BEYOND THE NUMBERS

Federal Reserve Chair Janet Yellen recently noted two salient facts about the labor market that tomorrow’s jobs report won’t change:

The labor market has achieved considerable progress over the past several years. Even so, further improvement in labor market conditions would be welcome because we are probably not yet all the way back to full employment.

Of course, “full employment” isn’t a statistic you’ll find in tomorrow’s jobs report. The Fed’s statement of its longer run goals and monetary policy strategy acknowledges that its assessment of the unemployment rate consistent with its policy goal of maximum employment is based on a number of factors and that that assessment is “uncertain and subject to revision.”

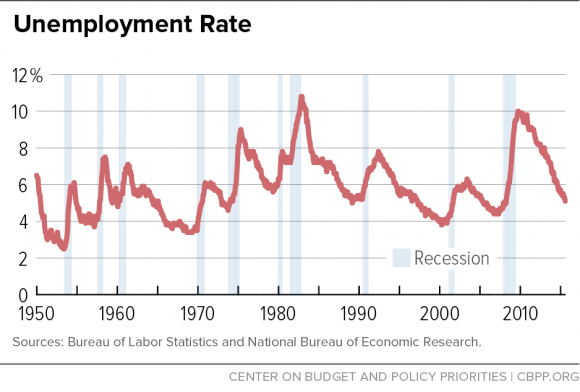

The unemployment rate has fallen substantially from its peak, as shown in the chart below from our Legacy of the Great Recession chart book (which we’ll update tomorrow with the new numbers). Indeed, the unemployment rate is closing in on the Fed’s current estimate of its sustainable long-run rate of 4.9 percent.

Two things are notable about that estimate. First, it’s a recent downward revision of the estimate of between 5.2 and 5.5 percent that the Fed was using earlier this year. Second, it’s still higher than the lowest unemployment rate achieved in the later stages of each of the last two recoveries.

Three indicators about the labor market recovery to watch for in tomorrow’s report:

- The ongoing low rate of labor force participation (the share of the population either working or actively looking for work). There are still potential workers on the sidelines who want to work and would be working in a stronger labor market but are not yet confident that jobs are available. While the unemployment rate has fallen this year, labor force participation has been stuck at a level last seen in the late 1970s. Any hint of a revival in tomorrow’s report would be a welcome sign.

- The elevated number of people who have a job but aren’t working as many hours as they would like. The Labor Department’s broadest measure of unemployment and underemployment (the U-6 rate), which includes people who would like to be working but aren’t in the labor force and people working part-time who want more hours, has come down substantially but isn’t back to normal historical levels.

- Sluggish wages. Wages continue to rise slowly at a 2 percent annual rate (before adjusting for inflation). Low gasoline prices and low inflation are temporarily allowing workers to stretch their paychecks. But until labor markets tighten further, there will continue to be more willing jobseekers than there are jobs and little reason for employers to start raising wages faster. Look at the change in the average hourly earnings since a year ago in tomorrow’s jobs report to see if there is any evidence that this is changing.

With low inflation and a still incomplete labor market recovery, an important consideration is whether it’s a better policy to test if current estimates of the sustainable long-run unemployment rate might still be too high rather than to start raising interest rates anytime soon.