BEYOND THE NUMBERS

A recent New York Times op-ed explains that the nation’s housing policy focuses too much on tax subsidies for homeownership — which mainly benefit the wealthy — and too little on helping struggling and moderate-income families afford decent housing. We agree, and we’ve recommended rebalancing federal housing policy by creating a tax credit to help low-income families afford their rent.

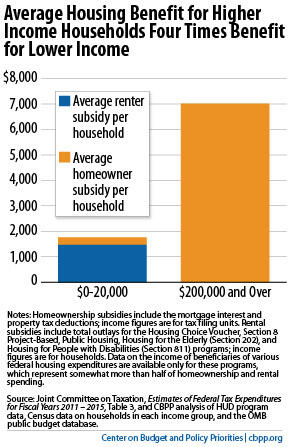

Homeownership tax subsidies comprise the bulk of overall federal housing spending. At more than $100 billion in 2012, the deductions for mortgage interest and property taxes cost about twice as much as all federal low-income housing programs combined. The homeownership subsidies are so large and tilted toward the top that families with incomes above $200,000 get about four times as much federal housing assistance as those with incomes below $20,000, on average (see graph).

Are these the right priorities? As we’ve pointed out, housing needs among low-income households, especially families with children, have grown sharply over the past decade. More than 7 million low-income families who receive no federal housing assistance pay more than half of their income for rent and utilities.

Such rent burdens force families to shift resources away from other basic needs like food, medicine, and clothing for school or work, and place them at greater risk of housing instability and homelessness — problems that do serious harm to children’s long-term health and development.

There’s growing talk of reforming the homeownership tax deductions in ways that would make them more efficient and help reduce the deficit. Policymakers could also use a modest share of the savings to fund measures that address unmet needs at the bottom of the income scale, such as the National Housing Trust Fund to develop housing for poor families (as the op-ed suggests) and our proposed renters’ credit, which could be used in conjunction with the trust fund.

As we outlined here, a renters’ credit capped at $5 billion a year could:

- Assist about 1.2 million of the lowest-income renter households;

- Reduce each household’s rent by an average of $400;

- Cut the number of very low-income households paying more than half of their income for housing by about 700,000; and

- Lift 250,000 families out of poverty and lift four of five of the poorest families it assists out of deep poverty (defined as having income below half of the federal poverty line).