BEYOND THE NUMBERS

In Case You Missed It . . .

This week at CBPP, we focused on food assistance, poverty and inequality, federal taxes, state budgets and taxes, health, housing, and the economy.

-

On food assistance, Dottie Rosenbaum highlighted six takeaways from the Congressional Budget Office estimate of the House Agriculture Committee’s SNAP (food stamp) proposals. Ed Bolen, Lexin Cai, Stacy Dean, Brynne Keith-Jennings, Catlin Nchako, Dottie Rosenbaum, and Elizabeth Wolkomir updated their paper on how the proposals would increase food insecurity and hardship.

We released a series of briefs on how the committee’s SNAP cuts and work requirements would hurt children, workers, veterans, older Americans, people with disabilities, and women.

- On poverty and inequality, Robert Greenstein described how the President’s reported “public charge” rule would threaten low-wage legal immigrants if their families receive any of a wide array of benefits, including the Earned Income Tax Credit. Sharon Parrott, Shelby Gonzales, and Liz Schott pointed out that such a rule would prove particularly harsh for pregnant women and children.

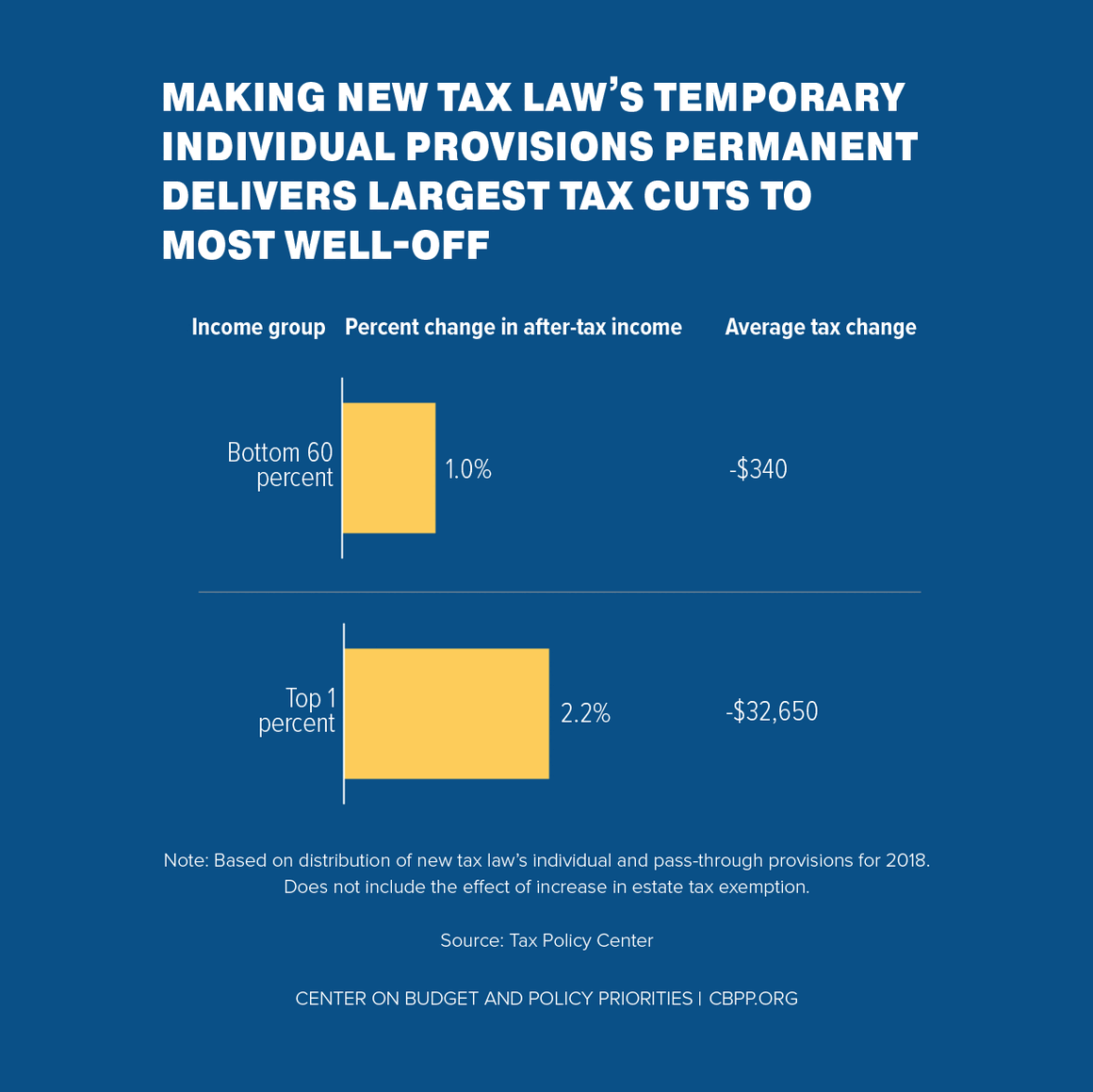

- On federal taxes, Chye-Ching Huang showed that although Republican policymakers say they want to promote work, this concern was absent from the 2017 tax law. She also explained that permanently extending the tax law’s individual tax provisions would double down on its fundamental flaws. Chuck Marr rebutted the argument for the law’s pass-through tax break.

- On state budgets and taxes, Michael Mazerov argued that states shouldn’t use the changes to federal foreign tax rules in the 2017 tax law to justify tax cuts.

- On health, Jesse Cross-Call explained that Ohio’s Medicaid proposal would mean coverage losses and new costs for local governments. He also detailed how Michigan’s Medicaid proposal would harm low-income workers and noted that it can’t be fixed. Shelby Gonzales described how marketplace sign-ups are strong despite a tumultuous last year, and listed ways that states can keep them strong.

- On housing, Will Fischer warned that housing work requirements would harm families and many workers. We published a guide to Small Area Fair Market Rents, which housing agencies can use to help families with housing vouchers move to high-opportunity neighborhoods.

- On the economy, we updated our chart book on the legacy of the Great Recession and our policy basic on how many weeks of unemployment compensation are available.

Chart of the Week – Making New Tax Law’s Temporary Individual Provisions Permanent Delivers Largest Tax Cuts to Most Well-Off

A variety of news outlets featured CBPP’s work and experts recently. Here are some highlights:

The fuzzy math of adding work requirements for food stamps

CBS News

May 3, 2018

Rent Increases and Work Requirements for the Poor, Mortgage-Interest Deductions for the Rich

The American Prospect

May 3, 2018

A Republican Plan Could Worsen Rural America's Food Crisis

The Atlantic

May 2, 2018

Teacher strikes roil states that limit tax increases

Politico

May 1, 2018

Don’t miss any of our posts, papers, or charts — follow us on Twitter, Facebook, and Instagram.