- Home

- Federal Budget

- House Appropriations Bills Provide Very ...

House Appropriations Bills Provide Very Substantial Increases in Programs for Low- and Moderate-Income Families

The House Appropriations Committee has approved all 12 of its fiscal year 2022 appropriations bills and the full House has passed nine of them.[1] Closely following President Biden’s 2022 budget, the House appropriations bills would significantly increase funding for key programs, especially those supporting low- and moderate-income families and individuals.[2] The increases the House was able to provide for low-income programs highlight the importance of reaching agreement on a robust topline for non-defense funding in coming negotiations over 2022 appropriations.

- Overall funding for non-defense programs would increase by $109 billion or 16 percent.[3]

- Within that total, low-income programs would increase by $43 billion or 28 percent, while other non-defense programs would increase by $66 billion or 13 percent.

- Low-income programs constituted 23 percent of total non-defense funding in 2021 but would receive 39 percent of the $109 billion total non-defense funding increase.

- The largest increase is for education programs, which would grow by 51 percent, driven by a sharp boost in funding for Title I education grants to local school districts.

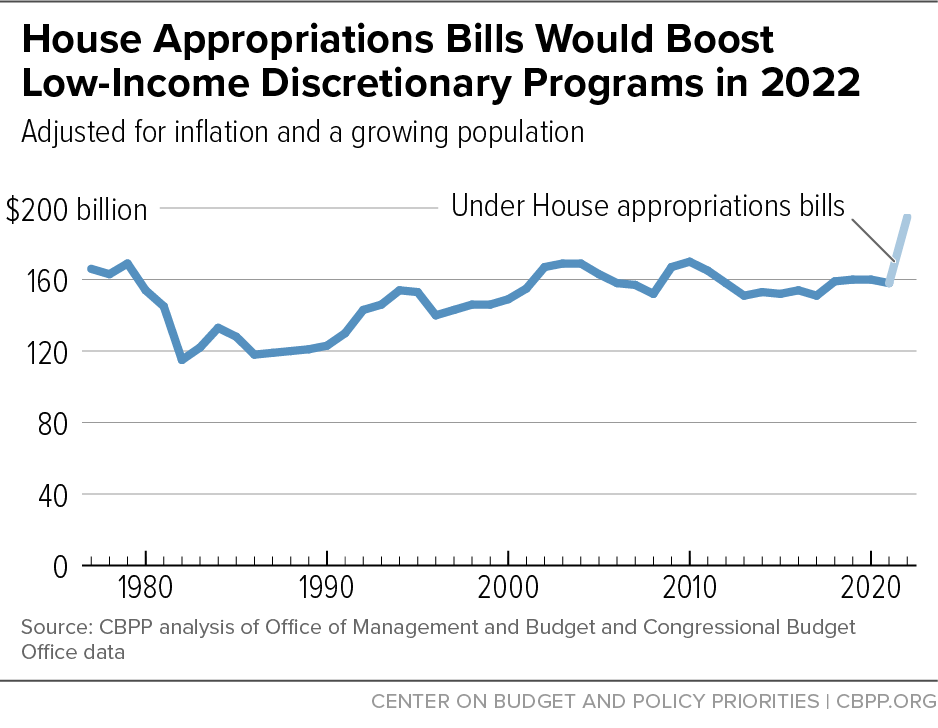

- The 2022 funding increases for low-income programs would undo a decade of stagnation; funding for these programs would reach a 45-year high even after accounting for inflation and population growth.

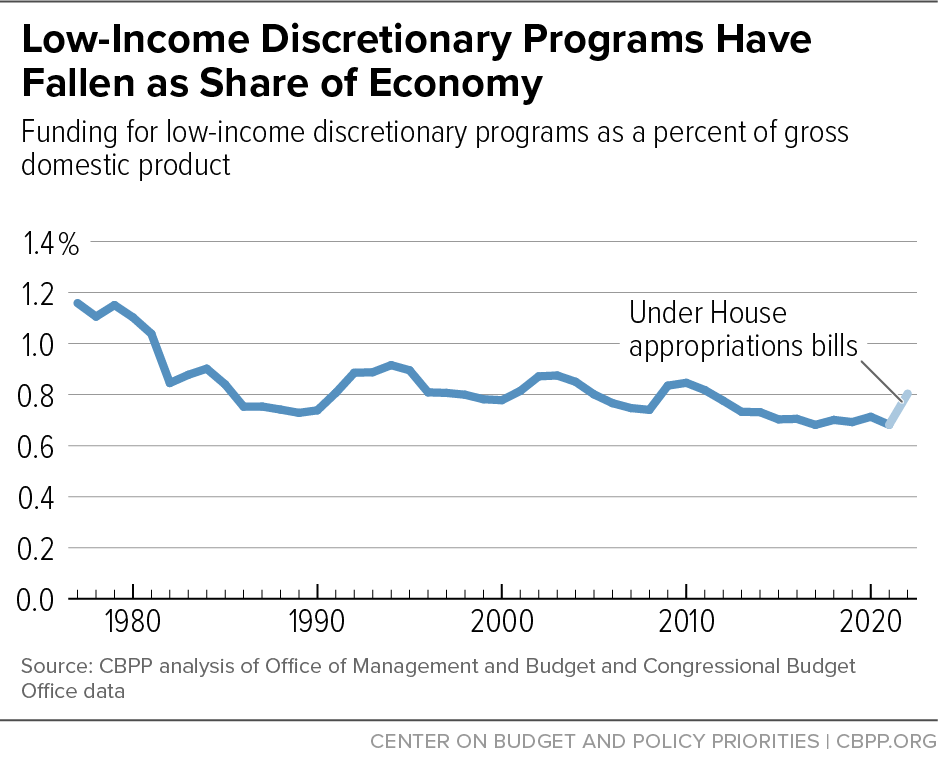

- But when these programs are measured relative to the size of the economy, their share has generally shrunk over the last 45 years, with the 2022 increase reversing only part of that decline.

| TABLE 1 | ||||

|---|---|---|---|---|

| House Appropriations Bills Would Provide Significant Funding Increases, Especially for Low-Income Programs Dollars in billions |

||||

| 2021, enacted |

2022, House |

Dollar increase |

Percent increase |

|

| Low-income programs | 153 | 195 | 43 | 28% |

| Other non-defense programs | 524 | 590 | 66 | 13% |

| Total non-defense funding | 677 | 786 | 109 | 16% |

Note: Figures may not add due to rounding. Figures exclude 2021 funding for COVID-19 relief. See Appendix 1 for an explanation of our other adjustments to the figures.

The House increases in low-income programs face substantial risk in coming congressional negotiations over final 2022 appropriations bills. Senators can filibuster appropriations bills, and ending a filibuster requires the vote of 60 senators. Because the Senate is split 50-50 between the parties, appropriations bills can pass the Senate only with some degree of bipartisan compromise. There is significant pressure, particularly from Republican senators, to reduce total non-defense funding and increase defense funding. So far, the Senate Appropriations Committee has approved only three bills. The Committee’s Democratic senators, led by Senator Patrick Leahy, have released proposed drafts of the remaining nine bills, which would trim House increases in non-defense programs including low-income programs and provide a somewhat larger defense increase. As policymakers negotiate the final 2022 appropriations bills, they should prioritize these low-income programs.

Low-Income Program Increases in House Appropriations Bills

The programs discussed in this paper help fight poverty and increase opportunity in many ways. Some provide resources to improve elementary and secondary education in high-poverty areas, some provide financial aid to help students of modest means afford college, some support job training — all with the goal of increasing individuals’ future earning capacity and life opportunities. Other programs help make decent housing or quality child care affordable to low-income families. Still others help improve nutrition for infants and young children — which is important for their healthy development — or improve access to health care in underserved areas.

These low-income programs also advance racial equity. In part, that’s because a disproportionate share of low-income people are people of color, reflecting a long history of discrimination and racism. Many of these programs also help address specific effects of racial discrimination experienced by people of color, such as lower-quality, under-resourced schools; gaps in school readiness; substandard and overcrowded housing; and less access to high-quality health care.[4] Some programs respond to the specific needs of American Indians and Alaska Natives in areas such as health care and education that result from long-standing discrimination or neglect.

For purposes of this analysis, we classify a program as low income when its services or benefits go mostly to families or individuals below or only modestly above the poverty line — whether or not the benefits are formally means tested. (Appendix 2 lists the programs we consider low income.) For example, each applicant to tenant-based rental assistance or the Low-Income Home Energy Assistance Program (LIHEAP) must have an income that falls below a specified level. In contrast, while community health center grants by the Health Resources and Services Administration are not explicitly means tested, about 90 percent of patients served by the health centers have low incomes.

Table 2, below, divides programs supporting low- and moderate-income families and individuals into seven different categories. While the House bills would provide each of the seven categories with notable gains from 2021 to 2022, the increase in education stands out — encompassing more than half of the overall increase in low-income programs.

- Education: The 51 percent increase is very largely driven by a more than doubling of Title I education grants to local school districts to help students in high-poverty schools succeed. Of the $23.3 billion increase in education, $19.5 billion is for Title I, while most of the rest is for Pell Grants and other programs that help low-income students afford college, support colleges and universities that serve high proportions of students of color, and encourage and assist underserved individuals to enter and complete college.

- Housing: The 13 percent increase is mainly for Tenant Based Rental Assistance, which funds vouchers that help people with low incomes rent housing in the private market. Other, smaller housing accounts are also increased, including the Public Housing Fund and the HOME Investment Partnership Program.

- Health: The 25 percent increase goes for the Indian Health Services and Indian Health Facilities accounts and for the Health Resources and Services account, whose largest components are community health centers, maternal and child health, strengthening the health workforce, and care and support for low-income people living with HIV/AIDS.

- Social services: The 18 percent increase goes overwhelmingly for Head Start.

- Jobs and training: The 15 percent increase goes mostly for the Labor Department’s Training and Employment Services account, which helps workers get and retain jobs and provides employers with skilled workers to fill job vacancies.

- Nutrition: The 20 percent increase largely reflects increased funding for Special Supplemental Nutrition Program for Women, Infants, and Children (WIC). For decades, in good times and bad, this program has been funded at levels sufficient to serve all eligible applicants. The additional funding extends a temporary increase, enacted in March 2021 in the American Rescue Plan, in the monthly amount of fruit and vegetables, which will make the food that WIC provides more consistent with recommendations by the National Academies of Sciences, Engineering, and Medicine. (The Senate Appropriations Committee approved a nearly identical funding increase for WIC when it reported the Agriculture appropriations bill on a bipartisan basis.)

- Other low-income discretionary programs: While this area encompasses six programs, the biggest increase is for the Refugee and Entrant Assistance account within the Department of Health and Human Services, largely reflecting the rising costs of caring for unaccompanied migrant children. In addition, the Child Care and Development Block Grant would receive a substantial increase.

| TABLE 2 | ||||

|---|---|---|---|---|

| House Appropriations Bills Would Increase Each Category of Low-Income Funding Dollars in billions |

||||

| 2021, enacted |

2022, House |

$ increase, 2021-2022 |

% increase, 2021-2022 |

|

| Low-Income NDD funding | 152.7 | 195.4 | 42.7 | 28.0% |

| Education | 45.4 | 68.6 | 23.3 | 51.3% |

| Housing | 55.1 | 62.4 | 7.4 | 13.4% |

| Health | 13.7 | 17.1 | 3.4 | 25.1% |

| Social services | 13.1 | 15.5 | 2.4 | 18.4% |

| Jobs and training | 5.8 | 6.7 | 0.9 | 15.0% |

| Nutrition | 5.2 | 6.2 | 1.0 | 20.2% |

| Other | 14.4 | 18.8 | 4.3 | 30.0% |

Note: NDD = non-defense discretionary programs (appropriations). Figures may not add due to rounding. Figures exclude 2021 funding for COVID-19 relief. See Appendix 1 for an explanation of our other adjustments to the figures.

Low-Income Programs Over Time

Tables 1 and 2 show nominal dollar funding increases from 2021 to 2022, but there are better ways to determine whether the services and benefits that low-income appropriations fund grow or shrink over time. First, it is essential to account for inflation because, with inflation, the same amount of dollars can pay for fewer benefits or services over time. Second, it is important to account for population growth, either because a growing population generally means that these programs’ benefits are spread among more people or because the society-wide cost of financing these programs is spread over more people.

Adjustments for inflation and population growth are therefore especially important when examining trends over more than a single year. For this reason, the first two graphs that follow below adjust all dollar amounts prior to 2022 for inflation and a growing population; that is, we index those amounts to the 2022 levels of prices and population.

Figure 1 shows that discretionary funding for low-income programs has risen and fallen since 1977. Such funding reached a nadir during the 1980s under President Reagan, though the funding had started to decline even before the first Reagan budget was implemented. More recently, the restrictive discretionary caps of the 2011 Budget Control Act, and the further “sequestration” (automatic reduction) of those caps, constrained discretionary funding as a whole; defense, non-defense, and low-income programs all fell from their 2010 levels. Even in 2021, after policymakers enacted a series of bills to ease the severity of the Budget Control Act, discretionary programs — including low-income programs — were noticeably below the 2010 peak. The 2022 House appropriations bills would not only bring low-income programs as a whole above their 2010 levels, but also would raise them to their highest level for which data are available.

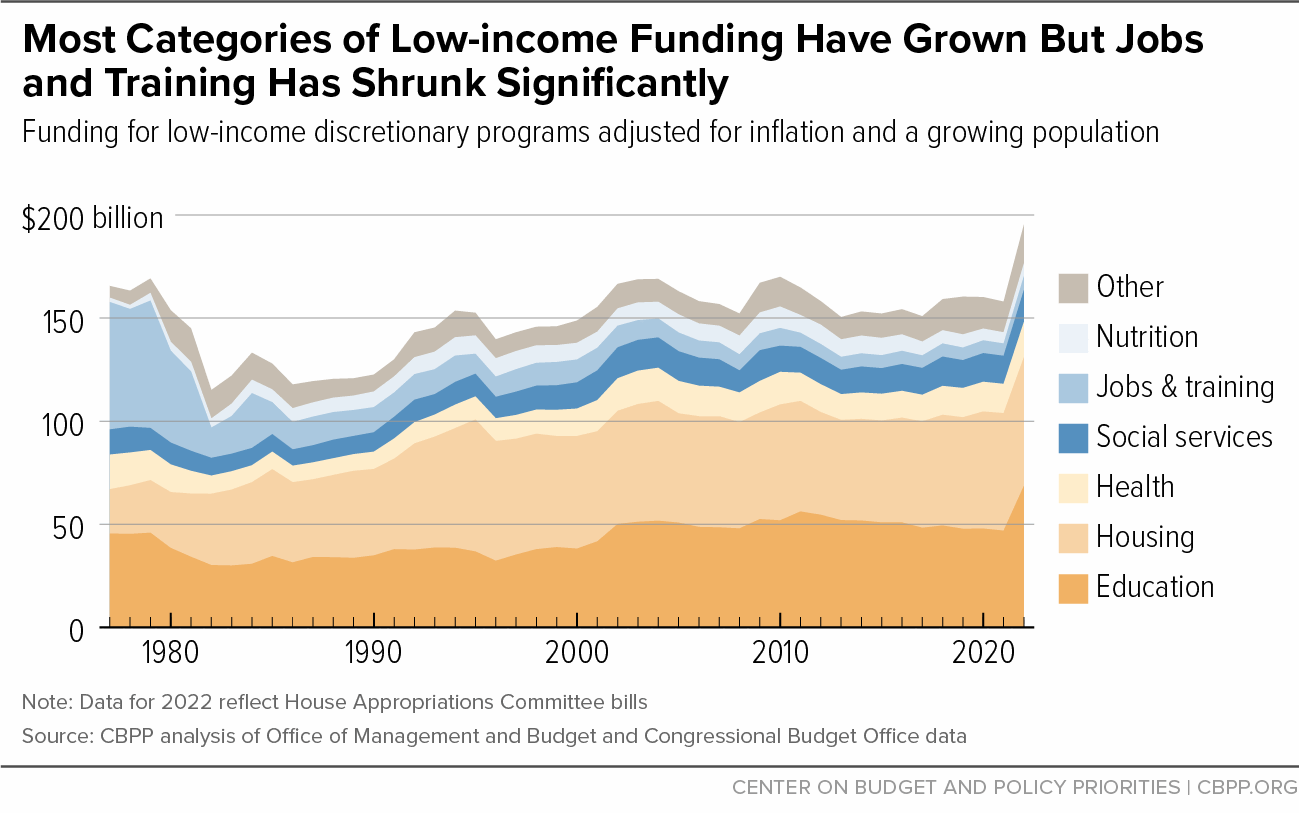

Figure 2 shows the funding levels for each of the seven low-income categories shown in Table 2, as adjusted for inflation and a growing population. Changes over time in some categories of low-income programs stand out. Specifically:

- Recent funding for jobs and training, including the 2022 level, is well below the historical average. During the late 1970s, job training and retraining, including subsidized jobs under the 1973 Comprehensive Employment and Training Act, received very significant funding. Policymakers cut this area 70 percent under President Reagan, somewhat further under President Clinton, and still further after the 2011 Budget Control Act capped and then cut non-defense funding through 2021.

- By contrast, all other categories of low-income funding except health are at least somewhat larger in 2021 than they were in the late 1970s. Of these, assisted housing — especially via direct subsidies for rental housing — shows by far the biggest dollar growth through 2021 and even 2022, notwithstanding the large increase that the House bills would provide for education.

As explained, Figures 1 and 2 use data that adjust pre-2022 funding levels for inflation and a growing population to best assess whether programs have been growing or shrinking. A different question is whether the nation is devoting a greater or smaller share of the economy to these programs. The answer, as shown in Figure 3, is smaller, but the 2022 increase would reverse part of that decline.

That is, to the extent that Figure 1 shows that low-income programs have grown since the Reagan years, Figure 2 shows that the economy (as measured by gross domestic product) has grown more. The economy has become notably more unequal over the decades; economic growth has very largely benefited the wealthiest households. But regardless of its increasing maldistribution, a growing economy provides a growing tax base, which policymakers could have used to increase these low-income programs more than they have — and so could have better mitigated growing inequality.

Appendix 1: Our Adjustments to Nominal Funding Data

Our data on funding for non-defense discretionary (NDD) programs comes from the public database of “budget authority” (i.e., funding) maintained by the Office of Management and Budget (OMB) for fiscal years 1977 through 2020.[5] Our data on funding for fiscal year 2021 comes from a database prepared by the Congressional Budget Office (CBO). And our data on funding for fiscal year 2022 comes from appropriations bill runs by CBO.

Before adjusting historical NDD funding data for inflation and population growth, we make the following adjustments to nominal OMB and CBO figures.

- We remove CHIMPs from CBO’s 2022 data. Appropriation bills routinely contain some legislative language making changes in mandatory programs (CHIMPs). OMB’s historical data reflects the budgetary effects of that legislation in its data on mandatory programs, as do CBO’s databases. But to enhance committee accountability, when judging whether appropriations bills have met the dollar targets established by budget resolutions or statutory caps, congressional scorekeeping and enforcement counts the budgetary effect of that legislation as though it were an appropriation or rescission of discretionary funding. For that reason, the budgetary effects of CHIMPs are included in CBO’s bill runs for 2022 appropriations bills. We remove those effects so that our figures apply only to funding for discretionary programs themselves, consistent with CBO’s and OMB’s historical data.

- We remove housing fee income. Since 1992, income from fees that the Federal Housing Administration and the Government National Mortgage Association charge has been recorded as offsetting receipts — negative funding. The amount of this fee income is not determined by any action of the Appropriations Committees, however, and can vary significantly from year to year, depending on the housing market. To better represent funding for standard NDD programs and avoid year-to-year fluctuations that have little programmatic meaning, we remove these negative amounts from our figures.

- We remove ARRA and COVID-19 funding. CBO’s data on discretionary funding in the 2009 American Recovery and Reinvestment Act and in COVID-related legislation is removed from OMB’s historical funding data and CBO’s database of 2021 funding. Unfortunately, it is generally impossible to remove other NDD amounts that were intended as one-time funding in response to disasters or emergencies.[6]

- We add Senate items for 2022. Following custom, the House Appropriations Committee did not include any funding for purely Senate items, such as the Senate’s personal and committee staff, committee investigations and expenses, and the Senate Sergeant at Arms, in the 2022 Legislative Branch appropriations bill. The House, however, made room for $1.2 billion for this purpose within its budget targets, so we added that amount to CBO’s rack-up.

-

We use outlay data to remove funding distortions from assisted housing accounts and Temporary Employment Assistance, substituting outlays for budget authority in our data for years before 2021.

Doing so removes a distortion in the Project Based Rental Assistance account and its predecessors. Initially, rental assistance was provided through appropriations for 30-year contracts with landlords but, as the years passed, the new contracts (and the appropriations) were for shorter periods; more recently, they have been one-year contracts. As a result, very large amounts of funding[7] in the 1970s produced relatively modest amounts of outlays; the funding appeared to decline dramatically as contract lengths were shortened, but the outlay data show that the program and its successors in fact grew quite meaningfully over time. That’s why we substitute outlay data for funding data in our analysis.

Similarly, we use outlays instead of appropriations for funding for public service employment under the 1973 Comprehensive Employment and Training Act, which also had multiple years’ costs funded up front.

- We substitute program-year funding for budget-year funding. Some NDD programs — especially those making grants to school districts — are “forward funded.” That is, they provide funding for a school year or program year that begins toward the end of the fiscal year. During the period we’re examining, the Appropriations Committees started providing part of this funding as “advance appropriations,” becoming available at the start of the next fiscal year. That didn’t change the funding provided for a school year, but it did shift the year in which the appropriations were recorded. To avoid this distortion, we treat those advance appropriations as if they were provided in the prior fiscal year. These distortions were most significant in 1996, 1999-2001, and 2009. There have been no distortions (so our adjustments make no difference) in any year after 2013.

Appendix 2: Our List of Low-Income Discretionary Budget Accounts

Table 3 lists the budget accounts that we classify as low income. Our historical data also include predecessor accounts — that is, accounts that no longer exist and were superseded by other accounts — though we do not list them.[8] We classify an account as low income when the services or benefits it provides accrue mostly to families or individuals below or only modestly above the poverty line, whether or not the benefits are formally means tested. Many budget accounts fund more than a single program but, because it is often impossible to access historical funding data below the account level, our data use account totals. We also list the subfunctions in which accounts are classified by OMB; some accounts are split among subfunctions.

| TABLE 3 | |

|---|---|

| List of Budget Accounts We Classify as Low Income | |

| Program category and budget account | Subfunction |

| Education | |

| Indian Education | 501 |

| Operation of Indian Education Programs | 501 |

| Education for the Disadvantaged | 501 |

| Student Financial Assistance | 502 |

| Higher Education | 502 |

| Housing | |

| Rental Assistance Program (rural housing service) | 604 |

| Housing Counseling Assistance | 604 |

| Self-help and Assisted Homeownership Opportunity Program | 604 |

| Homeless Assistance Grants | 604 |

| Home Investment Partnership Program | 604 |

| Native Hawaiian Housing Block Grant | 604 |

| Housing for Persons with Disabilities | 604 |

| Tenant Based Rental Assistance | 604 |

| Project-based Rental Assistance | 604 |

| Housing Opportunities for Persons with AIDS | 604 |

| Native American Programs | 604 |

| Housing for the Elderly | 604 |

| Choice Neighborhoods Initiative | 604 |

| Self-Sufficiency Programs | 604 |

| Public Housing Fund | 604 |

| Rural Housing Assistance Grants | 604 |

| Multifamily Housing Revitalization Program Account | 604 |

| Mutual and Self-help Housing Grants | 604 |

| Operating Expenses (U.S. Interagency Council on the Homeless) | 808 |

| Health | |

| Lead Hazard Reduction | 451 |

| Contract Support Costs (Indian Health Service) | 551 |

| Health Resources and Services | 551&552 |

| Indian Health Services | 551 |

| Indian Health Facilities | 551 |

| Social Services | |

| Promoting Safe and Stable Families | 506 |

| Children and Families Services Programs | 506 |

| Jobs and Training | |

| Training and Employment Services | 504 |

| Community Service Employment for Older Americans | 504 |

| Jobs Corps | 504 |

| Nutrition | |

| Commodity Assistance Program | 605 |

| Special Supplemental Nutrition Program for Women, Infants, and Children (WIC) | 605 |

| Other | |

| Operation of Indian Programs | 302&452 |

| Rural Housing Insurance Fund Program Account | 371 |

| Contract Support Costs (Bureau of Indian Affairs) | 452 |

| Low Income Home Energy Assistance | 609 |

| Refugee and Entrant Assistance | 609 |

| Child Care and Development Block Grant | 609 |

| Payment to the Legal Services Corporation | 752 |

End Notes

[1] Fiscal year 2022 began on October 1, 2021; programs funded through appropriations bills are currently operating under a “continuing resolution” that generally allows them to proceed at last year’s rate of operations through February 18, 2022. One-third of total federal expenditures are for programs whose funding is within the legal discretion of the Appropriations Committees. Hence, those programs are known as “discretionary.” About half of discretionary funding is for defense. The rest of the budget is known as “mandatory” and comprises programs such as Social Security, Medicare, Medicaid, interest on the debt, and federal retirement. See “Policy Basics: Non-Defense Discretionary Programs,” CBPP, updated April 13, 2020, https://www.cbpp.org/research/federal-budget/non-defense-discretionary-programs.

[2] We make a few adjustments to historical data from the Office of Management and Budget (OMB) and 2022 data from the Congressional Budget Office (CBO) to improve year-to-year comparability; see Appendix 1. For a list of the discretionary programs that we categorize as low-income, see Appendix 2.

[3] This analysis focuses on funding provided through the regular, annual appropriations process. The figures do not reflect funding for discretionary appropriations provided by legislation enacted in response to COVID-19, nor do they reflect amounts for 2022 that may be enacted in pending Build Back Better legislation.

[4] See for example Danilo Trisi and Matt Saenz, “Economic Security Programs Reduce Overall Poverty, Racial and Ethnic Inequities,” CBPP, updated July 1, 2021, https://www.cbpp.org/research/poverty-and-inequality/economic-security-programs-reduce-overall-poverty-racial-and-ethnic and Will Fischer, Sonya Acosta, and Erik Gartland, “More Housing Vouchers: Most Important Step to Help More People Safford Stable Homes,” CBPP, updated May 13, 2021, https://www.cbpp.org/research/housing/more-housing-vouchers-most-important-step-to-help-more-people-afford-stable-homes.

[5] https://www.whitehouse.gov/wp-content/uploads/2021/05/budauth_fy22.xlsx

[6] OMB’s database contains funding totals for individual budget accounts but does not further subdivide the data. As a result, users cannot separate disaster funding from regular funding. Likewise, when budget caps or plans include certain “adjustment items,” such as war funding or program integrity funding, OMB data do not show those amounts separately. To be consistent, our data for 2021 and 2022 include funding for the “allocation adjustment items” in the fiscal year 2021 and 2022 budget resolutions: continuing disability reviews, IRS tax enforcement (in 2022), health care fraud and abuse control, reemployment services and eligibility assessments, and wildfire suppression. However, we do not include disaster or emergency funding in those two years.

[7] Because a 30-year contract (for instance) is binding, it is good practice to record the full 30-year cost of that contract in the year that funding is appropriated rather than spreading it over 30 years. But while this accounting does a fine job of keeping track of and enforcing the constitutional rule that the executive branch may make binding commitments only to the extent that funding has been “appropriated by law,” it means that in such a case, year-to-year funding patterns do not necessarily display program costs as that term is commonly understood.

[8] An example of a predecessor account is the Department of Housing and Urban Development’s “annual contributions for assisted housing” account, which stopped receiving funding in 1996. Much of that account was superseded by the “housing certificate fund” account, which in turn was superseded by the Tenant Based and Project Based rental assistance accounts.

More from the Authors