to be split 50-50 between defense programs and non-defense programs.

The BCA’s automatic sequestration provisions cut $54.7 billion per year for ten years (2012-2021) from defense and from non-defense programs each. Almost all the defense cuts came by reducing discretionary funding because almost all defense programs are discretionary.[6] But some non-defense mandatory programs, such as Medicare, farm subsidies, and the Social Services Block Grant, are subject to sequestration. As a result, about two-thirds of the non-defense sequestration came from non-defense discretionary programs, with the remainder coming from non-defense mandatory programs.

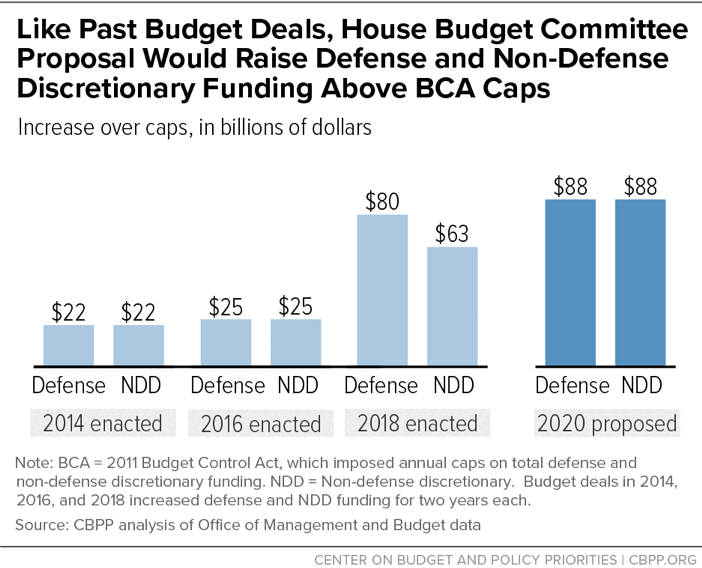

There has been a bipartisan consensus that the resulting BCA funding ceilings are too low to meet national needs. That is why policymakers have enacted a one-year budget deal, followed by three two-year budget deals, to raise the caps. In each case, the increases have involved parity in one form or another, reflecting in part the idea that since the BCA’s sequestration cuts were split evenly between defense and non-defense programs, funding increases above the BCA levels should similarly provide equal increments. The House Budget Committee bill would be the fourth such agreement, covering the final two years of the discretionary caps, 2020 and 2021.

Figure 2 shows the first year of the three two-year deals and the first year of the Yarmuth-Lowey proposal. As can be seen, the dollar amounts of the increases above the levels of the defense and NDD caps were identical in the first and second deals and are again proposed to be identical in the Budget Committee’s bill — this can be termed parity. In the 2018-2019 deal, by contrast, policymakers raised the defense cap by more than NDD cap, although some view the 2018-2019 deal as also encompassing parity, with parity measured a different way.[7]

Under existing law, certain types of discretionary funding occur outside the caps: war funding (known as Overseas Contingency Operations or OCO, also called Global War on Terror or GWOT); disaster and emergency funding; and program integrity funding to reduce erroneous payments.[8]

Over the years, war funding has increasingly been viewed as largely indistinguishable from regular funding subject to the caps. In 2019, defense received $69.0 billion in war funding, and the State Department (classified as an NDD agency) received $8.0 billion. The Yarmuth-Lowey proposal would freeze war funding at those levels in 2020 and 2021. Press reports often combine regular and war funding, summing to $733 billion for defense in 2020 and $639 billion for NDD programs in 2020.

The proposal would create two additional types of funding outside the caps:

- Census. For the 2020 census, the proposal would permit $7.5 billion in funding for the decennial census to be provided outside the 2020 NDD cap. Census funding jumps dramatically in the year of the decennial census, which requires hiring and training 300,000 enumerators and supervisors, opening field offices, conducting a vigorous outreach campaign to improve response rates, going door-to-door to elicit information from unresponsive households, and processing responses. Census funding will fall back to a far lower level in 2021, at which point it will once again be fully under the NDD cap.

- IRS enforcement. The bill would also allow IRS enforcement activities to rise by $400 million in 2020 and $750 million in 2021, outside the caps. In each of his last two budgets, President Trump has proposed that Congress enact such an outside-the-caps provision, and the precedent for this approach dates to the 1990 Budget Enforcement Agreement, which accommodated IRS compliance activities outside the caps. Both the Office of Management and Budget and the Congressional Budget Office estimate that extra funding for IRS enforcement would raise far more additional revenues over time than the extra discretionary funding would cost, which is why it makes sense to exempt some enforcement funding from the caps.