BEYOND THE NUMBERS

December 10, 2020: We've updated this blog.

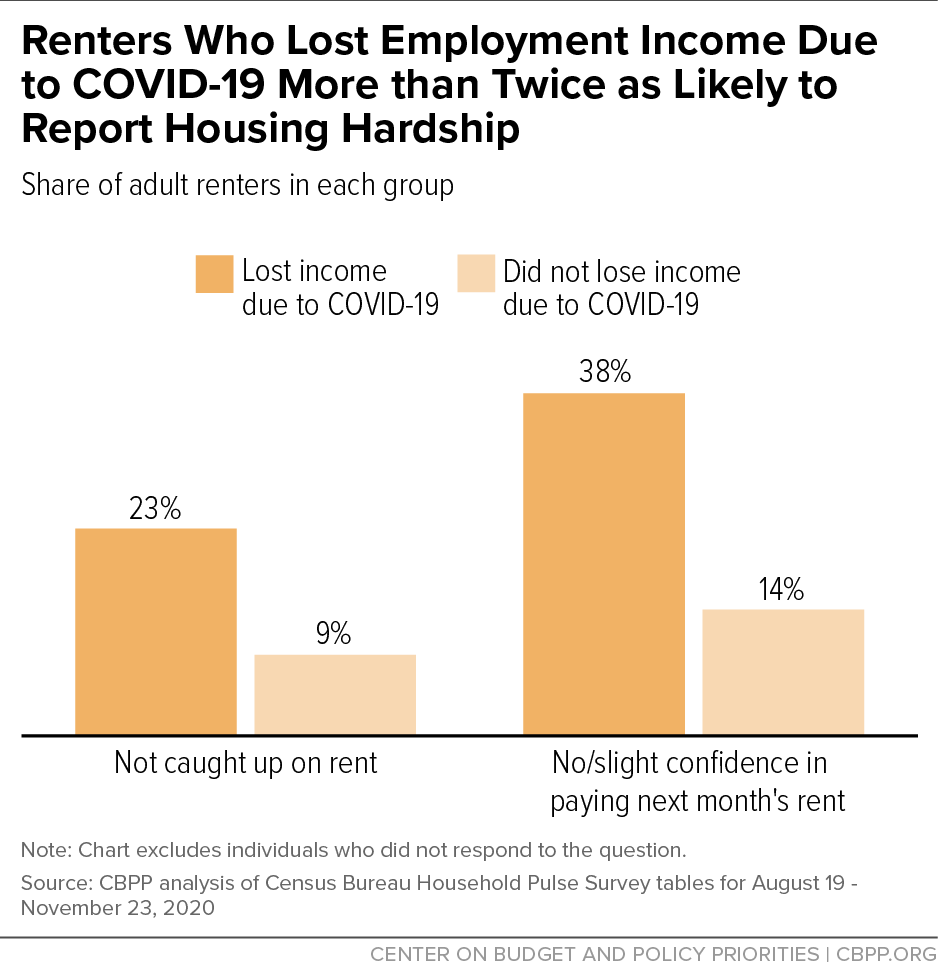

An estimated 9.2 million adult renters who have lost employment income during COVID-19 are not caught up on rent, 23 percent of such renters, our new analysis of Census Bureau Household Pulse Survey data from August to November shows. (See graph.) That’s more than twice the rate among those who have not lost income, showing how COVID-19 has dramatically worsened renter hardship. Hardship will rise further if policymakers let the CARES Act’s expanded unemployment benefits and the Centers for Disease Control and Prevention’s (CDC) eviction moratorium expire at year’s end as currently scheduled, just as COVID-19 cases are surging and the economic recovery is slowing.

Renters who have lost employment income, likely due to job loss or reduced hours, are worried about keeping a roof over their head through winter. An estimated 15.5 million adult renters who lost employment income report no or slight confidence that they can pay next month’s rent – 38 percent of such renters. That’s considerably higher than the 14 percent of renters who have not lost employment income. Among renters who lost employment income and are not caught up on rent, 51 percent say they are very or somewhat likely to be evicted in the next two months.

That the economic recovery seems to be losing momentum leaves renters in a precarious position — particularly those already affected by an uneven recession that is exacerbating longstanding racial and gender inequities. Some 49 percent of renter households lost employment income between March and September, compared to 36 percent of homeowners, Harvard’s Joint Center on Housing Studies estimates.

While the CDC moratorium currently provides protections from eviction, many renters who have lost employment income are accumulating debt from back rent and late fees. Renter households with a COVID-related job loss will owe an estimated average of $5,400 in back rent, according to the Federal Reserve Bank of Philadelphia. Letting the moratorium lapse will raise the risk that households with rental debt will lose their homes.

After the CARES Act moratorium expired in July, Princeton’s Eviction Lab observed a steady increase in eviction filings in August, and then a significant drop once the CDC reinstated the moratorium in early September. Another rise in eviction filings in January would overwhelmingly affect and displace communities of color, which have historically been disproportionately affected by evictions. Forcing people from their homes and into shelters or doubled-up living situations during this public health crisis also threatens to accelerate COVID-19’s spread and worsen health inequities.

To avoid a widespread spike in evictions and homelessness in early 2021, the President and Congress must swiftly enact a multi-faceted policy solution that combines an extended CDC order with comprehensive rent relief to help households address their rental debt. Policymakers should also expand short- and long-term rental assistance programs and extend emergency assistance to those who have lost their homes so they can move towards stable housing. They should also provide relief in other areas, such as extending and strengthening unemployment benefits, to help renters keep a roof over their heads as the economy recovers. Failing to act swiftly will cause unnecessary hardship and long-term damage to households struggling to pay rent.