BEYOND THE NUMBERS

In Case You Missed It . . .

This week at CBPP, we focused on federal taxes, the federal budget, and health care.

-

On federal taxes, Robert Greenstein warned that Republican leaders, having passed a tax bill that provides a bounty to those at the top, may next seek to cut programs that help low- and middle-income Americans. Jacob Leibenluft listed Republican leaders’ broken promises on taxes, the budget, and health with their tax bill. Chuck Marr showed that Republicans chose corporate shareholders over working families in the bill.

Chye-Ching Huang, Guillermo Herrera, and Brendan Duke analyzed Joint Committee on Taxation (JCT) estimates showing that the bill is skewed to the top and will hurt many low- and middle-income Americans. Huang cited JCT estimates finding that millions of households will face tax increases or get no tax benefits under the bill.

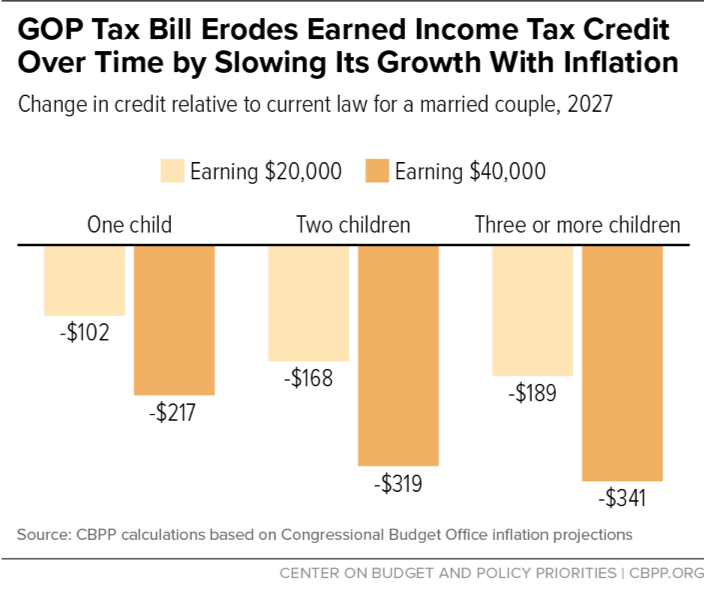

Marr explained that the bill erodes the Earned Income Tax Credit’s value over time. Joel Friedman explained why the bill could cost as much as $2.2 trillion over the next decade. Huang noted that 10 million kids from low-income working families will get little or nothing from the bill’s changes to the Child Tax Credit (CTC). Leibenluft highlighted that the bill also ends the CTC for roughly 1 million kids from low-income working families who lack a Social Security Number.

We posted an interactive detailing how the bill will affect each state.

- On the federal budget, David Reich analyzed a House Republican bill that effectively eliminates caps on defense spending while leaving non-defense priorities underfunded and failing to address other pressing needs.

- On health care, Aviva Aron-Dine explained why temporary funding for state reinsurance programs wouldn’t undo the damage from repealing the individual mandate. Jessica Schubel warned that proposals to lower the Medicaid income limit jeopardize coverage for many low-income adults. Shelby Gonzales explained what to look for in the report on healthcare sign-ups during open enrollment through HealthCare.gov for 2018.

Chart of the Week: GOP Tax Bill Erodes Earned Income Tax Credit Over Time by Slowing Its Growth With Inflation

A variety of news outlets featured CBPP’s work and experts recently. Here are some highlights:

This Congress’s clear priorities: corporations, not children

Vox

December 21, 2017

What's in the GOP's final tax plan

CNN Money

December 20, 2017

How the tax bill adds to the debt headache

Axios

December 20, 2017

What Marco Rubio got for his tax vote

Washington Post

December 19, 2017

The GOP Tax Bill Isn't for the Middle Class. And It Was Never Meant to Be

Time

December 19, 2017

Community Health Centers at Risk of Closing Without Congressional Action

Stateline

December 18, 2017

Don’t miss any of our posts, papers, or charts — follow us on Twitter, Facebook, and Instagram.