BEYOND THE NUMBERS

The House is expected to vote this week on a Ways and Means Committee bill that reinstates and makes permanent a tax provision known as “bonus depreciation,” which lets businesses take bigger upfront tax deductions for certain new purchases such as machinery and equipment. The Ways and Means Committee bill is economically unjustified and fiscally irresponsible. The Joint Tax Committee estimates the measure would cost the Treasury $276 billion in forgone revenues over ten years, adding to deficits and debt.

In April, the Ways and Means Committee began to consider a series of mostly business “tax extenders” — so named because Congress routinely extends them for a year or two at a time. The cost of all the business tax cuts that Ways and Means has adopted, including bonus depreciation, now totals $581 billion, and includes not only extensions of tax provisions that have been routinely extended, but also generous expansions of some of those provisions. That’s enough to wipe out three-quarters of the $770 billion in revenue raised by the high-income provisions of the 2012 “fiscal cliff” legislation.

The full House has already passed a number of these Ways and Means bills. Members shouldn’t add the bonus depreciation bill to that list. In addition to the bill’s cost, there are other compelling reasons why policymakers should not reinstate bonus depreciation and make the policy permanent:

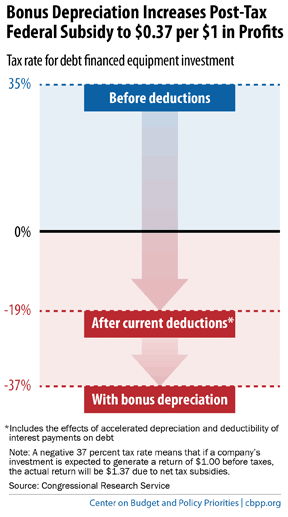

- It increases already generous tax treatment. Under current law, companies already receive generous tax treatment when they invest in equipment and buildings, particularly if they borrow the funds to finance this investment. In those cases, instead of a company investing in equipment, making a profit, and sending a percentage of those profits to the government in taxes, the government in effect adds to the pre-tax profit of the company by providing a subsidy through the tax code. Adding bonus depreciation would greatly expand this generous tax subsidy, as the chart below shows.

Image

- It was meant to be temporary. Congress enacted bonus depreciation solely to bolster the economy during the recession, and not with the intent of making it a permanent feature of the tax code (or extending it year after year like a tax extender). In the previous economic downturn, Congress enacted bonus depreciation in 2002 — and then a Republican President, House, and Senate let it expire after 2004, when the economy was stronger. Moreover, studies have shown that bonus depreciation “is largely ineffective as a policy tool for economic stimulus,” according to the Congressional Research Service.