BEYOND THE NUMBERS

Roundup: CBPP’s Analyses of the Senate Tax Plan

The Senate Finance Committee’s tax bill would overwhelmingly benefit the wealthy and corporations, eventually raise taxes on many low- and middle-income families, leave 13 million more people uninsured, and dramatically increase deficits. We’ve collected our analyses of the bill here.

The Senate GOP tax bill will ultimately raise taxes on many middle- and lower-income households and leave 13 million more people uninsured to pay for permanent tax cuts for profitable corporations.

Interactive Maps: How Do the Republican Tax Bills Affect Your State? House | Senate

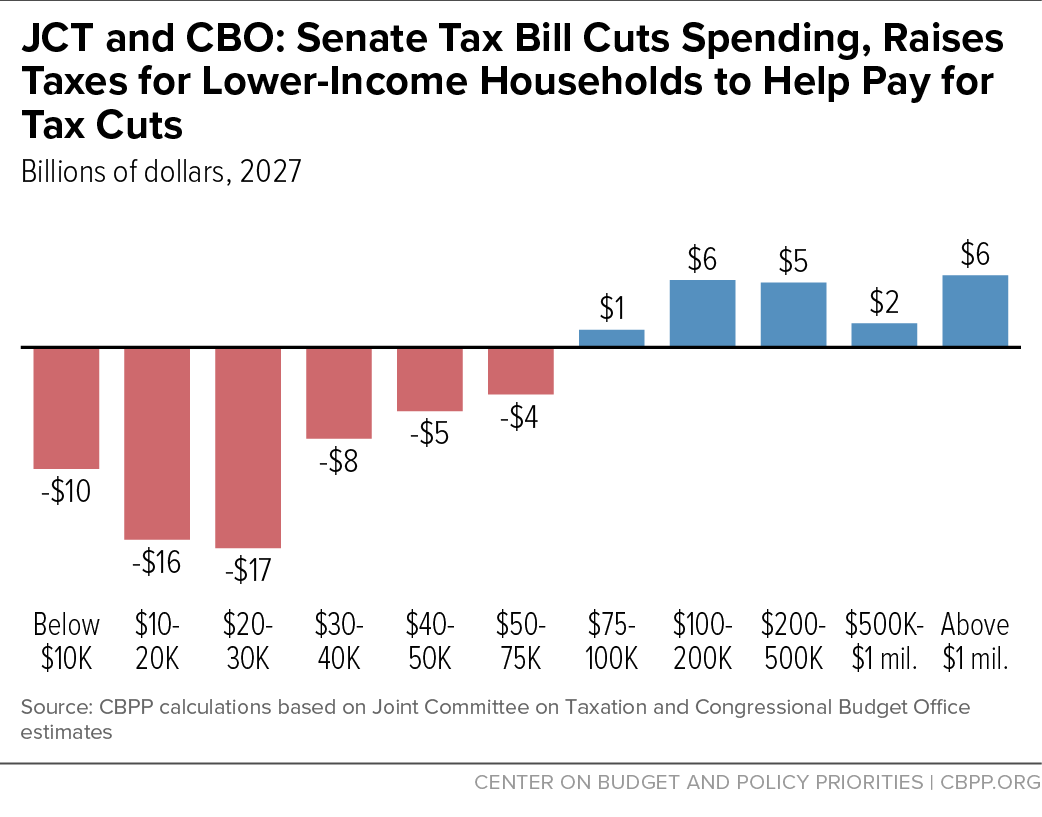

CBO and JCT Estimates Show Senate Bill Skewed to Top, Harmful to Low- and Middle-Income Americans

The Joint Committee on Taxation (JCT) and Congressional Budget Office (CBO) estimates show just how skewed the Senate bill is when it comes to its full effects on federal taxes and spending. In 2025, the bill would on average raise taxes on households with incomes below $40,000; provide small tax cuts on average for households with incomes between about $40,000 and $75,000; and provide tax cuts averaging thousands of dollars for high-income households, including tax cuts averaging $36,000 for households with incomes over $1 million.

The Senate Finance Committee bill’s repeal of the Affordable Care Act’s mandate that people get health coverage or pay a penalty would add 13 million people to the uninsured and increase premiums by about 10 percent to pay for tax cuts for the top 0.1 percent.

- Alexander-Murray Legislation Can’t Undo the Severe Harm Resulting From Individual Mandate Repeal

- Yes, the Massive Coverage Losses From Repealing the Individual Mandate Would Be Harmful

- Repealing Individual Mandate Would Hurt, Not Help, Low- and Moderate-Income People

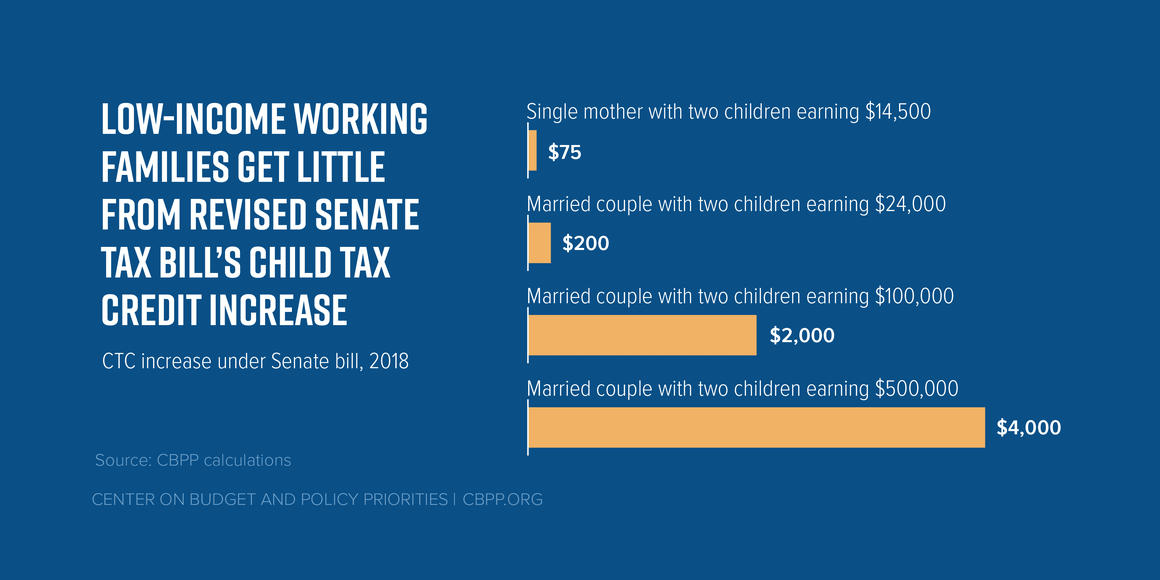

Senate Tax Bill’s Child Tax Credit Increase Provides Only Token Help to Millions of Children in Low-Income Working Families (with state-by-state data)

The recently revised Senate Republican tax bill would increase the maximum Child Tax Credit from the current $1,000 to $2,000 per child – up from $1,650 in the prior version — but low-income working families would largely miss out on the increase, just as in the earlier version. Indeed, in revising the proposal, Senate Finance Committee Chair Orrin Hatch increased the cost of the proposal by about $13 billion per year, but did nothing for the millions of low- and moderate-income working families that would get only token help under the prior proposal.

Senate’s “Pass-Through” Tax Cut Favors Biggest Businesses and Wealthiest Owners

The Senate Finance Committee bill includes a tax cut for “pass-through” businesses that’s heavily skewed to the biggest businesses and the wealthiest business owners.

Senate Tax Bill Could Prove Costlier Than Official Estimate

JCT estimates that Senate Finance Committee Chairman Orrin Hatch’s revised tax bill would lose $1.4 trillion between 2018 and 2027, but begin to raise revenue starting in 2027. If policymakers in the future extend the tax cuts that would expire after 2025 and stop the tax hikes that would take effect starting in 2026, we estimate that the bill would cost roughly $1.9 trillion over the decade and lose more than $200 billion in 2027.

Budget Briefs: The Two-Step Fiscal Agenda

Congressional Republicans are poised to launch step one of a likely two-step tax and budget agenda: enacting costly tax cuts now that are heavily skewed toward wealthy households and profitable corporations, then paying for them later through program cuts mostly affecting low- and middle-income families.

Senate Tax Plan’s End to SALT Deduction a Poor Trade for Tax Cuts for Wealthy

The Senate Finance Committee tax plan would eliminate the federal deduction for state and local taxes, which lets taxpayers who itemize deductions deduct state and local property taxes and either state and local income taxes or general sales taxes, and use the revenue to pay for cutting income tax rates. That trade would be a bad deal for most Americans, especially low- and middle-income people.

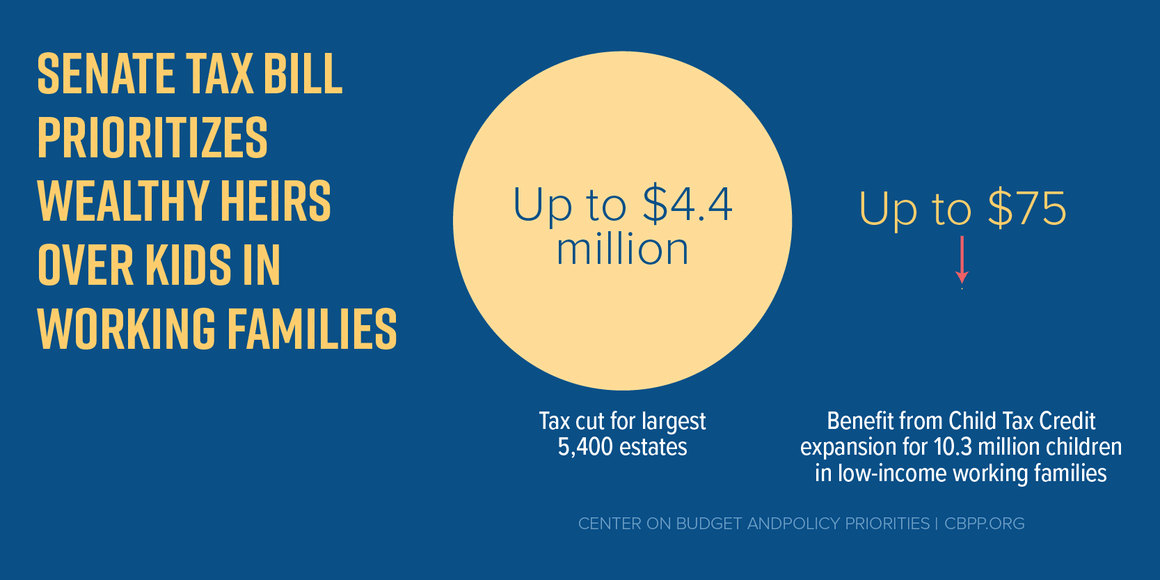

Doubling Estate Tax Exemption Would Give Windfall to Heirs of Wealthiest Estates

The bill would double the value of estates that’s exempt from the estate tax, from $11 million per couple ($5.5 million per person) to $22 million per couple ($11 million per person). That would cut the share of estates facing the tax from 2 in 1,000 to fewer than 1 in 1,000 and give each of the 1,800 very largest estates a tax cut of $4.4 million per couple.

GOP Making Highly Unrealistic Claims for Wage Gains From Tax Cuts

In a post for US News & World Report’s Economic Intelligence, CBPP’s Chad Stone discusses how Republicans’ claims that their tax cuts will give American workers a large pay raise don’t stand up to scrutiny.