- Home

- Federal Budget

- Five Things To Look For In The House Rep...

Five Things to Look for in the House Republican Budget Resolution

The House Budget Committee is reportedly preparing to unveil the latest Republican budget proposal this week. While the plan won’t be accepted by the Senate and so can’t directly shape budget legislation this year, it remains important as an articulation of big-picture fiscal policies supported by House Republican committee members — the members charged by the party’s leadership in the chamber to set its broad fiscal policy.

It is likely that this new plan will be much like past Republican budget plans. We have reviewed every budget Republicans in Congress or in the White House produced since 2012, and they are strikingly similar. They consistently proposed large and damaging program cuts across a broad swath of non-defense areas.

The proposed cuts disproportionately fell in programs for households with low and moderate incomes, but they were also broad-based and included deep cuts in the part of the budget that funds public services whose funding is provided annually, such as education, medical research, environmental protection, and the administration of the Social Security Administration.

Major targets in past Republican budgets included Medicaid and the financial help people receive to purchase health coverage in the Affordable Care Act (ACA) marketplace, as well as other forms of assistance that reduce poverty and hardship and expand opportunity, like food assistance through the Supplemental Nutrition Assistance Program (SNAP). Republicans claimed these cuts were designed to reduce projected deficits, yet none of their budgets called for higher revenues and many proposed costly tax cuts that would both worsen inequality and shrink the nation’s already depleted revenue base.

Given this history, here are five things to look for in the coming House Republican budget:

1. Large and damaging program cuts in the name of deficit reduction, with no contribution from higher revenues.

Many past Republican budget plans proposed to balance the budget within ten or fewer years. The Congressional Budget Office (CBO) estimated in March that it was not possible to balance the budget in fiscal year 2033 while protecting Social Security, Medicare, defense, and certain veterans’ programs from cuts while also extending the expiring 2017 tax cuts — policy preferences many House Republicans support.[1] Even after eliminating all other programs, a small deficit would remain. House Budget Committee Chair Jodey Arrington has reportedly stated his budget plan will balance in ten years. Regardless of whether the plan portrays a zero deficit in 2033, it is still likely to propose very substantial program cuts — not only to achieve Republicans’ likely aggressive deficit-reduction goals but also to offset the high cost of extending the 2017 tax law’s expiring provisions, discussed more below.

2. Disproportionate cuts in programs that help households with low and moderate incomes, increasing poverty and hardship and narrowing opportunity.

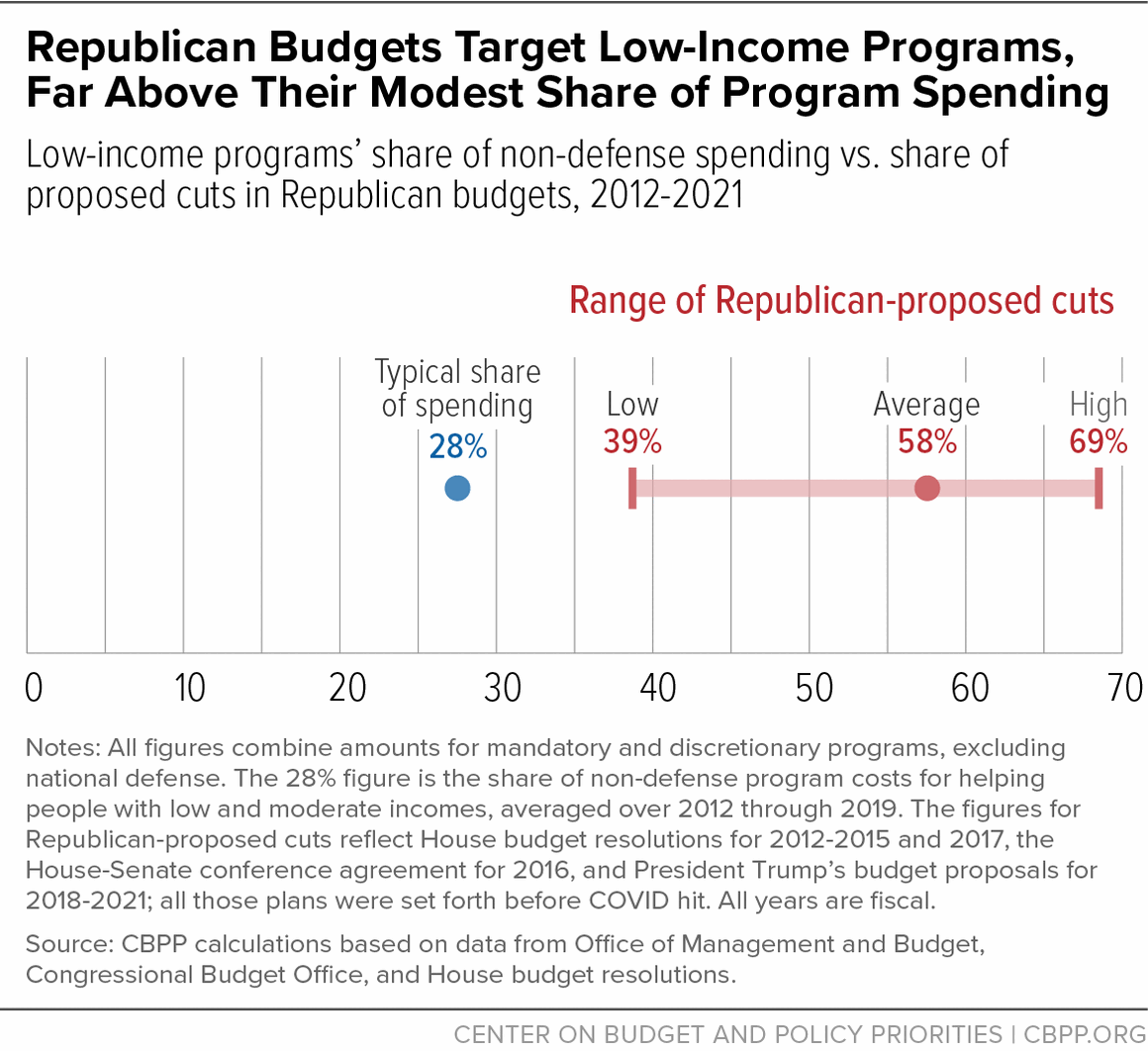

Prior Republican budgets consistently targeted programs or program areas that assist low- and moderate-income households and broaden opportunity. Such programs have historically accounted for about 28 percent of all program costs outside defense. But since 2012, 39 to 69 percent of proposed Republican cuts to non-defense spending have targeted these programs; with Republican cuts averaging 58 percent, that is more than twice their share of actual costs.

The programs include, for instance: Medicaid; ACA premium tax credits; SNAP and other nutrition programs; rental housing assistance; Pell grants for higher education; and Title I education, which provides funding to schools to boost educational services for disadvantaged students.

3. Deep cuts in Medicaid and in ACA marketplace financial help, leading to millions of families losing health insurance.

Past Republican budgets have targeted Medicaid and ACA’s marketplace premium tax credit for the largest cuts of any programs. This was the case in the years following the ACA’s enactment in 2010, and also in the years after Republicans failed to repeal the entire ACA in 2017. Even after repeal failed in Congress, President Trump’s budgets called for repealing the ACA’s financial assistance with premiums and cost-sharing charges and its expansion of Medicaid, as well as making additional cuts to Medicaid.

Such draconian cuts to these health programs would eliminate or weaken coverage for tens of millions of people and their ability to afford health care. The additional cuts in Medicaid would likely require a radical restructuring of the program, such as by eliminating the guarantee of coverage for eligible people, converting federal funding to a block grant that does not respond to changes in need or medical costs, or shifting substantial costs to over-burdened state budgets by capping the federal government’s contributions. Such changes would leave even more people uninsured, significantly weaken benefits, and reduce already inadequate Medicaid provider payment rates, making it more difficult for those who still had Medicaid to find care.[2]

4. Dramatic reductions in important domestic investments, achieved by shrinking non-defense appropriations to levels as a share of the economy not seen since the Hoover Administration.

Over the last dozen years, Republicans have aggressively sought to cut non-defense appropriations — also called non-defense discretionary (NDD) funding. They forced deep cuts in 2011 appropriations, and those austere levels were then locked in by the statutory funding caps and further “sequestration” cuts created in the 2011 Budget Control Act. Republican budgets since then consistently called for shrinking spending on these programs further, to an average of 1.8 percent of GDP by the tenth year of their budget plans — levels not seen since the beginning of the Hoover Administration.

NDD spending supports a wide range of functions and services: administration of Social Security and Medicare; medical care for veterans; support for K-12 and college education; Head Start and child care; mental health and substance use treatment; small business assistance; public health programs and medical research; highways; national parks; clean air and water; rental housing assistance for families with low incomes; law enforcement and the courts; and many others.

This April, the House-passed debt ceiling bill (which the Republican majority named the Limit, Save, Grow Act) would have reduced total discretionary appropriations by $3.6 trillion over ten years.[3] The severe cuts required by that bill were largely set aside in later debt-limit negotiations, but there have been calls in the House for deeper cuts than required by those negotiations — and proposing cuts in this area may appear attractive because the budget resolution does not have to specify which programs would be cut.

5. Tax cuts that worsen inequality and shrink the nation’s already depleted revenue base.

Over the past dozen years, most Republican budgets called for extending expiring tax cuts as well as calling for new tax cuts. All those tax plans favored those at the top of the income spectrum, either through reductions in the top income tax rates or through more favorable treatment of capital, corporate profits and other business income, and inherited income. These policies both increase income inequality and shrink the Treasury’s revenues, making it harder to make investments that can broaden opportunity or achieve the deficit reduction the Republican budgets purport to champion.

Consistent with these past budgets, 100 House Republicans have sponsored a bill to permanently extend the individual income and estate tax cuts in the 2017 law, which are scheduled to expire after 2025.[4] Rep. Arrington has also said that he will include these permanent tax cuts in the House budget plan.[5] These provisions would provide annual tax breaks averaging $41,000 to tax filers in the top 1 percent but only about $500 to those in the bottom 60 percent, according to Tax Policy Center estimates.[6] Simply extending those expiring provisions would be expensive, with costs growing to more than $350 billion a year and totaling $2.6 trillion over the coming decade, CBO estimates. [7]

End Notes

[1] Congressional Budget Office, “Spending Reductions That Would Balance the Budget in 2033,” March 14, 2023, https://www.cbo.gov/publication/58984.

[2] Allison Orris and Sarah Lueck, “Congressional Republicans’ Budget Plans Are Likely to Cut Health Coverage,” CBPP, updated March 20, 2023, https://www.cbpp.org/research/health/congressional-republicans-budget-plans-are-likely-to-cut-health-coverage.

[3] David Reich, “Vital Government Services Would Take a $3.6 Trillion Hit in McCarthy Bill,” CBPP, updated May 19, 2023, https://www.cbpp.org/blog/vital-government-services-would-take-a-36-trillion-hit-in-mccarthy-bill.

[4] TCJA Permanency Act, H.R. 976, https://www.congress.gov/bill/118th-congress/house-bill/976?s=1&r=13.

[5] Jack Fitzpatrick, “House GOP Prepares Budget Vote Calling for Entitlement Panel,” Bloomberg Government, September 13, 2023, https://www.bgov.com/next/news/S0XV5GT0AFB4.

[6]Tax Policy Center, Table T22-0144, “Make the Individual Income Tax and Estate Tax Provisions in the 2017 Tax Act Permanent, by ECI Percentiles, 2026,” https://www.taxpolicycenter.org/model-estimates/make-individual-income-tax-and-estate-tax-provisions-2017-tax-act-permanent-1.

[7] Congressional Budget Office, “Budgetary Outcomes Under Alternative Assumptions About Spending and Revenues,” May 16, 2023, https://www.cbo.gov/publication/59154.

More from the Authors